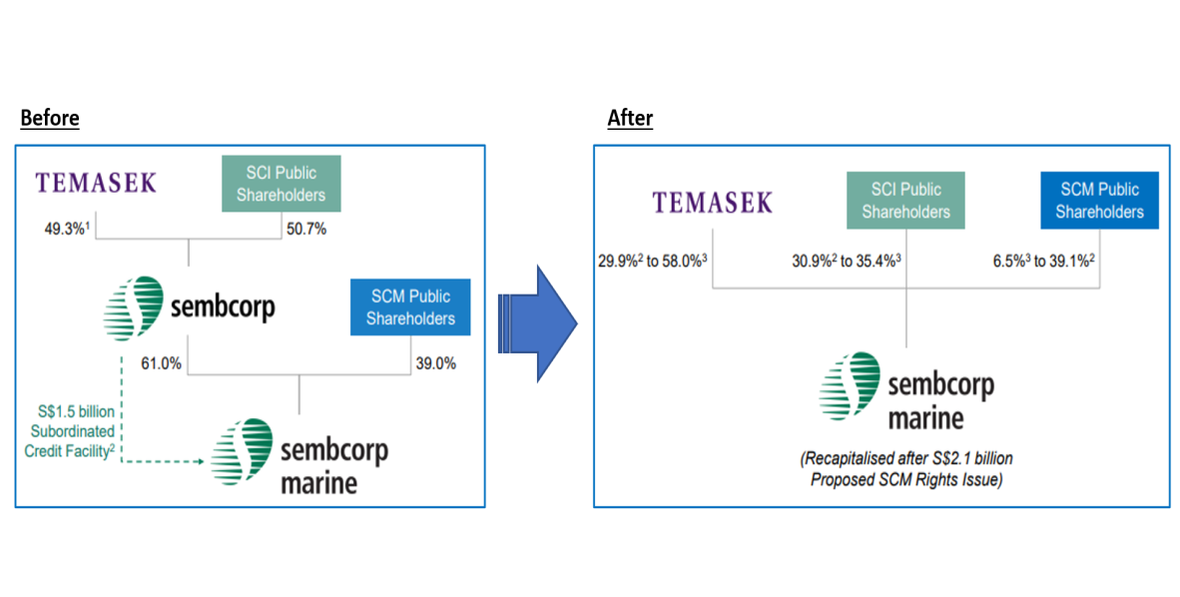

Sembcorp Industries (SCI) and its 60.96% owned subsidiary, Sembcorp Marine (SCM) jointly announced a recapitalisation and demerger exercise consisting of:

- A 5-for-1 rights issue at $0.20 per share to raise S$2.1 bn.

- SCI has undertaken to subscribe up to S$1.5 bn worth of rights shares by offsetting the subscription amount it has to pay with an existing S$1.5 bn subordinated loan it extended to SCM in June 2019.

- However, SCI’s full entitlement under the rights issue amounts to only S$1.27 bn with the remaining S$0.23 bn commitment coming in the form of excess rights shares subscription should there be any left after allocating to minority shareholders.

- SCM will also pay back to SCI any amount outstanding from the S$1.5 bn loan after setting off SCI’s total subscription amount (entitlement plus excess rights)

- The remaining S$0.6 bn of rights shares will be underwritten by DBS Bank, and ultimately sub-underwritten in full by Temasek Holdings, SCI’s parent company.

- SCM will pay an underwriting fee of 0.15% of the underwritten amount to DBS Bank but DBS Bank will not be paying any sub-underwriting fee to Temasek.

- A distribution in specie by SCI of all the SCM shares it holds after the SCM rights issue.

- Temasek Holdings is expected to end up with at least 29.9% of SCM’s shares post the rights issue and distribution in specie by virtue of its 49.3% shareholdings in SCI currently.

- Temasek’s shareholding may increase up to 58% if it ends up having to subscribe for the entire S$0.6 bn amount of rights shares. This maximum shareholding scenario is only possible if not a single minority shareholder subscribes to his/her entitlement, unlikely given the steep 31% discount to TERP based on last 5-day VWAP.

- SCI will not hold any SCM shares post-demerger

Our Take- Winners, Losers and future implications

Winners- SCI and SCI shareholders

One of the biggest beneficiaries from this exercise is obviously SCI. Not only will it rid itself of SCM, which has been an albatross round its neck and a negative drag on the group’s earnings the past 2 years, it also gets a chance to claw back part of the S$1.5 bn it extended to SCM in June last year, thereby improving its own liquidity. That said, SCI will now have to tap onto other sources to repay the 5-year bonds of the same amount it issued last year to finance the SCM loan.

SCI shareholders should find even more reasons to rejoice because on top of standing to reap all the benefits the company enjoys, they get free SCM shares which they can then choose to encash in the market.

Losers- SCM shareholders

The same cannot be said for SCM shareholders though. Not only are they asked to stump up cash for the rights issue, hopes of a cash exit offer for their shares have now been put on ice. In addition, given that one of the stated benefits of the demerger is to create two separate focused companies, the possibility of SCM being outright taken over by Keppel Corp in future is now less likely.

Nonetheless, a potential merger between SCM and Keppel Offshore and Marine cannot be completely ruled out. Afterall, post the ongoing partial offer for Keppel Corp and this demerger exercise, Temasek will still be the controlling shareholder in both entities. It is just that it might come in the form of a combined entity separated from Keppel Corp’s other businesses instead. Regardless, this is likely to be scant consolation for existing SCM shareholders.

RSS Feed

RSS Feed