Company distributing more than the net proceeds from the Divestment

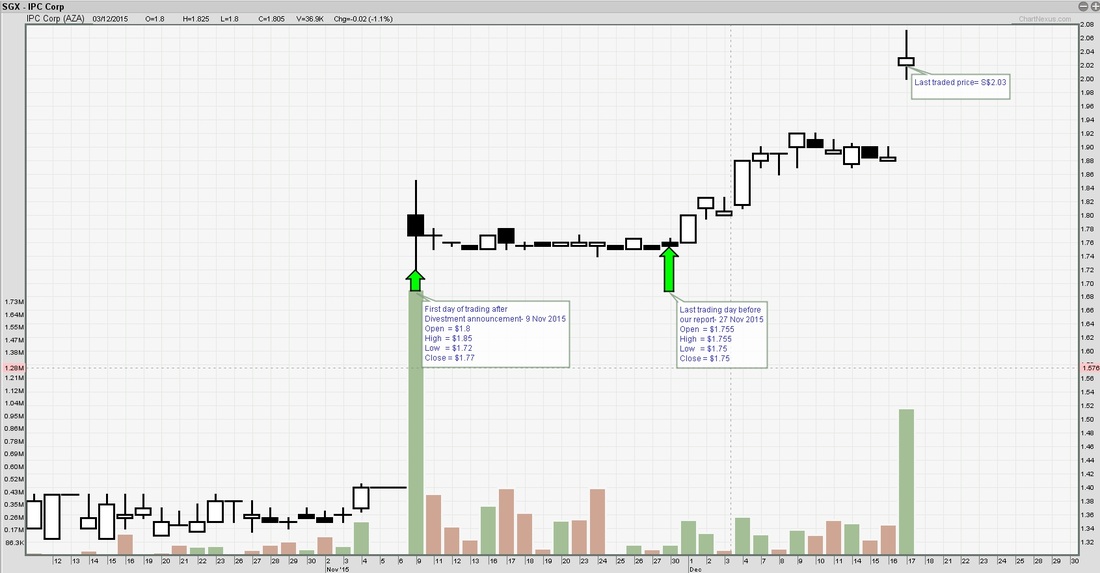

On 17 December 2015, however, the Company announced the successful completion of the Divestment along with a much higher than expected cash distribution of S$1.600 per share! This is a pleasant surprise to us as we have assumed that the Company would only distribute proceeds from the Divestment and retain the remainder of its cash hoard for future reinvestment purposes. The market meanwhile has reacted positively to the surprise move, with the share price spiking up almost 10% to S$2.07 before closing at S$2.03 on the same day.

Recommendation

While we think that IPC can easily afford the cash distribution S$1.600 per share, given its extremely robust net cash position of S$1.633 per share post Divestment in addition to S$0.136 per share worth of listed bond funds, we see the latest corporate move as possibly heralding the Company’s exit from the real estate business altogether. To recap, the value of IPC's remaining assets lies largely in a major mixed development (Xu Ri Wan Huan Yuan) in China. From a strategic perspective, IPC thus has the option to remain as a single asset play, which we think is unlikely. Alternatively, it could either continue its expansion in China and other markets (note that it has more or less exited from both the Japan and US markets) or exit completely. The move to distribute substantially all its excess cash seems to suggest the latter.

Should the Company go down this path, we posit that there could be further divestment and cash distribution exercises in the future. The gradual monetisation of its assets could well see the share price of the company approach its estimated NTA value of S$2.813 or more. At the last traded price of S$2.030, IPC remains pretty much undervalued.

RSS Feed

RSS Feed