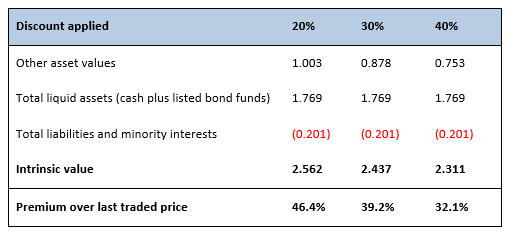

Assuming the successful completion of the Divestment, we estimate that the company will have a balance sheet stuffed with net cash and fairly liquid bond fund holdings amounting to S$1.769 per share, which by itself is already more than the last traded price of S$1.750 per share. Even if we further assume very conservatively that the remainder of its assets consisting mainly unsold Chinese property developments are written down by as much as 40% in value, the shares would still be worth S$2.311 per share or 32% above its last traded price.

As the company had already announced that it will pay out the net proceeds of the Divestment by means of a capital reduction, we think that its shareholders could stand to reap a cash bonanza of S$0.957 cents a share, which should provide further near term boost to its shares. We think that IPC offers compelling value at this price.

Background

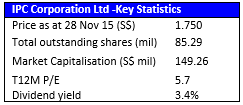

IPC Corporation Ltd (“IPC”) is a property and hospitality group controlled by Singapore based billionaire Oei Hong Leong, son of Indonesian tycoon Eka Tjipta Widjaja of the Sinar Mas group.

On 6 November 2015, IPC announced that it had entered into a sale and purchase agreement with Tokyo-listed Ichigo Group Holdings Co., Ltd (“Ichigo”), for the sale by the Company of its collection of seven business hotels in Japan for a total sale consideration of JPY 14.9 billion or approximately S$172.2 million. Ichigo, which recently upgraded its listing to the First Section of Tokyo Stock Exchange, is a diversified real estate group with a market capitalisation of approximately S$1.9 billion.

The seven hotels are located throughout Japan in the following cities: Tokyo (2), Okayama, Matsuyama, Kumamoto, Naha and Osaka, and carried on the company’s books at JPY10.4 billion (S$119.4 million). IPC is expected to generate a net gain of JPY2.7 billion (S$31.1 million). This translates into net proceeds of JPY13.1 billion (S$150.5 million). While the Company did not explain the significant difference between the gross and net proceeds, our guess is that a large part of it could be attributed to Japan’s capital gains tax which could cost well over 30% for assets held for less than 5 years.

Completion of the transaction is expected to take place on 17 December 2015. The Divestment follows the sale of its two Sapporo hotels, incidentally also to Ichigo, for S$29.6 million in December 2014 and heralds IPC’s exit from Japanese hospitality assets, representing a turnaround from the Company’s stated aim of expanding its Japan hotel portfolio in its FY2013 annual report.

Our Views

This latest corporate action did not come as a surprise. Afterall, IPC had been mulling the sale since at least as early as March 2015 when it announced that it was in negotiations for the proposed disposal for a then total consideration of S$150 million. The Company subsequently announced in June 2015 that it will not proceed with the sale under those terms. With the latest agreed consideration at a significant premium to both the previous consideration as well as the market valuation of S$119.4 million, we believe this represents a good opportunity for IPC to cash in on the assets it had amassed between June 2010 and October 2013 at a healthy profit.

Equally motivated buyer should ensure successful deal completion

On the other hand, Ichigo may appear to be getting the short end of the stick having to fork out an additional JPY4.5 billion (S$52.8 million) over market valuation for the acquisition. However, we note that Ichigo had in October established a new hotel J-Reit, Ichigo Hotel REIT, scheduled to be listed on TSE on 30 November 2015. Ichigo Hotel REIT’s initial portfolio consist primarily of 9 hotels that Ichigo sold to the REIT, includng the two Sapporo hotels which it had earlier acquired from IPC. We further note that these two hotels were sold at a combined valuation of JPY3.6 billion, a significant premium over the JPY2.7 billion it paid IPC just 10 month prior. Similarly, we expect Ichigo to inject the seven hotels into Ichigo Hotel REIT in due course at favourable valuations. At a total consideration of JPY 14.9 billion, the seven hotels would also provide a significant boost to Ichigo Hotel REIT’s portfolio, currently worth about JPY 20.4 billion. It is thus also very much in Ichigo’s interest to see the transaction through.

Our belief that both parties are motivated to complete the sale is further reinforced by the presence of a significant JPY 0.5 billion (S$5.8 million) break fee for the transaction, which should serve as a sufficient deterrent against potential deal default by either side.

Balance sheet to strengthen considerably post completion, shares are currently undervalued

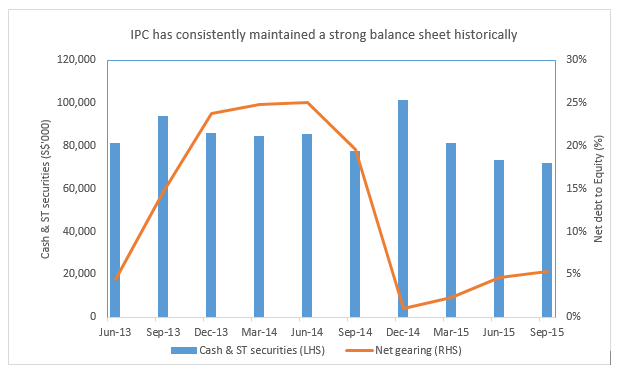

IPC has typically maintained a strong under-geared balance sheet. Its net debt to equity over the last 10 quarters has not been more than 25%, with the latest figure at 5.3% as at 30 September 2015.

Post completion, we expect its balance sheet to strengthen even further to a net cash position of S$139 million or S$1.633 per share. In addition, IPC also holds S$20.3 million of financial assets consisting mainly listed bond funds and unlisted debt investments in a China property company. We estimate that the listed bond funds, which should be fairly liquid, amount to about S$11.5 million or S$0.136 per share, giving the company S$1.769 per share of value in net cash and listed bond funds alone.

The remainder of IPC’s assets consist largely of:

- Xu Ri Wan Huan Yuan (completed in 2014 and comprising hotel, kindergarten, club house and car park)

- Minority investments in three property investment in China, including Aenon International Plaza and Ju Ren Da Sha.

- Unsold Oiso Condominium Units in Japan

Amongst the above assets, Xu Ri Wan Huan Yuan is by far the most sizeable with a net book value of S$77.4 million[i]. As little information on the status of this property has been disclosed, we conservatively assume that it is currently 100% unsold and illiquid.

All in, the other assets held by IPC amounted to S$107.0 million or S$1.254 per share, giving the company an adjusted NAV post DIvestment of S$2.81 per share.

However, in order to satisfy ourselves with a conservatively derived value for IPC, we decided to apply a stress test[ii] to the value of these other assets which we deem to be largely illiquid by applying various discounts of between 20% to 40%. The results show that even at a maximum discount of 40% which should provide us with a healthy margin of safety, IPC would still be worth about S$2.311 per share.

IPC shareholders to be rewarded with cash bonanza estimated at S$0.96 per share

Aside from trading at a steep discount to its intrinsic value, we also expect IPC’s share price to be given a near term boost once the Divestment is completed as expected by 17 December 2015. This is largely due to the fact that the Company had already announced its intention to distribute the net proceeds to its shareholders via a capital reduction exercise. With the net proceeds at approximately S$150.5 million, we estimate conservatively that upon repayment of its borrowings related to the seven hotels, IPC will have S$81.6 million available for distribution to shareholders. This is equivalent to S$0.957 per share representing a sizeable 55% of the last traded price of S$1.750.

Bullish purchases by Oei Hong Leong further reinforces our views that the shares are undervalued

On 1 April 2015, Oei Hong Leong, the controlling shareholder of IPC and one of the most watched investors in the Singapore stock market, acquired 6,319,200 shares (pre-consolidated basis, equal to 631,920 shares after the 10 to 1 consolidation on 9 June 2015), thereby triggering the mandatory conditional takeover offer of IPC at S$0.17 per share (equivalent to S$1.70 post consolidation). The mandatory offer is triggered when a shareholder first takes his shareholding across the 30% mark in a SGX-listed company. The offer ultimately did not succeed and Oei’s stake remained at 30.56%.

On 3 August 2015, Oei further acquired 850,000 post-consolidation shares albeit at a lower average price of S$1.53 per share, thus bringing his holdings to 31.56%. We note that this is the maximum amount that Oei can acquire within any six month period without triggering another takeover offer. The bullish purchases by Oei further reinforces our view that the shares are undervalued.

Recommendations

We believe IPC to be grossly undervalued. At the latest closing price of S$1.750 per share as at 27 November 2015, it is trading at below the value of its net cash plus listed bond holdings of approximately S$1.769 per share assuming the successful completion of the Divestment. Even if we were apply a very conservative 40% discount to the book value of all its other assets, the shares would still be worth at least S$2.311 per share or 32% above the current share price.

With the Company announcing that it will distribute the net proceeds from the Divestment to its shareholders in the form of a capital reduction estimated to be as much as S$0.957 per share, we think that the share price could also be due for a near term boost. Still further upside could come from positive developments from its China properties.

With a healthy margin of safety, we see compelling value in IPC at S$1.750 and are definitely buyers at this price.

Key Risks

Non completion of the Divestment or lower than expected distribution from the Divestment could have short term adverse impact on the share price.

[ii] We note that in the offeree circular sent to its shareholders on 30 April 2015, the Independent Adviser had indicated a valuation surplus arising from latest open market value of Xu Ri Wan Hua Yuan of S$96.6 million. Our conservative valuation has not taken into account any potential valuation surplus that this property may generate as it is currently unsold.

[iii] Exchange rate used S$1 = JPY86.75

RSS Feed

RSS Feed