After all the hullabaloo about how US stocks recorded one of the worst Decembers since 1931, the S&P 500 ended 2018 down a relatively mild 6.2% while all major Asian indices managed to register much larger declines. STI, for instance, fell 9.8% despite not running up as much comparatively over the previous 2 years. Hang Seng, Nikkei 225 and the Shanghai Composite, which slid 12.1%, 13.6% and 24.6%(!) respectively, fared far worse.

For the whole of 2018, we only made one stock recommendation: Sysma Holdings- a net-net niche contractor cum developer trading at a substantial discount to its net cash position alone. At the same time, we also continued covering developments at Hupsteel, which was a pick we made towards the end of 2017. We will touch briefly on the performance of these two below.

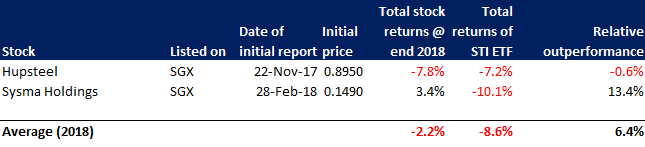

Performance of our picks

Overall, the two stocks delivered an average total return of -2.2% since our first reports on them. Even though this is good enough to beat the benchmarks by a margin of 6.4% for the 4th year in a row, both stocks have not traded up to our expectations amidst dwindling volumes.

Hupsteel- Management moving in the right direction

Our interest in Hupsteel stems from our belief that management changes (Stepping down of co-CEO and change of Chairman) in the last 2 years would spur the company to unlock substantial value from its attractive portfolio of freehold properties. That remains pretty much the case.

Since our initial report in late 2017, the Company has already announced two major developments with respect to its property portfolio:

- The redevelopment of 38 Genting Lane into a new 8-storey industrial building capable of being strata subdivided for use by multiple users; and

- Successfully leasing out of its previously vacant industrial property at 6 Kim Chuan Drive

The market though appears to have completely ignored the company's efforts and intentions in this area. For despite the company raising its dividend payout for the 3rd year in a row to 4 cts a share for FY2018, representing an attractive yield of 5.1%, the stock continues to trade at a sizeable 32% discount to just the sum of its liquid assets (cash + listed securities) and value of investment properties. Nonetheless, should the management succeed in monetizing some of its investment properties, Hupsteel shareholders can expect happier days ahead.

Sysma Holdings- Cash rich, price poor

As for Sysma Holdings, we have already provided multiple updates throughout the year. You might want to refer to the links at the bottom if you have not read them before.

Based on the last traded price of S$0.146, the stock still trades at a puzzling 27% discount to its fully cash-backed NTA. While the construction industry has been affected by the current lull in the property sector, Sysma’s order book of S$56.7 million as of 31 July combined with the latest S$18.6 million contract win in December should ensure that its core construction business remains sufficiently shielded against likely increasing headwinds.

Consequently, we do not envisage any deterioration in its financial position or a reduction of its dividend payout of 0.8 cts per share (good for 5.5% yield) in the near to mid-term.

Closing Note

We enter 2019 slightly more optimistic than a year ago. This is not to say that we expect equity markets to turn positive anytime soon. On the contrary, we expect volatility to remain for an extended period of time. A global economic slowdown, continued trade protectionism and rising interest rates coupled with record high corporate debt all pose substantial risks to the equities. However, none of these present a greater potential threat than the man currently occupying the White House.

Starting a new trade war severe enough to cause a slowdown in the world’s second largest economy? Shutting down the US government down to try to fulfil a campaign promise he can’t keep and potentially shaving billions off the US GDP? Antagonising and subsequently romancing the leader of a nuclear power known for his erratic behaviour? Or casting doubts over the independence of the world’s foremost central bank? Check, check, check and check. The bottom line is, with Trump at the helm, the next market-moving event is always just a tweet-from-the-hip away.

What this means is that there will be probably be more days in 2019 when the manic-depressing Mr Market (an apt description for Trump himself if I may add) will be kind enough to offer stocks of quality companies at substantial discounts to their intrinsic value. And for value focused investors with longer investment horizons, there can be no sweeter sounding music than this.

Cliff

Links:

Hupsteel report and updates: Sysma Holdings report and updates:

Usual disclosure: The above views are our own and are not meant to be construed as an offer, or solicitation of an offer to sell or buy securities referred herein. Please refer to the section “Important Notice” at the bottom of our homepage for additional information.

RSS Feed

RSS Feed