Background

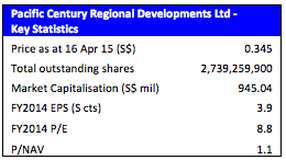

Pacific Century Regional Developments Ltd ("PCRD") has been an integral part of billionaire Richard Li Tzar Kai's empire ever since he acquired control of the SGX-listed company in 1994. Currently, it serves mainly as an intermediate holding company for Hong Kong listed PCCW Ltd, which in turn controls:

- now TV, Hong Kong's leading Pay TV operator;

- PCCW Solution, an IT services leader in Hong Kong and mainland China;

- 70.8% (92.6%*) of HK-listed Pacific Century Premium Developments Limited ("PCPD"), positioned as a premium property developer with projects in Hong Kong, Japan, Thailand and Indonesia; and

- 63.1% of HKT Trust and HKT Limited (together "HKT"), Hong Kong’s premier telecommunications service provider and listed in Hong Kong as stapled securities under a business trust structure.

*Note: Even though PCCW holds only 70.8% of the ordinary shares of PCPD, it also owns Bonus Convertible Notes issued in 2012 under an unusual bonus share cum bonus convertible note issue specifically executed to restore the public float of PCPD to more than 25%. The notes have been conferred the same economic rights as the bonus shares and give PCCW an effective economic interest in PCPD of 92.6% instead of 70.8%.

For FY2014, PCCW recorded total revenue of HK$33.27 billion and a profit after tax (PAT) and minority interests of HK$3.31 billion. However, this includes a gain of HK$1.31 billion on disposal of Pacific Century Place, Beijing by its subsidiary PCPD, without which the adjusted PAT would have been around HK$2.00 billion. Further, we estimate that HKT contributed approximately HK$1.93 billion or almost 97% of the adjusted PAT.

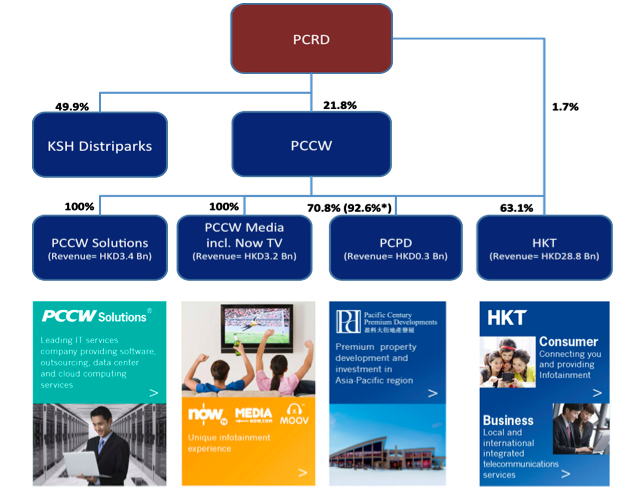

Crown Jewel HKT

Of all the assets within the PCRD group, the 63.1% owned HKT (previously known as Hong Kong Telecom) is by far the largest and most profitable.

HKT was first acquired by PCCW in August 2000 at the height of the dot-com bubble for over an estimated US$28 billion in cash and shares. Then, PCCW beat out a rival bid from Singtel, amidst rumours of Beijing's concerns over potentially sensitive telecom assets falling into foreign hands. The acquisition did not initially turn out well and saddled PCCW with massive debts. In subsequent years, PCCW tried disposing of various assets to raise cash in order to pare down its debts including ironically that of HKT's assets. Eventually, PCCW managed to spin off the HKT assets into a trust listing on the Hong Kong Stock Exchange in 2011, raising US$1.2 billion in the process.

HKT is the undisputed leader in telecommunication services in Hong Kong. While it has long been the dominant player in the fixed-line and broadband services segments, its acquisition of CSL New World Mobility Ltd (“CSL”) from Australia-based Telstra in May 2014 for US$2.4 billion further catapulted it to the No. 1 position in mobile services as well. In Hong Kong, it has a market share of >60% for both fixed line and broadband segments and a 31% market share in the mobile segment.

Since listing in November 2011, HKT has performed well operationally. For the year ended 31 December 2014, it recorded total revenue of HK$28.8 billion and profit after tax of HK$ 3.1 billion, registering strong growth in both primarily due to a maiden 7.5 months contribution from the newly acquired CSL. Adjusted funds flow (defined as EBITDA minus capital expenditures, customer acquisition costs, license fees paid, taxes paid, net finance costs paid, and adjusted for changes in working capital), which HKT uses as a gauge for dividend distribution, has also grown steadily from FY2011 to FY2014 at a CAGR of 12%. With a first full-year contribution from CSL in 2015, top and bottom line as well as adjusted funds flow are expected to improve further.

Other Business Segments

Although the other business segments such as PCCW Solutions and PCCW Media generated sizeable revenues, their contributions have been dwarfed by that of HKT. For FY2014, all the other business segments outside of HKT contributed just 14% of PCCW's total revenues and less than 1% of the group's EBITDA. This means that PCCW is at present in effect a proxy for HKT. That said, both PCCW Media and PCCW Solutions have continued to grow steadily and offer good growth opportunities.

PCCW Media, which includes the Pay-TV business operated under the brand "now TV", has been increasing its own entertainment production following a successful first TV drama series production "The Virtuous Queen of Han", which reached 38 million viewers in China. now TV's international footprint also continued to widen through affiliate partnerships to distribute now TV channels across countries in Asia and North America, with the latest addition being Taiwan.

PCCW was also recently awarded a 12-year licence to operate two free to air TV broadcast channels, becoming the first in 40 years to be awarded a new licence by the Hong Kong government. However, with the market dominated by a strong incumbent in TVB, we think the free TV licence is unlikely to contribute meaningfully to PCCW in the near future.

PCCW Solutions, an IT services leader in Hong Kong, has grown revenue and EBITDA by CAGR of 17% and 20% respectively over the last 3 years and continues to secure healthy orders. As at 31 December 2014, it has secured orders worth US$730 million (about 1.7x its FY2014 revenue) although we note that this is down slightly from the corresponding secured orders of US$819 million as at 31 December 2013.

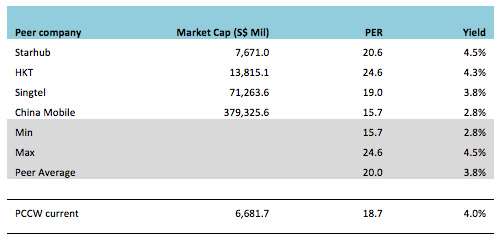

PCRD trading at a steep discount to the value of its underlying assets

PCRD has only two significant assets on its books, its 21.8% stake in PCCW and a direct holding of 131,626,804 Share Stapled Units in HKT.

PCRD last traded at S$0.345 per share as at 16 April 2015, giving it a market capitalisation of S$945 million. Although its stake in PCCW is carried on its books at S$645 million, it is worth around S$1.45 billion on the market based on the closing price of HK$5.11 per share. In addition, PCRD's direct holding of Share Stapled Units in HKT is worth S$240 million. This means that at the current price, investors buying into PCRD are practically buying its controlling stake in PCCW as well as units in HKT at a huge 44.2% discount off the market value.

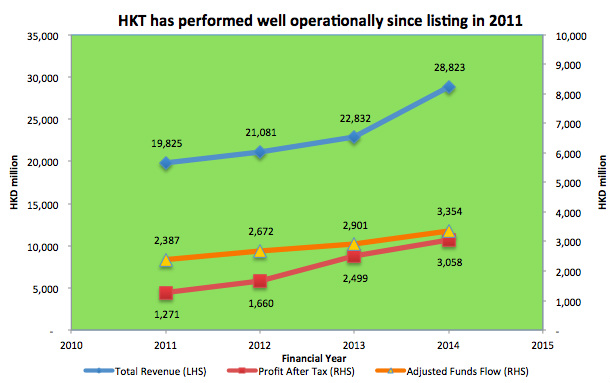

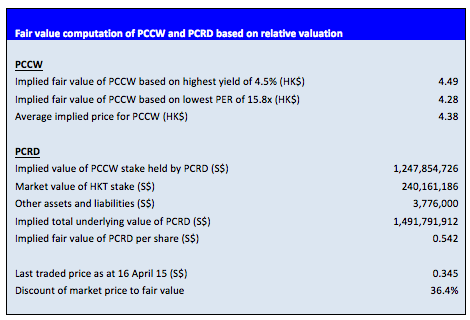

To further establish that PCRD is indeed trading at a deep discount to its intrinsic value, we look at its key underlying asset, PCCW and compare its valuation against regional peers:

As you can see above, PCCW’s current valuation is in line with its peers based on both PE ratio ("PER") and dividend yield. However, to be conservative, we decided to peg PCCW to its implied valuation based on the highest dividend yield (4.5%, Starhub) and lowest PER (15.7x, China Mobile) of its peer group.

This resulted in a fair value price for PCCW of HK$4.38 per share. Based on this new fair value price, we established an implied fair value for PCRD of S$0.542 per share. The current price of S$0.345 is thus at a steep discount of 36.4% to its fair value, which we do not think is justified.

Aggressive share buyback returning value to shareholders in lieu of dividends while concurrently shrinking public float

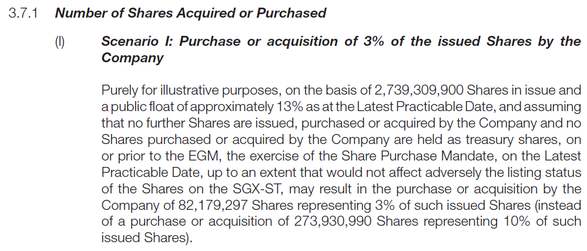

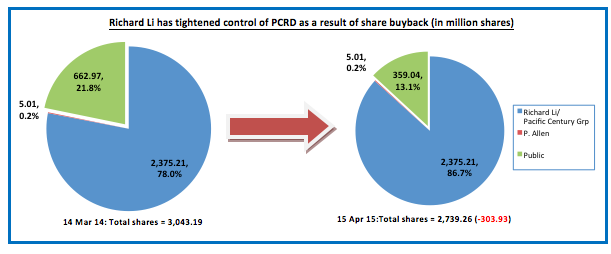

PCRD has embarked on an aggressive share buyback programme in the last one year, acquiring and cancelling 9.99% of its own shares equivalent to 303,932,200 shares in total and almost maximising the 10% limit allowed under its share purchase mandate approved at last year’s annual general meeting. While share buybacks are not uncommon, we note that this is one of the rare instances in Singapore where any company has actually bought back close to the maximum amount of shares allowable under its annual share purchase mandate. As a result of the aggressive purchases, the public float has shrunk to 13.1%, a level dangerously close to the minimum 10% limit stipulated by SGX.

We note that the Company has proposed a further renewal of the share purchase mandate for its upcoming shareholders' meeting on 24 April 2015. In its latest circular for the shareholders' meeting, it specifically catered for the scenario of a maximum purchase of 3% of its total outstanding shares. We see this as an indication that the Company is prepared to resume buying back its shares aggressively until such time when the public float is close to the minimum of 10%.

Delisting imminent?

One other direct effect of the aggressive buybacks has been the tightening of Richard Li and his Pacific Century Group's control on PCRD.

With Richard Li and the Pacific Century Group controlling almost 87% of PCRD’s total shareholdings and with the shares trading at a steep discount to its underlying intrinsic value, we think there is a good chance that this could be the year that Richard Li finally pulls the privatisation trigger. We see little justification now for PCRD as a de facto intermediate holding company within the Pacific Century Group to remain listed and incur unnecessary compliance and listing costs.

PCRD should continue to return sustainable value to shareholders even if privatisation does not take place

While we see a good chance of the Company being privatised, we also considered the possibility of PCRD remaining listed despite the low public float. Under this scenario, we think that the Company could possibly resume paying cash dividends to shareholders.

For FY2014, PCRD returned almost S$76.9 million of capital through share buybacks alone. With the free float at only 13%, it is only a matter of time when the Company maxes out on its share buyback limits. What next then? For a start, we should note that the PCRD is an investment holding company with no other core operations on its own. This means that it does not have much need for capital or operating expenditures other than to maintain its listing and other corporate expenses.

Its main sources of cash income are derived primarily from its stake in PCCW and its holdings in HKT.

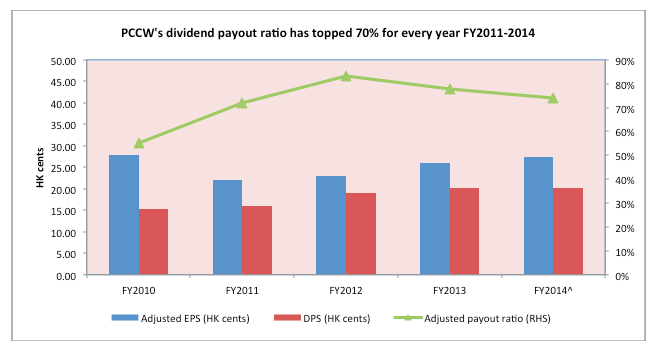

PCCW has consistently paid out a good chunk of its earnings as dividends (payout ratio >70%) over the last 4 years. In FY2014, its full year dividend payouts amounted to HK 20.2 cents per share. This translates to S$57.5 million worth of dividends for PCRD. In addition, PCRD also received S$8.9 million in dividend income from HKT directly. This gives it a potential cash income of S$66.4 million annually if the dividend payments are sustained. As an illustration, if all these cash were to be paid out as dividends to PCRD shareholders, it would translate to an annual dividend yield of about 7.0%.

As we previously indicated, the bulk of PCCW's earnings come from HKT and HKT's earning should continue to grow in the near future with the full consolidation of CSL in FY2015. Hence, we believe that both HKT and PCCW's dividend payments are sustainable.

While there is no assurance that PCRD will elect to receive its dividends from PCCW in cash (it opted for scrip dividends in FY2014 and cash in the preceding two years), or that it will resume paying cash dividends in future, the benefits from the cash income from PCCW and HKT should eventually accrue to shareholders in one form or the other.

Recommendations

We believe PCRD to be deeply undervalued. Based on its latest closing price of S$0.345 per share as at 16 April 2015, it is trading at a steep discount to the market value of its underlying stakes in PCCW and HKT. Even if we were to peg the value of its stake in PCCW to the lowest valuation metrics within its peer group, PCRD would still be trading at a discount of 36.4% to the conservative implied fair value of S$0.542 per share.

With the Company also aggressively buying back its shares and boosting Richard Li's control to 86.7% while simultaneously reducing public float to 13.1%, we also believe this year to be an opportune time for Richard Li to finally pull the privatisation trigger.

Should Richard Li elect not to privatise the Company, shareholders would also benefit, in one form or the other, from PCRD's stake in PCCW and cashcow HKT. Sans share buybacks, if the Company elects to pay out its cash income derived mainly from the dividends collected from PCCW and HKT, we think that the Company would be able to sustain an attractive dividend yield of about 7.0% based on the last traded price of S$0.345 per share, further reinforcing our conviction that the stock is selling at far below its fair value.

Key Risks

Further share buybacks will heighten trading liquidity risks going forward. This is somewhat mitigated by the fact that the Company has at present a sizeable share base of more than 2.7 billion, such that even a minimum 10% float amounts to more than 270 million shares. This should be able to sustain some healthy trading activity going forward.

PCRD has high asset concentration risks as its prospects are predominantly tied to HKT. However, HKT's business model has proven to be resilient over the years especially given its market leadership position in Hong Kong. This should help to ensure that PCRD's earnings going forward remain relatively stable.

(SGD:HKD X-rate of 5.70 assumed)

RSS Feed

RSS Feed