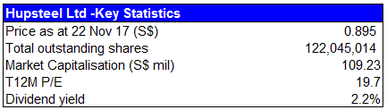

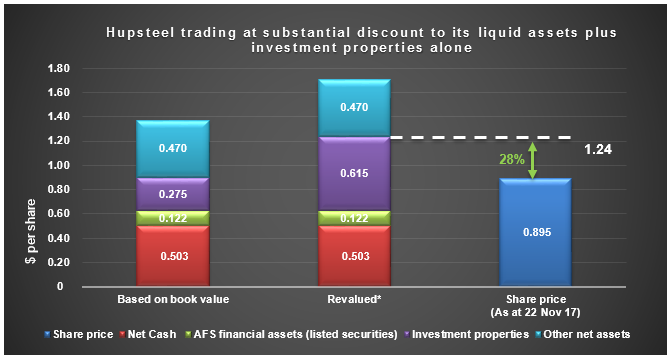

Previously in June, we cited the possibility of a renewed interest in steel stockists like Hupsteel and Asia Enterprises following the intriguing developments at HG Metal. While Hupsteel’s share price has returned 12% since then (14% if dividends are included), it is still trading at a substantial 28% discount to just the sum of its net cash, available for sale financial assets and investment properties alone and an even more attractive 48% discount to its revalued NTA of $1.71 per share. Furthermore, recent signs that the Company’s management is turning its attention towards maximising the returns of its investment properties has us increasingly positive that this big discount it is trading at will narrow considerably in the near to mid future. We are buyers at the last traded price of $0.895.

Valuable investment properties portfolio- more action in store with new sole CEO at helm?

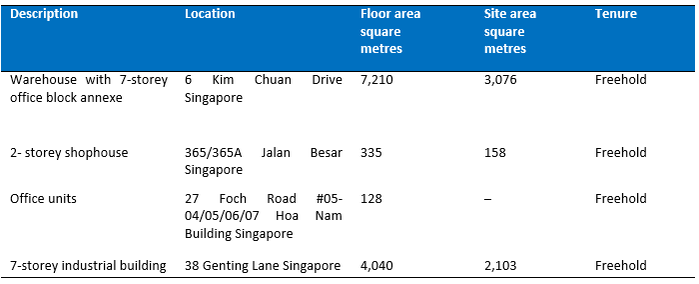

To recap, Hupsteel owns, under its property division, a relatively sizeable portfolio of freehold commercial and industrial investment properties that it had held substantially unchanged from the time of its IPO in 1994. On 29 Jun this year, however, the Company announced that it had sold one of its two long-held Jalan Besar shophouses at a price of S$5.2 million, booking a handsome profit of $4.5 million in the process.

This came as a surprise as prior to this sale, the only significant activity Hupsteel undertook with respect to its investment properties in the last 23 years had been the redevelopment of 6 Kim Chuan Drive into a 7-storey industrial building in 2015.

6 Kim Chuan Drive as featured on online commercial real estate platform, www.commercialguru.com.sg

Hupsteel’s remaining investment properties

Although the sale generated little fanfare, we posit that it could mark the beginning of a series of developments signifying the Company’s intentions to maximise returns from its investment properties. Our views are reinforced by telling disclosures in the latest annual report and comments made by the management during last month’s AGM.

Besides promising that “more action will be taken on its remaining properties in anticipation of a recovery in market conditions” in its latest annual report when reporting the sale of the said Jalan Besar shophouse, the management also presented some updates at the AGM with respect to the rest of the portfolio, namely:

- The Company is in advanced talks to lease out the majority of 6 Kim Chuan Drive, the largest property in its portfolio, to a single MNC client;

- Rising en bloc activities especially in the nearby Jalan Besar Plaza[1] could stir increased interest in their office units in Hoa Nam Building which is similarly zoned as a mixed development and that may in turn lead to opportunities for the Company to cash in; and

- The Company may consider plans to redevelop its aging 7-storey industrial building at 38 Genting Lane to optimise its potential

We think it is no coincidence that the above developments are taking place less than a year after Mr Lim Bor Chuan, the 3rd generation member of the controlling Lim family, took over as sole CEO of the Company, a role previously shared with his uncle Lim Kim Thor. After all, the younger Lim has a degree in Estate Management and has been in charge of managing the Company’s real estate portfolio since IPO. With him at the helm, we are optimistic that Hupsteel will be more proactive in managing the portfolio, which should be music to shareholders’ ears.

Given that the remaining investment properties have a total market value of $75.2 million[2], any attempts to maximise the potential of this portfolio could go a long way towards closing the gap between its share price and revalued NTA.

Core business turning a corner

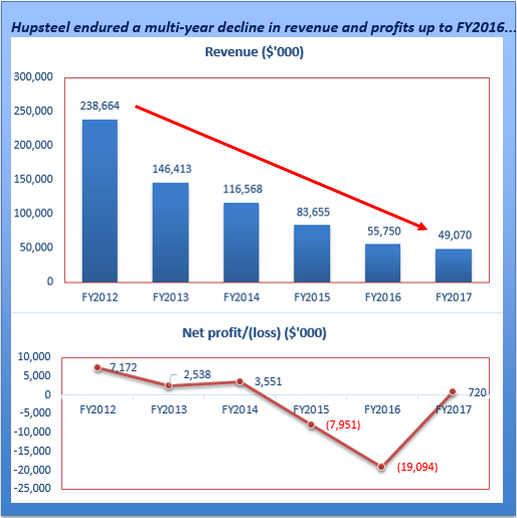

The positive developments with respect to Hupsteel’s property division also comes at a time when its core business seems to be finally stabilising after a multi-year decline.

Hupsteel’s core business is in the supply of steel products and industrial hardware to industries such as the oil and gas, chemical and petrochemical, energy, infrastructure, marine, etc., with the majority of its revenue derived from Singapore. Perhaps unsurprisingly, it was badly affected by the downturn in the marine and oil and gas sectors in the last few years. In fact, between FY2012 and FY2016, Hupsteel’s revenue collapsed almost 80% while its profit after tax swung from a positive $7.2 million in FY2012 to a loss of $19.1 million in FY2016, mainly due to write-downs in both its inventory and receivables.

By FY2017, however, its core business appears to have finally stabilised and that momentum continued into 1Q2018 when it announced its fourth consecutive quarter of profits[3].

A large part of this recovery should be credited to the Company’s efforts to better manage its inventory “by making small regular purchases to avoid being saddled with the burden of holding large quantities of slow moving inventory and making sure that commonly required sizes were readily available to meet customers’ needs”[4].

In addition, the Company also revealed that it is actively seeking collaboration opportunities with some of its customers to work together on tendering for projects in a bid to broaden its revenue stream. If successful, we reckon this could lead to an increase in both revenue and profit margins. Nevertheless, regardless of whether it succeeds in its new approach, we think the worst is likely over for its core business.

Strong net cash balance can support increased share buyback and dividends

On the back of the welcome stabilization of its core business and a strong balance sheet with net cash balance of $61.5 million[5] as at 30 Sep 17, Hupsteel has also been stepping up both its share buyback and dividend payout. For FY2017, it paid a dividend of 2 cts per share, giving it a dividend yield of 2.2%. This is an increase from the 1 ct and 0.5 ct declared in FY2016 and FY2015 respectively, although it is still a far cry from the 5 cts per share it paid in the years prior to FY2015.

Meanwhile, it has resumed its share buyback activities in FY2017, after a break of 2 years. Although the amount of cash it typically spends on buybacks is still insignificant (<$1 million per year), it nonetheless signifies the management’s confidence in the Company’s outlook especially when taken together with the increased dividend payout.

Going forward, we think there is scope for the Company to increase its dividend payout even further for FY2018, possibly funded by the proceeds from the disposal of its Jalan Besar shophouse.

Recommendation

We expect further actions by Hupsteel in the coming year to drive increased returns from its valuable investment properties. These could include:

- Sale of the smaller properties within its portfolio such as its remaining shophouse at 365/365A Jalan Besar and the office units in Hoa Nam Building

- Entry into a lease agreement for substantially the entire 6 Kim Chuan Drive building. The lease agreement would also likely enhance the attractiveness of the building as an investment and consequently, we also would not rule out its sale if the right offer comes along.

That said, we see the redevelopment of 38 Genting Lane as less probable in the near future as the management is likely to be extra cautious in pulling the trigger having already experienced an uncomfortably long 2-year (and counting) wait to rent out or dispose of the redeveloped Kim Chuan Drive property.

With the worst of the downturn facing its core steel trading business likely over, any actions taken by the management to enhance returns from its investment properties should have a positive effect on its share price. Consequently, we expect to see the large discount it trades at to its revalued NTA to narrow significantly.

As it is, even if we were to value the Company conservatively based on the sum of its net cash, available for sale financial assets (which consists primarily of listed securities) and investment properties alone and discount its core business entirely, we would still arrive at a value of $1.24 per share, implying a 39% upside from its last traded price of $0.895.

Following HG Metal’s 30% run-up over the last 5 months, we are also of the opinion that Hupsteel now offers better value as well as more share price catalysts than HG Metal. We are buyers at this price.

Key Risks

Another prolonged decline in oil price could lead to an extended downturn for its core steel trading business. However, we think the Company has learned its lesson and would continue to exercise caution in managing its inventory to avoid future losses arising from write-offs.

[1] It has since been reported that Jalan Besar’s en bloc attempt did not draw any bids but attracted instead an expression of interest from a developer. Discussions are still on-going. (Source: Business times, 20 Nov 17)

[2] As at 30 June 2017

[3] Even though a segmental breakdown was not included in the quarterly results, the property division, which only contributed a loss before tax of $835k and profit before tax of $14k in FY2016 and FY2017 respectively, is unlikely to be the major cause of this turnaround outside of the one-time gain from the dispoal of the shophouse in June. Hence, we can surmise that the turnaround is primarily due to a stabilisation of its core steel business.

[4] Source: Hupsteel annual report, FY2017

[5] Adjusted for the 2 cts dividend paid on 15 Nov 17