Firstly, Sysma Holdings announced last Tuesday (9 Jul) a fresh contract win worth $4.9 million to build a bungalow in District 10.

Then, just barely 3 days later, Sin Ee Wuen, Deputy CEO and son of Sysma's Executive Chairman and major shareholder, Sin Soon Teng, acquired more than 7.6 million or 3% of all Sysma shares from various parties and in the open market last Friday at between $0.16 and 0.17 per share.

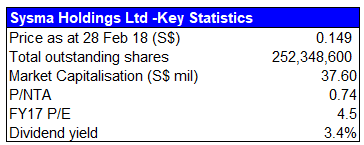

While it is hard to know exactly the intention of this seemingly bullish insider purchase, we note that it also comes very close to Sysma's financial year-end of 31 July. The average purchase price of $0.166 is also at a substantial discount to the company's 100% net cash-backed NAV of 22.3 cts per share.

Hence, the purchase could be taken as a possible sign of positive news flow from its upcoming results announcement or simply a shrewd move to acquire the shares at a bargain price.

Either way, we remain convinced that the shares deserve to trade at a price closer to its NAV.

RSS Feed

RSS Feed