SGX listed OKP Holdings Ltd (OKP) suffered a major setback last Friday when a worksite accident took the life of a worker and injured 10 others. The project in question was awarded by the Land Transport Authority of Singapore (LTA) in November 2015 for the designing (undertaken by its project partner CPG Consultants) and building of a viaduct from the Pan Island Expressway to Upper Changi Road East. Scheduled to be completed by November 2019, it was also the largest LTA contract the Company has won in recent years. This follows another fatal accident on one of its sites two years earlier when a worker was killed, resulting in the company being fined $250,000.

While the unfortunate accident is bound to trigger thorough investigations by the authorities with the definitive conclusion yet unknown, OKP being the main contractor is unlikely to escape culpability.

The stock market has likewise responded by pushing OKP’s share price down from 43 cts to 39.5 cts before trading was halted early last Friday and further to 37 cts on Monday, after the halt was lifted over the weekend. Over the last two trading sessions, OKP has lost 14% or S$18.5 million of its market capitalisation.

The extent of public backlash is understandable given that a precious life was lost in addition to multiple other casualties suffered. However, is the Company’s safety record really as atrocious as it is currently construed? And is it all gloom and doom for OKP as its share price plunge suggests or can the company get its act together and emerge from the challenges it faces?

OKP- A public infrastructure specialist with a proven track record and LTA as its major client

OKP is an established player in the local civil engineering sector, having participated in numerous infrastructure projects over the past 51 years since establishment[i]. While it has undertaken projects awarded by private sector companies such as ExxonMobil and Changi Airport Group, its bread and butter is firmly in public infrastructure works, especially road works. Naturally, LTA is one of its key clients.

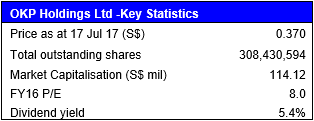

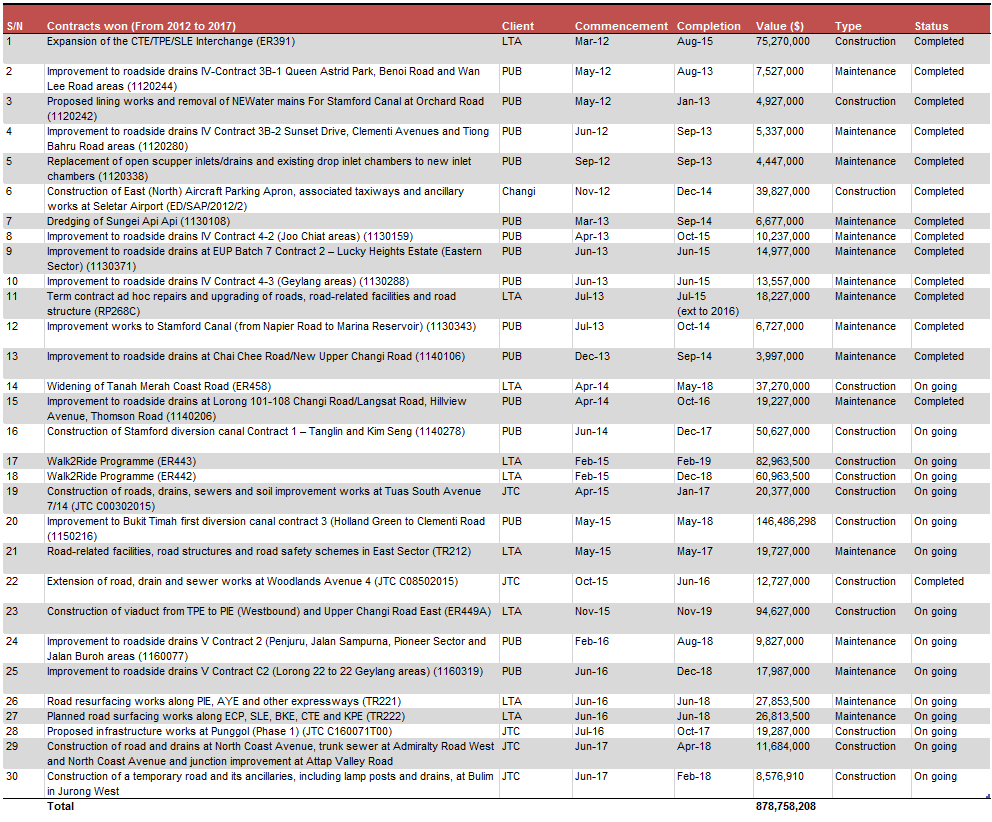

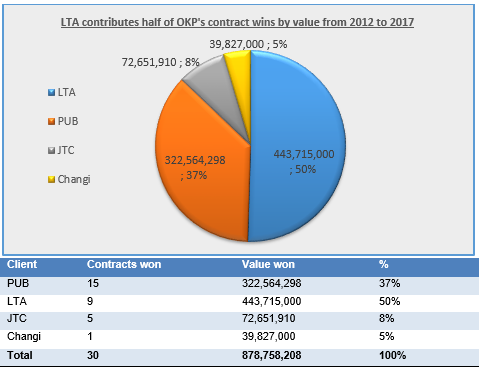

According to its annual reports and SGX filings, OKP has won a total of 30 contracts worth $879 million from 2012 to 2017 year to date. Of these, LTA contributed 9, making up slightly more than half of the total value at $444 million. PUB is its next biggest client with 15 contracts worth $323 million.

(Source: Company, Stockresearchasia)

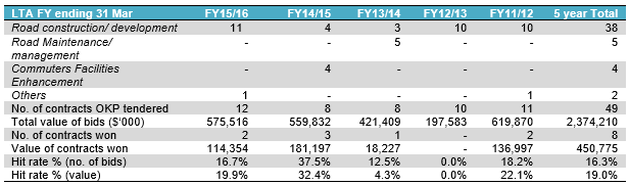

In addition, poring over LTA’s data over the past 5 financial years[ii], we estimate that OKP has won roughly one out of every six major contracts it has tendered for. With an average of 7.8 bidders for each of these tenders that OKP participated in, this translates into a better than average success rate in tendering for LTA projects.

(Classifications as per LTA annual reports. Source: LTA, Stockresearchasia)

Taken together, the above clearly illustrates LTA’s importance as a client to OKP. Hence, any setbacks such as the last which could potentially impede OKP’s ability to tender for future LTA projects is likely to adversely affect the Company’s prospects going forward. That said, we think It is important to look beyond the latest accident and examine OKP’s longer term safety track record in order to get a better feel of the potential impact.

Safety track record in focus

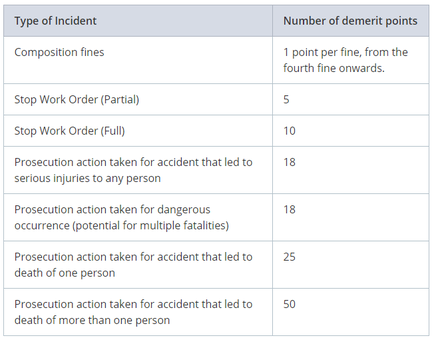

According to its website, the Ministry of Manpower (MOM) adopts a demerit points systems for the construction sector as a means of regulating workplace safety. Under the system, contractors will be issued demerit points according to the following categories of safety infringements:

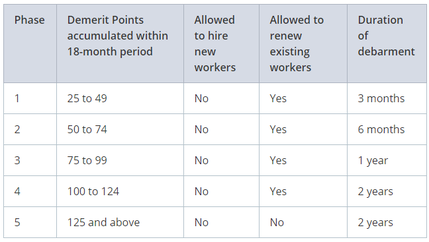

Punishments are meted out in the form of debarments from hiring foreign workers. Since most of the construction firms in Singapore are heavily reliant on foreign workers for their projects, such punishments severely handicap their ability to operate normally and serve as useful deterrents against worksite safety infringements.

(Source: MOM)

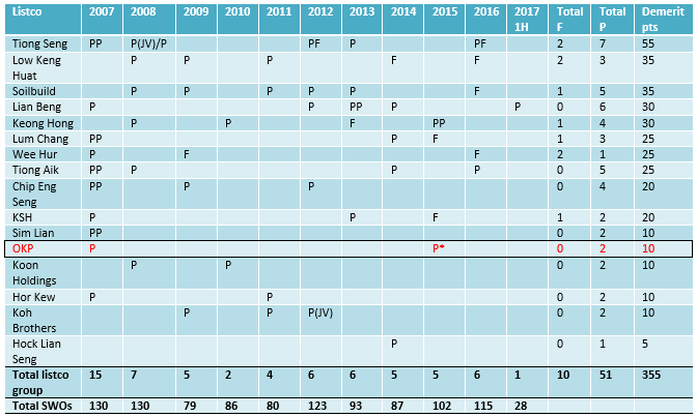

While the individual contractor’s historical demerit point record does not appear to be publicly available, MOM’s record of Stop Work Orders (SWOs) issued over the past 10 years provides a telling clue as apart from major accidents that lead to public prosecution, SWOs contribute the bulk of the demerit points. A careful analysis of OKP and its fellow SGX listed contractors’ SWO records thus provides a good indication of their safety track record.

(Source: MOM, Stockresearchasia. Full listing of SWO can be found on MOM’s webpage)

From the table we compiled above, we note that:

- The total number of SWOs issued on a yearly basis ranges from 79 to a surprisingly high 130, perhaps indicating that the construction industry as a whole still have some ways to go when it comes to taking adequate workplace safety measures.

- Within the select group of listed contractors, Tiong Seng appears to be the most frequent offender, chalking up 55 demerit points alone from 9 SWOs received. Three others have 5 or more. Incidentally, Tiong Seng also has the dubious honour of topping the most current list of contractors with demerit points at 55.

- At the other end of the spectrum, two companies have performed relatively well: Hock Lian Seng only had one partial SWO in the period under study and Sim Lian had gone 10 years since its 2 partial SWOs in 2007. Needless to say, other listed contractors that did not have a single SWO in the whole 10 year period performed better still.

- Interestingly, OKP only received 2 partial SWOs in the 10 year period, the second of which was for the aforementioned fatal accident in Sep 2015. Prior to that, it had gone 8 years from Jun 2007 to Aug 2015 without getting an SWO.

Based on the criteria of the demerit points system and OKP’s track record, it is likely that the 25 demerit points it currently has is solely due to the September 2015 accident. Prior to the recent two fatal accidents, OKP’s track record in safety had been relatively good compared to other listed contractors as further evidenced by the multiple safety awards and certificates of recognition it has won since 2006, ironically mostly for its LTA projects. This could partially explain LTA’s willingness to continue awarding it contracts even as recently as 2016.

Nonetheless, we are of the view that worksite safety should be a paramount concern for all and if found culpable, OKP should deservingly be dealt the appropriate punishment. The Company clearly has to step up its efforts in this regard to restore the confidence of its government agency clients. The silver lining is that it has shown itself capable of doing so previously in the period of June 2007 to August 2015.

Despite latest setback, OKP’s robust order book, stellar balance sheet strength and resilience should see it through

OKP currently has a strong order book of $326.6 million[iii] which translates to a book to bill ratio of close to 3x based on FY2016’s full year revenue of $111.1 million. This should ensure earnings visibility through to 2019 even though its near term margins are likely to be hit with possible delays to the Tampines project and potential associated liquidated damages.

The latest accident may also cast a temporary pall over OKP’s ability to successfully tender for future LTA projects. As each demerit point is valid for 18 months, the latest accident could bump its demerit point total to 50 or 75 depending on the final fatality count[iv] and timing of the point issuance. This could prevent OKP from hiring new foreign workers for up to 1 year but is not expected to keep it from renewing existing workers’ permits. OKP’s capacity to execute its current order book should therefore remain intact.

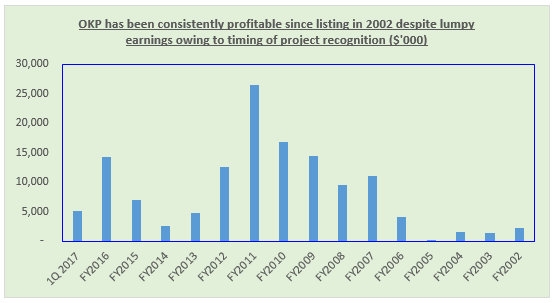

OKP has also proven in the past its ability to operate in tough environments such as during the 2009 GFC and 2003 SARs outbreak. Its bottom line has consistently been in the black ever since its listing in 2002. This is despite lumpy revenue recognition by nature of its project-based business and the cyclical construction industry.

(Source: Company, Stockresearchasia)

In addition, OKP is sitting on a large net cash position of $83.3 million[v] (or $0.27 per share) representing a hefty 73% of its market capitalisation. It currently trades at an attractive dividend yield of 5.4%. Given its strong cash generating capability (>$20 million in operating cashflow in each of the last 2 financials years), its near to mid-term earnings visibility underpinned by a robust order book and large cash position, we expect the Company to at least maintain the dividend yield going forward.

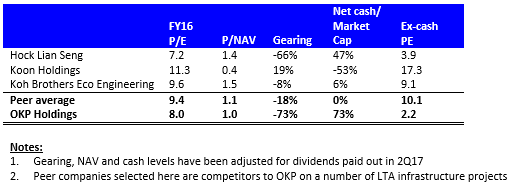

Current valuations are undemanding compared to peers

At the last closing price of $0.37, OKP trades at an FY16 PE of 8.0x, below its peers’ average of 9.4x. However, on an ex-cash basis, this works out to be just 2.2x FY16 earnings, significantly lower than the next higher 3.9x Hock Lian Seng is trading at. Despite the current negative sentiments, we think OKP should trade at a minimum the same level as Hock Lian Seng, which would translate into a price of at least $0.45 per share, representing an upside of more than 21% from current levels.

Further upside might be in store as improving sales at Amber Skye could bump cash pile up another $20 million by mid-2018

Besides its core civil engineering business, OKP has in recent years ventured into property development. Its current exposure to this segment is limited to 10% stakes in each of two maiden development projects: Lake Life at Yuan Ching Road and Amber Skye in District 15.

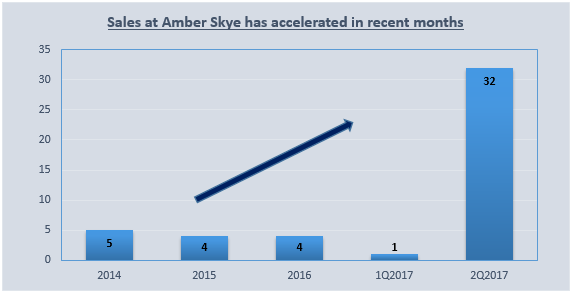

Lake Life, an executive condominium project, has been fully sold and recognised in OKP’s accounts as at 31 March 17. Amber Skye, though, is a different story. As a 109-unit luxury condominium developed together with 90% majority partner China Sonangol Land, it has performed poorly since launching in September 2014. In the 2.5 years from launch to end of 1Q2017, it sold a paltry 14 units at an average psf of $1802.

However, on the back of better property sentiments, sales have accelerated in 2Q2017. During the months of April to June this year, the project managed to sell another 32 units at a much higher psf of $1917, according to caveats lodged with URA. Together with the lone sale in early July, the project has now sold 43% of its total available units. It may be early days yet but should the upward momentum be sustained, the project would be on track to sell the majority of its units by early 2018.

(Source: URA, Stockresearchasia)

With the estimated breakeven cost of the project at around $1550 to $1600 psf, Amber Skye is likely to contribute at most $2-4 million to OKP’s bottom line over the next 12 months. The bigger impact instead, will come from the repayment of $19.7 million in shareholder’s loan that OKP has extended to the project company. The loan is currently repayable in full by 26 June 2018 and had previously been written down by $1.4 million due to poor sales performance. If Amber Skye succeeds in selling the majority of its units by the repayment date, OKP should get back more than $20 million in cash (including its share of profits) giving its already strong cash position a major boost to around $0.335 per share even if we fully discount any additional cash to be generated from its operations.

Recommendation

Amidst the extensive media coverage on its latest mishap, OKP is likely to face increased scrutiny from its public sector clients, particularly LTA, in its current projects and future tenders. At the same time, its share price could also face short term downward pressure from the negative sentiments generated.

However, we think that its solid fundamentals buttressed by a robust order book, strong net cash position (which could potentially get even stronger by mid-2018) representing 73% of its market capitalisation, low valuations and attractive dividend yield should see it through the current challenges.

As for its mid to long term prospects, much will depend on the Company’s success in convincing these public sector clients of its efforts to improve its worksite safety. We believe that LTA and other government agencies will take OKP’s overall track record, including the 8-year run when the Company succeeded in avoiding any MOM-issued SWOs, into account in assessing its future tenders.

Given the above, we think the selling is overdone and that the current depressed share price offers a good opportunity for value investors to accumulate OKP shares with a potential upside of at least 21%. Further upside over the next 12 months might be in store should its 10% owned Amber Skye project continue its strong sales momentum. We are opportunistic buyers at this price.

[i] Or Kim Peow Contractor was first established as a sole-proprietorship in 1966 before Or Kim Peow Contractors (Pte) Ltd was incorporated as an exempt private company to take over the sole proprietorship’s business.

[ii] From 1 Apr 11 to 31 Mar 16 based on LTA’s financial year ending 31 Mar.

[iii] As per announcement on 20 Jun 2016

[iv] It has been reported in the media that 2 of the 10 injured workers are still in critical condition at time of writing

[v] After adjusting for dividends of 1.5 cts per share paid in May