MIIF, an entity listed on the mainboard of SGX but structured as a closed ended fund, had announced on 15 May 2015 the sale of its sole remaining asset, an 81% effective interest in Hua Nan Expressway Phases 1 and 2 (HNE) to Topwise Consultants Limited, an existing minority shareholder in HNE, for a total cash consideration of S$110 million (the “Proposed Divestment”). Post completion, MIIF intends to distribute the net proceeds and any excess cash it holds by way of a share redemption, following which it will be delisted from SGX.

The share redemption is expected to take place by 30 October 2015 provided that the Proposed Divestment is completed by its long-stop date of 15 September 2015 and investors will be returned around 8.25 S cts per share based on MIIF estimates which we deemed to be reasonable. This gives investors a potentially low risk return on investment (ROI) of 3.1% over what is likely to be a maximum two-month holding period or an equivalent return of close to 20% annualized.

Brief Background

In December 2012, MIIF made the decision to initiate the disposal of all its then existing assets following a strategic review. In subsequent years since, MIIF successfully completed the divestments of Taiwan Broadband Communications, Changshu Xinghua Port and Miaoli Wind and returned 54 S cts per share to its shareholders. HNE is currently the sole investment held on its books.

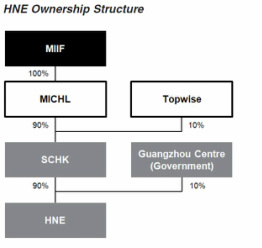

MIIF’s interest in HNE is held through its 90% owned subsidiary, South China Highway Development (HK) Ltd (“SCHK”), which in turn holds a 90% interest in HNE. This gives MIIF an effective interest of 81% in HNE. Topwise Consultants Limited (“Topwise”), the proposed buyer owns the remaining 10% of SCHK. The proposed transaction involves the sale of MIIF’s 90% share of SCHK to Topwise for a total consideration of S$110 million. Little is known and has been announced of the buyer except that in 2007, Topwise, together with Precise Management Ltd, sold the same equity stake to MIIF for $295.7 million[1].

HNE is a dual-carriage urban toll road in the city of Guangzhou, China and acts the city’s main artery for north-south traffic. The interest in HNE comes with the exclusive rights to operate and collect tolls up to 2026. In the last two full financial years, namely FY2014 and FY2013, HNE contributed S$12.3 million and S$12.1 million in dividends respectively.

Investment case

3.1% returns over a two-month period sufficiently attractive under current market conditions

We believe that MIIF would make for a sensible arbitrage opportunity returning around 3.1% based on the last traded price per share of S$0.08 over an estimated period of 2 months or about 20% annualised. While a 3.1% return may not be much to shout about under normal circumstances, we think that this would be a sufficiently attractive opportunity for investors seeking short term stable returns with excellent downside protection especially given the current turmoil in the stock markets.

Low execution risks and high probability of deal completion

While the completion of the Proposed Divestment was originally envisaged to be on 5 August 2015 and has since been delayed, we still believe that there is a high likelihood that the transaction would be completed in due course and before the long stop date of 15 September 2015:

- The key condition precedent for the transaction is the approval of MIIF shareholders, which has already been obtained on 27 July 2015.

- As a long time existing shareholder of HNE, Topwise does not require any due diligence and accordingly, the Proposed Divestment will not be subject to conditions typically expected from other third party purchasers and includes only limited representations and warranties.

- As one of the two previous owners of the HNE stake, we expect that there will be little or no regulatory risks regarding the transfer of the ownership to Topwise as is sometimes the case for Chinese acquisitions.

- While little is known or has been announced of Topwise and their financial standing, we believe that financing is unlikely to be an issue given that Topwise, together with Precise Management, had received a much higher consideration of S$295.7 million when they sold the stake to MIIF in 2007. In addition, Topwise has remained as a minority partner in HNE since the original sale and MIIF is likely to have done its part in ensuring that Topwise has the necessary financing lined up before entering into the sale and purchase agreement.

MIIF's manager has 17.4 million reasons to see through transaction

MIIF’s manager, Macquarie Infrastructure Management (Asia) Pty Limited (MIMAL) stands to enjoy a big windfall of S$17.4 million upon successful completion of the transaction as the total cumulative proceeds from all its divestments including HNE will exceed the minimum S$694.9 million threshold thereby triggering the success fee. This gives MIMAL extra motivation to see through the transaction.

Excellent downside protection even if deal falls through

In the unlikely event that the Proposed Divestment falls through at this late stage, MIIF would still be able to continue benefiting from the stable cashflows HNE generates going forward. For FY2014 and FY2013, HNE contributed S$12.3 million and S$12.1 million respectively in dividends to MIIF. This helped MIIF maintain a dividend payout of 0.9 S cts for FY2014. We believe that MIIF should be able to pay out a similar amount going forward even if they were forced to retain the HNE stake. This is supported by KPMG's view as the Independent Financial Adviser to the MIIF for the Proposed Divestment that "based on an 85.0% dividend payout ratio of MIIF’s estimated dividends on an undiscounted basis, it would take approximately seven to eight years for Shareholders to realise the estimated net proceeds of 8.25 S cts per share."

Our Recommendations

We believe that MIIF shows all the characteristics of a good short term arbitrage opportunity: high probability of deal completion, decent returns over a two month holding period with potential to be magnified with leverage, and excellent downside protection even if the deal fails at this late stage. For investors seeking a respite from the current carnage in the equity markets, we would recommend this as a viable investment opportunity and are buyers at at S$0.08 and below.

Risks

A prolonged closing of the Proposed Divestment could negatively affect the risk-return dynamics although at the moment we would assign a low probability to this happening given the background of the buyer.

(All preceding amounts in SGD unless stated)

RSS Feed

RSS Feed