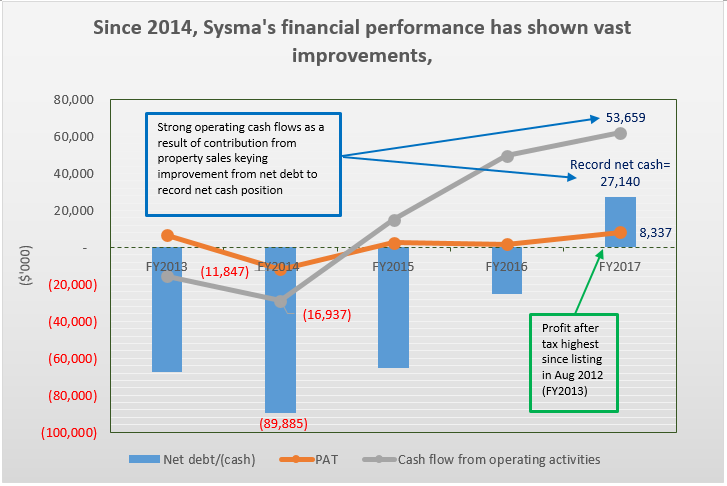

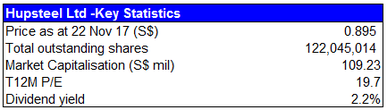

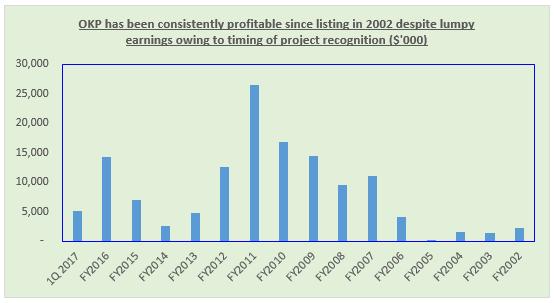

- Its half year profit after tax came in at $4.3 million or 1.71 cts per share. This is lower than last year’s $4.8 million but only because of the lower net write-back of provision for foreseeable losses ($0.7 million vs $2.8 million).

- More importantly, as we previously indicated, its completed properties on hand have substantially been sold during the financial period and converted into cash. Company is now debt free, other than <$1 million of finance leases.

- While NTA came in slightly lower than we expected at $50.5 million or $0.20 per share, its net cash has now more than doubled to $55.9 million from just $27.1 million 6 months back. This is equivalent to more than $0.22 per share and much more than we estimated, although not a major surprise since we had conservatively assumed an aggressive paying down of payables on hand.

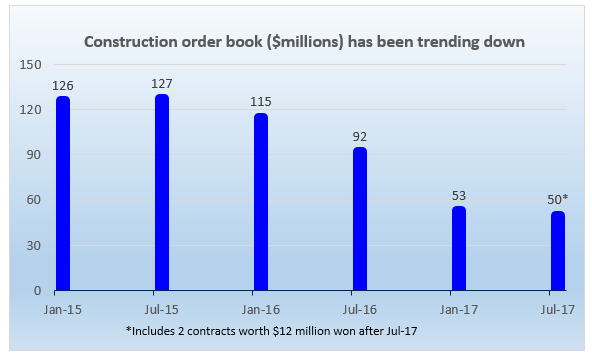

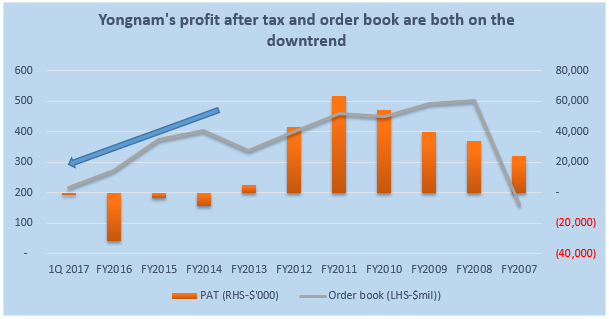

- Only negative is that the construction order book continues to decline to $34 million as at 31 Jan 18 from $38 million 6 months prior. (Refer to our initial report for more discussion on this)

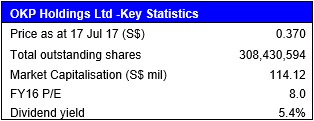

Given that the company’s NTA of $0.20 is now substantially backed by cash, the current share price of $0.151 continues to significantly under-represent its value. We expect the gap between the two to close considerably going forward.

We also reiterate our belief that barring new substantial investments, payment of a much larger annual dividend or a one time special dividend may be in store. Further catalysts to come from more contract wins for its high end landed construction business.

RSS Feed

RSS Feed