Almost 2 years on, that quote has proven to be more prescient than we originally envisaged as markets bottomed out shortly after with the STI surging 32% from 2577 to end 2017 at 3403. However, even this performance pales in comparison to S&P 500’s 40% gain and HSI’s even more impressive +57% run over the same period. As a result, equity owners should, by and large, be satisfied with the gains recorded over the last 2 years. Indeed, the ongoing bull market appears to be humming in global unison, backed by better than expected growth in top economies like the USA and Japan.

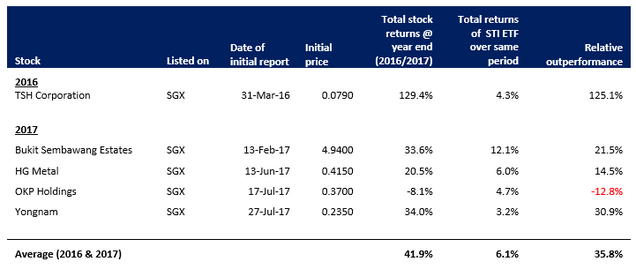

Our picks in the last 2 years have similarly done well and, with the exception of one, outperformed the market significantly. As we did not do a year-end review for 2016, we have included picks for that year in this report. In terms of benchmark, we have elected to use the SPDR STI ETF for the Singapore stocks that we covered instead of just using the STI Index as in the past in order to better quantify the impact of dividends on total returns [1].

Performance of our picks

For the two years combined, our picks have collectively turned in a commendable performance, outgunning the benchmark by an average of 35.8%. However, this is largely skewed by the only recommendation (TSH Corporation) we made in 2016, which generated outsized returns of 129% over 9 months, handily beating the STI ETF over the same period.

In 2017, our coverage was focused on 5 stocks, the last of which was Hupsteel. However, we will not be reviewing the latter given that our report on it was only issued little more than a month ago, making any comparison of its market performance over such a short period of time less meaningful.

Among the other four 2017 stock picks, OKP Holdings sticks out like a sore thumb for being the only underperformer, down 8% from the time we made the opportunistic call on 17 July 2017 vs a 5% gain in the benchmark over the same period. On the other hand, Bukit Sembawang Estates, HG Metal and Yongnam performed much better, generating average gains of 29% since the start of their respective coverage till the end of 2017. We should, however, highlight that in Yongnam’s case, the outperformance was somewhat fortuitous as the major contract win that we had originally identified as a potential catalyst did not materialise. Nevertheless, even if Yongnam had been excluded, our 2017 picks would still have outperformed the benchmark on average.

As usual, a summary of the performance of our stocks is tabulated below accompanied by key updates on selected companies:

TSH Corporation- impending acquisition could transform it into a property play

Since completing the disposal of its remaining core business at the end of August 2016, TSH has been a cash company as defined under Rule 1017 of the SGX Catalist rules and remains so. As we have mentioned in the past, cash companies typically have up to a year to enter into a new core business or risk being delisted by SGX. In an attempt to preserve its listing status, TSH has entered into a non-binding agreement on 21 August 2017 with entities controlled by its largest shareholder, Teo Kok Woon, to acquire a chain of Australian properties targeted at business owners in the beauty and wellness industry. The preliminary consideration is based on the combined net asset value of these properties of A$8.0 million and is to be satisfied by the issuance of new TSH shares at $0.035 apiece. The terms of the proposed acquisition, though, will only be finalised upon entry into a binding sale and purchase agreement at a date currently expected to be no later than 28 February 2018.

Recall that in our initial report, we had singled out the controlling Teo family as shrewd property investors with a strong track record. In the event that Teo decides to make TSH a de facto holding company for his family’s property business, more acquisitions can be expected in future. We think TSH and minority shareholders as a whole will stand to gain from his expertise in property investment and management. For Teo, having TSH as a ready listed platform for future acquisitions provides him with additional funding options to tap on without having to go through the hassle of a lengthy listing process. Naturally, we see the proposed acquisition as a win-win for both TSH and its largest shareholder.

For illustration, if the acquisition were to be completed based on the preliminary terms, we expect the NTA backing of TSH shares to increase to more than 2.9 cts per share from the current 2.4 cts.

Bukit Sembawang Estates- Market beginning to recognise its potential

Since our February report on Bukit Sembawang Estates (BSE), the market seems to have suddenly woken up to this deep value play, sending its share price soaring to a multi-year high of $6.90, before closing the year at $6.27. Together with a generous dividend pay-out of $0.33 per share for the third year in a row, BSE clocked total returns of over 33% from 13 February till end-2017, outperforming the benchmark by a wide 21% margin over the same period.

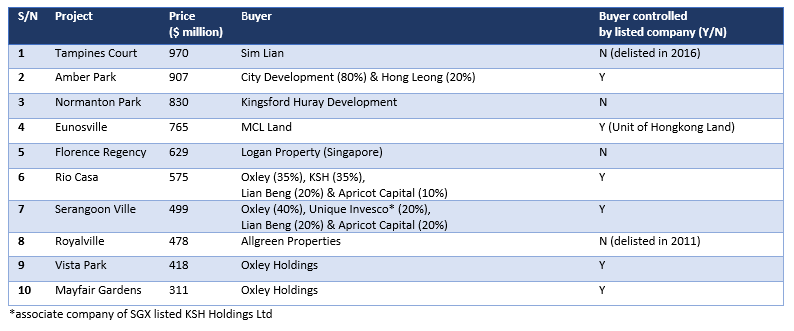

We think part of BSE’s rise could be attributed to the sudden pickup in collective sales activities in Singapore as developers bid ever more aggressively for attractive sites such as Amber Park (won by CDL’s subsidiary for $907.7 million) and Normanton Park (sold to Kingsford Huray Development for $830.1 million). In some cases, optimistic winning bids appear to have already built in a minimum increase of 10-15% in property prices. This in turn begs the question: why are developers suddenly throwing caution to the wind?

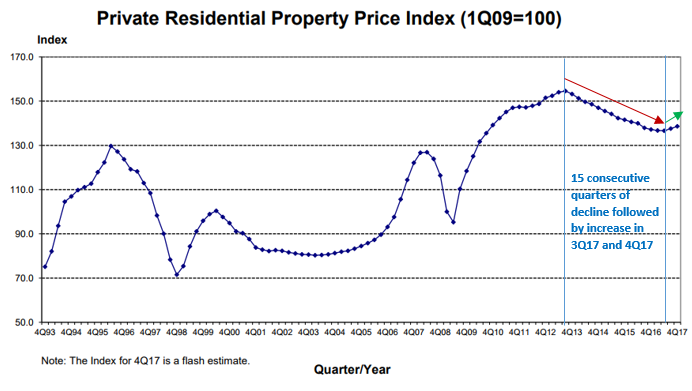

For one, the gradual improvement in property market sentiments could have boosted developers’ confidence of a sustained recovery in property demand and prices. Two consecutive quarters of increases in URA’s Private Residential Property Price Index following declines in the previous 15 quarters suggests that this confidence may not be misplaced after all:

In addition, the need for listed property companies to replenish their rapidly depleting land banks has also been touted as another possible reason. This seems to be supported by the fact that 6 of the top 10 largest residential collective sales in 2017 involve buyers controlled by listed companies:

Regardless of the real reasons that might be fuelling it, it remains to be seen if the collective sales boom will continue in 2018. What is clear though is that, unlike most other listed property developers, BSE is sitting tight on a huge land bank carried on its books at historical costs and is therefore under no pressure to join in the current collective sales fever. This puts it in an enviable position to benefit from any sustained recovery in the property markets without having to pay top dollar for land.

Going forward, we think that the impending launch of 8 Saint Thomas @ St Thomas Walk and Nim Collection @ Ang Mo Kio would likely provide the impetus for a further rise in BSE’s share price as well as the necessary cash flow to support its best-in-class dividend yield of over 5%. In particular, we estimate that 8 Saint Thomas could easily bump up BSE’s cash holdings by at least $500 million when fully sold, giving its already strong balance sheet a further boost.

As for Paterson Collection, BSE’s completed project near the plush Orchard Road area, there has been little update so far from the company. As we have mentioned previously, the project should already have been liable for QC penalties in October 2017 but BSE has yet to officially launch it. So far, the only sale made was for a single unit to the controlling Lee family in April last year for $3.3 million. Given that QC penalties could be much more substantial in 2018 and 2019 [2], we think the company’s management should do a much better job in communicating its plans for Paterson Collection to shareholders.

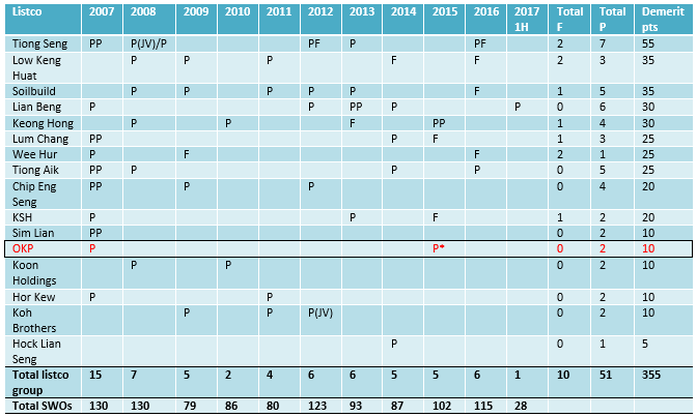

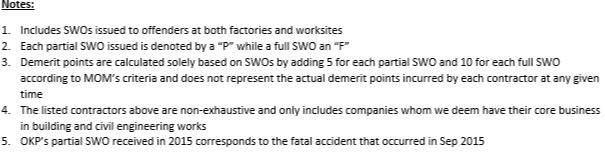

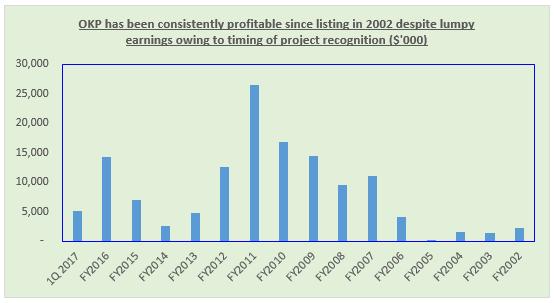

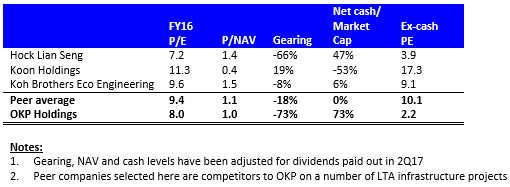

OKP Holdings- Delay in resumption of Tampines viaduct project an albatross around its neck

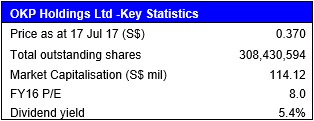

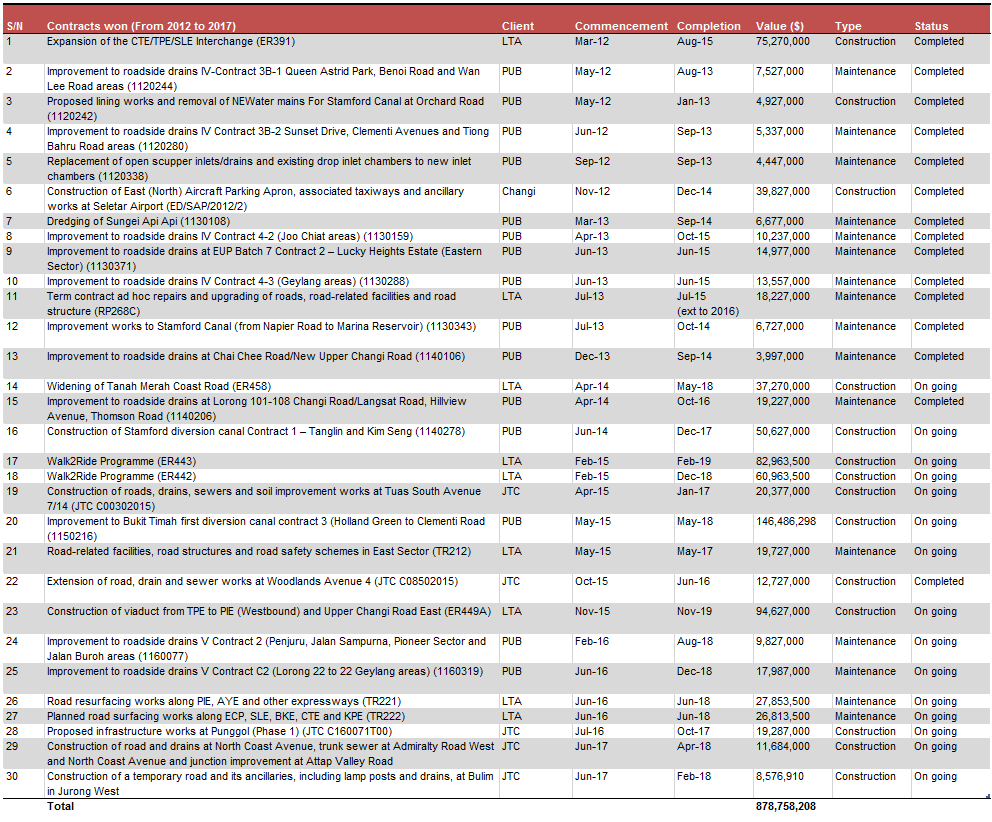

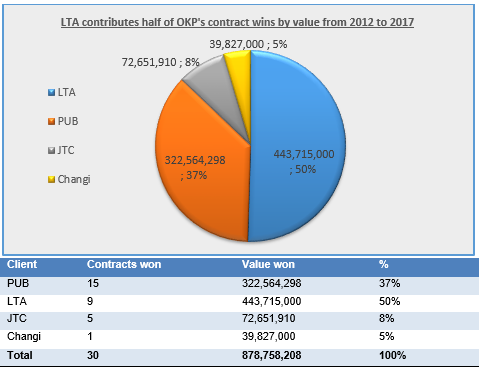

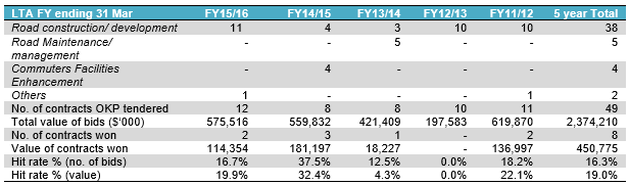

When OKP’s share price was punished for a fatal accident at its Tampines viaduct project worksite in July, we deemed it an opportunistic buy at $0.37 per share based on favourable factors such as its established track record, robust order book, strong net cash position, low valuations and an attractive dividend yield. At the same time, we warned that it is likely to face increased scrutiny in its current projects and future tenders and its share price could also be under short term downward pressure from the negative sentiments generated. Since then, OKP has languished mostly around the 33-35 cts range.

Despite previous indication from the authorities that the investigation will conclude by last October [3], results of the inquiry have not been released even as we come to the end of the first week of 2018. When we last paid a visit to the site in December, it was quiet and work did not appear to have resumed since the accident. A quick check with a few workers just outside the worksite confirmed this.

Needless to say, this puts a dampener into any hopes of OKP shareholders for a quick recovery from the accident as any further delays in the investigation process and pushback of subsequent work resumption would weigh heavily on OKP’s share price and financial performance for FY2018.

On a more positive note, OKP still managed to eke out a profit of $0.7 million for 3Q2017 despite recognising zero revenue and an additional $3.1 million cost for the Tampines viaduct project.

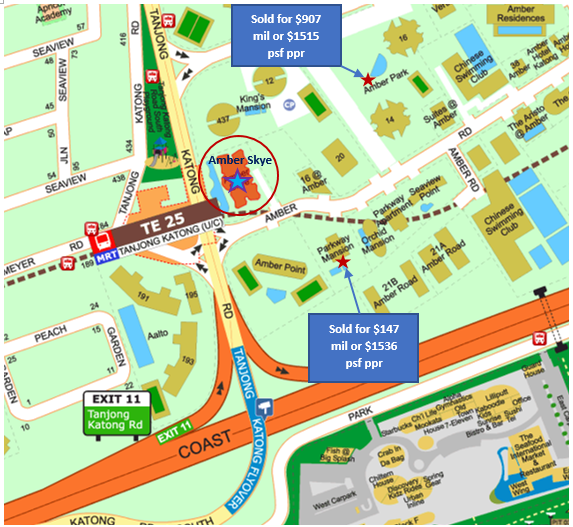

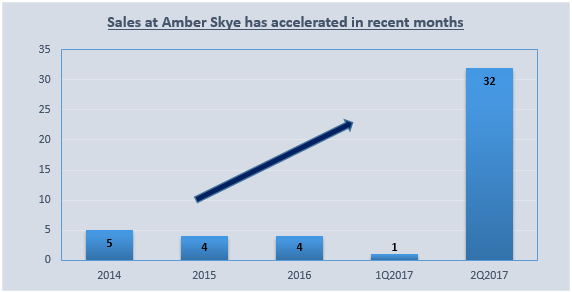

Its 10%-owned property development project, Amber Skye, has also seen improving sales over the past 3 quarters. According to URA caveats lodged, the project has now sold 73 of its 109 total units, up from a paltry 14 units just nine months ago. The attractiveness of the project has been further enhanced by the recent collective sales of nearby sites at bullish prices- Amber Park, for instance, was sold to a CDL subsidiary at a land cost of $1515 psf ppr whilst Parkway Mansion was sold to a Sustained Land consortium for $1536 psf ppr. Both the latter projects figure to have breakeven costs of above $2000 psf and projected selling prices upwards of $2300 psf. By contrast, the weighed average transacted price for the 73 units of Amber Skye sold so far is a much more affordable $1887 psf.

We think this bodes well for future sales at Amber Skye and reiterate our belief that the project should be on track to sell the majority of its units by mid-2018, when the near $20 million loan OKP had extended to the project company is due for repayment. Consequently, subject to any additional cost to be incurred arising from the delay of the Tampines viaduct project, we expect OKP’s net cash position during the year to improve to at least 30 cts per share, representing more than 85% of its last traded price of 35 cts.

Closing Note

So what can investors look forward to for the rest of 2018? The outlook for equities appears to be largely positive, at least according to multiple global banks and investment powerhouses. Our views are somewhat less sanguine. While we do not profess to have the ability to predict where the markets will end up when 2019 comes around, our personal observation is that bargains are harder to come by now than on average in the last 3 years as a result of an across-the-board increase in valuations. Consequently, we anticipate taking on less new positions in 2018 as well as moderate our expectations on returns from these positions.

NB 1: We have not included any updates on HG Metal and Yongnam as there has not been any notable development at either company since our last report on them in September.

NB 2: The above views are our own and are not meant to be construed as an offer, or solicitation of an offer to sell or buy securities referred herein. Please refer to the section “Important Notice” at the bottom of our homepage for additional information and disclosures.

[2] First year penalty for extension of Qualifying Certificate is 8% of land purchase price. This goes up to 16% and 24% respectively in years 2 and 3.

[3] As indicated by Senior Minister of State for Transport, Mr Lam Pin Min, and reported in the Straits Times on 1 Aug 2017

RSS Feed

RSS Feed