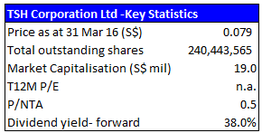

We believe that low profile SGX listed microcap TSH Corporation Ltd (“TSH”) should be on the immediate radar screen of investors. Not only does it trade at a steep 20% discount to its net cash position of S$0.099 per share, it recently declared a dividend of S$0.03, which in itself makes up 38% of the last traded price of S$0.079. On top of these, the company has also announced its decision to dispose of its freehold property near Tai Seng MRT, a building it acquired shortly after the GFC in 2009. Our conservative estimates show that if the company successfully disposes of the said property even at a significant discount to current asking prices of similar properties in the vicinity, its net cash position would balloon to S$0.169 or 2.1 times the last traded price! With the company choosing not to take an active approach in the capital-intensive property development business for now, we see limited risk of excessive cash drain threatening its cash pile.

At the current market price of S$0.079, TSH is significantly undervalued. We think it should, at the very least, trade at its existing net cash and short-term securities position of S$0.107, or a 35% premium to its last traded price. An even bigger upside could be realised if TSH succeeds in disposing of its freehold property at our assumed price or better.

Background

Brief summary on TSH

TSH operates in 3 main business segments: Homeland Security Services, Consumer Electronic Products and Property Development, the last of which is effectively dormant following the recent sale of its Australian property developments.

TSH’s Homeland Security Services business, which is largely project-based in nature, provides the following services:

- Defence related materials disposal and recycling;

- Land remediation;

- Security consultancy;

- Civil defence shelter; and

- Supply and choreography of pyrotechnic and firework displays.

Its Consumer Electronic Products business consists of the design and development of electronic products such as headphones, earphones, speakers and accessories for mobile phones and tablets as well as original design and manufacture of digital imaging products.

Prominent controlling shareholder

The largest shareholder in TSH is the family of late hotelier Teo Lay Swee, whose stake is held through family holding company Cockpit International Pte Ltd and Teo Kok Woon. The low key Teo family has a long history of shrewd property deals, the most prominent being the disposal of Cockpit Hotel (which has since been developed into Vision Crest Commercial and Residential buildings) together with the adjacent House of Tan Yeok Nee to WingTai for S$380 million[i] back in 1996, several times the total amount the senior Teo paid for them in 1983 and 1991 respectively. Others include selling Ibis Novena for S$118 million at a reported a profit of over S$40 million 2 years after developing it. That said, the family appears to be a rather passive controlling shareholder with Teo Kok Woon himself happy to remain as a non-executive director in TSH for the past 10 years.

Low key results announcements including dividends and property disposal

On 29 February 2016, TSH released its annual results for the year ending 31 December 2015. Its results were unremarkable as it recorded a pre-tax loss of S$7.1 million largely due to one off exceptional items including impairment losses and loss on disposal of property of S$4.5 million and S$1.9 million respectively. Excluding all exceptional items, the loss before tax would have been a much more benign S$0.2 million, reversing from a gain of S$1 million the year before.

Despite the loss, however, TSH unexpectedly announced a bumper dividend of S$0.03 per share or almost 38% of its last traded price of S$0.079. Interestingly, this is the first time the company announced a dividend in the last 5 years. As part of the announcement, the management also revealed its intention to dispose of its freehold property at Burn Road.

Freehold Property to be put up for sale

The freehold property in question is a 7-storey detached freehold industrial building named TSH Centre located within a short distance of Tai Seng MRT station and with an estimated gross floor area of 23,508 sq ft and land area of 10,623 sq ft. It was acquired at a bargain price of S$8.8 million close to the bottom of the property cycle in 2009. URA has zoned the area in which the property is situated as a B1 industrial zone with a maximum plot ratio of 2.5.

Our Take

Market is effectively paying you to buy TSH shares even if property sale does not happen…

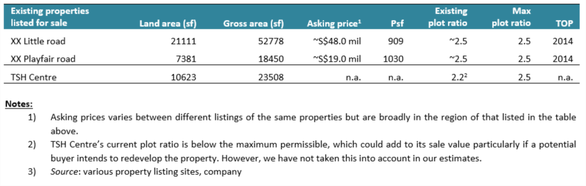

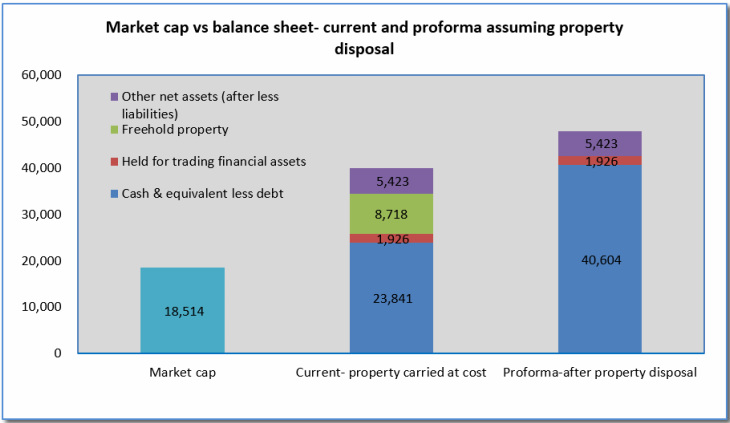

TSH currently trades at a discount of 20% to its net cash value (giving it a negative enterprise value) and a discount of 26% to the total value of its net cash and ST securities. This means that if you as an investor were to buy S$1000 of TSH shares at the current price, you would get back in value: net cash of S$1255 and another S$101 in short term securities. Yet more bonus value comes in the form of the freehold property (S$459 if measured by book value alone) and S$285 in other net assets.

…but potential reward increases significantly if property sale goes ahead

The sale of TSH Centre looks set to provide an even bigger boon to shareholders as it will unlock value in the property. We estimate that the property is currently carried on TSH’s books at a cost less depreciation of S$8.7 million or just S$378 per square foot of gross area. To estimate how this compares with the actual realisable price in the event of a sale, we did a search on publicly available commercial property platforms for B1 Industrial properties in the building’s vicinity. Our search yielded two freehold properties:

(Source: Map from URA, pictures by stockresearchasia.com)

Figure 1: Table and map showing plot ratio and key statistics of TSH Centre and nearby freehold properties listed for sale on commercial platforms

Both properties are being listed for sale at above S$900 psf, with a plot ratio close to the maximum permissible of 2.5. While both properties are broadly comparable to TSH Centre, they are also much newer and display different characteristics in terms of size, proximity to public transport facilities like the MRT station and frontage. Further taking into account that their actual transacted prices could be lower than list prices especially given the challenging market conditions, we choose to err on the side of caution and peg the value of TSH Centre at S$727 psf of gross area, a 20% discount to the lower psf of the two properties. This would yield potential sale proceeds of S$16.8 million or almost double its book value. Consequently, TSH’s net cash position could balloon to S$40.6 million or about 2.1 times the current market capitalisation.

Using our earlier example of the investor buying S$1000 of TSH shares to illustrate, should the company succeed in selling TSH Centre, the investor would be getting in value S$2138 in cash in addition S$101 in short term securities and S$285 in other net assets. This is not even taking into account the proposed dividend of S$380 that the investor should receive by May 2016.

Given that the company will not be actively seeking new property development projects, we posit that the management might even choose to reward shareholders with more bumper dividend payments in future.

Figure 2: TSH is trading at a steep discount to just its current net cash position; discount set to increase even further if property is disposed as planned by management

Possible target for shareholder activists?

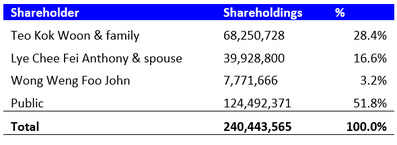

The Company’s shareholdings are fairly loosely controlled with the three biggest groups of shareholders, namely the Teo family, CEO Anthony Lye & his spouse and non-executive Chairman John Wong holding 48.2% in total, leaving the public free float at 51.8%. With more than 50% in the hands of the public, small market capitalisation and a cash loaded balance sheet, we think that TSH could potentially be targeted by activist shareholder groups. In the event this happens, value realisation could be expedited. We stress, though, that this should not be a primary reason for investors to buy into TSH.

Figure 3: Top 3 shareholders own less than 49% of TSH’s total outstanding shares

Recommendation

With the stock trading at such a significant discount to just the value of its net cash and short term securities, TSH is a compelling buy. The buy case gets even stronger if the company manages to sell its freehold property even at the conservative price we have assumed. Add to the fact that a dividend of 3 S cts per share is set to be paid in the coming months, we believe the risk reward for an investment in TSH is too favourable for investors to ignore. The current price presents an excellent opportunity to accumulate its shares with limited downside risks. We are definitely buyers at this price.

Key Risks

Further deterioration in the company’s consumer electronics business could put pressure on the company’s cashflow and consequently its cash pile. However, this should be partially mitigated by the more stable homeland security business. The company has also generated on average positive free cash flows over the past 5 years which provides us with some comfort in its cash flow generating powers.

[i] Cockpit Hotel and House of Tan Yeok Nee were separately acquired by Teo Lay Swee in 1983 and 1991 respectively. The consideration for Cockpit Hotel then was S$62 million. While the price for House of Tan Yeok Nee was not disclosed, it is safe to assume that it cost much less. The conservation property was onsold by Wingtai to Union Investment Real Estate AG and then ERC, the latter transaction happening in 2012 or 21 years after Teo Lay Swee bought it at a price slightly more than S$60 million and after Wing Tai had spent S$12 million restoring the property in 1999.