Global Investments Ltd- 5 interesting facts you should know

In our Centre Stage series, we will take a closer look at the respective companies featured and attempt to cast an illuminating light on some of their lesser known facts that we feel have been overlooked by investors.

We start off our series with Global Investments Limited, one of the handful of managed funds listed on SGX.

1. GIL has intriguing links to Singapore's sovereign fund Temasek Holdings

Global Investments Ltd is a mutual fund company incorporated in Bermuda and listed on the Singapore Exchange. It was formerly known as Babcock and Brown Structured Finance Fund Ltd and managed by Australian-based Babcock and Brown group. Babcock and Brown subsequently went into liquidation amidst the credit crunch in the 2009 global financial crisis. Subsequently, in September the same year, ST Asset Management Ltd (STAM), a wholly owned subsidiary of Temasek, took over as the fund’s manager with Mr Boon Swan Foo, ex-CEO of ST Engineering, appointed to GIL’s board as chairman.

Since late April 2016, however, STAM has relinquished the manager role to Singapore Consortium Investment Management Limited (SICIM), as it focuses on the management of funds of related companies instead of 3rd party funds. The key management of GIL remains the same though as SICIM is wholly owned by the current chairman, Boon.

Incidentally, Boon is also GIL’s largest shareholder with a stake of 12.6% as at 15 July 16 and has been adding to his holdings in recent weeks spending a cool S$1.82 million to acquire almost 14 million shares. In addition to being ST Engineering’s ex-CEO, Boon is also listed as a senior adviser to Temasek and is perhaps one of the handful of influential Singaporeans sitting on board a number of Asian giants, including Thai Telco, InTouch Plc (formerly Shin Corporation Plc), China state-owned automobile manufacturer Dongfeng Motor Corporation and the 3rd largest China national oil company, China National Offshore Oil Corporation.

We start off our series with Global Investments Limited, one of the handful of managed funds listed on SGX.

1. GIL has intriguing links to Singapore's sovereign fund Temasek Holdings

Global Investments Ltd is a mutual fund company incorporated in Bermuda and listed on the Singapore Exchange. It was formerly known as Babcock and Brown Structured Finance Fund Ltd and managed by Australian-based Babcock and Brown group. Babcock and Brown subsequently went into liquidation amidst the credit crunch in the 2009 global financial crisis. Subsequently, in September the same year, ST Asset Management Ltd (STAM), a wholly owned subsidiary of Temasek, took over as the fund’s manager with Mr Boon Swan Foo, ex-CEO of ST Engineering, appointed to GIL’s board as chairman.

Since late April 2016, however, STAM has relinquished the manager role to Singapore Consortium Investment Management Limited (SICIM), as it focuses on the management of funds of related companies instead of 3rd party funds. The key management of GIL remains the same though as SICIM is wholly owned by the current chairman, Boon.

Incidentally, Boon is also GIL’s largest shareholder with a stake of 12.6% as at 15 July 16 and has been adding to his holdings in recent weeks spending a cool S$1.82 million to acquire almost 14 million shares. In addition to being ST Engineering’s ex-CEO, Boon is also listed as a senior adviser to Temasek and is perhaps one of the handful of influential Singaporeans sitting on board a number of Asian giants, including Thai Telco, InTouch Plc (formerly Shin Corporation Plc), China state-owned automobile manufacturer Dongfeng Motor Corporation and the 3rd largest China national oil company, China National Offshore Oil Corporation.

Boon Swan Foo, Chairman, Global Investments Ltd

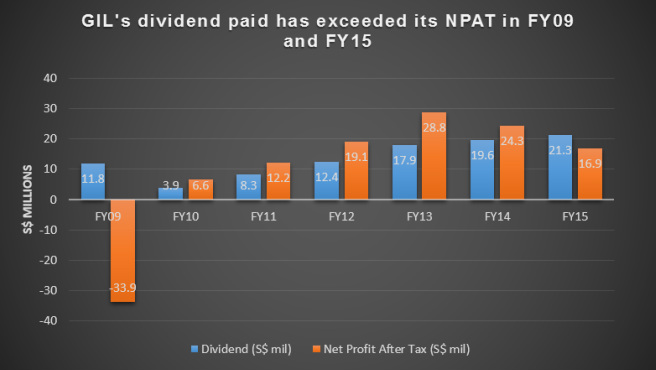

2. It can pay more dividends than its profits

Being incorporated as a mutual fund in Bermuda means that GIL is not governed by the Singapore Companies Act unlike most companies listed on SGX. While the Singapore Companies Act limits the payment of dividends to the amount of profit a company makes, GIL is governed by the Bermuda Companies Act which, in regard to dividends and other distributions, states under Section 54 (1) that

“A company shall not declare or pay a dividend, or make a distribution out of contributed surplus, if there are reasonable grounds for believing that—

(a) the company is, or would after the payment be, unable to pay its liabilities as they become due;

(b) or the realizable value of the company’s assets would thereby be less than its liabilities.”

The same Bermuda Companies Act also exempts mutual fund companies like GIL from Section 54 (1)(b), which basically means that GIL has the flexibility to pay dividends as long as the management believes it can meet its liabilities after paying them.

This is best demonstrated in FY15 when it paid out S$21.3 million in dividends even as net profit after tax fell to S$16.9 million. This is despite it carrying a negative retained earnings balance as at 31 December 2015 at both the Company and Group levels.

GIL’s own dividend policy is to pay out the majority of the economic income received from its investments, after payment or provision for operating and financing expenses.

2. It can pay more dividends than its profits

Being incorporated as a mutual fund in Bermuda means that GIL is not governed by the Singapore Companies Act unlike most companies listed on SGX. While the Singapore Companies Act limits the payment of dividends to the amount of profit a company makes, GIL is governed by the Bermuda Companies Act which, in regard to dividends and other distributions, states under Section 54 (1) that

“A company shall not declare or pay a dividend, or make a distribution out of contributed surplus, if there are reasonable grounds for believing that—

(a) the company is, or would after the payment be, unable to pay its liabilities as they become due;

(b) or the realizable value of the company’s assets would thereby be less than its liabilities.”

The same Bermuda Companies Act also exempts mutual fund companies like GIL from Section 54 (1)(b), which basically means that GIL has the flexibility to pay dividends as long as the management believes it can meet its liabilities after paying them.

This is best demonstrated in FY15 when it paid out S$21.3 million in dividends even as net profit after tax fell to S$16.9 million. This is despite it carrying a negative retained earnings balance as at 31 December 2015 at both the Company and Group levels.

GIL’s own dividend policy is to pay out the majority of the economic income received from its investments, after payment or provision for operating and financing expenses.

3. It has a running dividend yield of 11%

GIL has been one of the most consistent dividend payers in recent years, paying an annual dividend of 1.5 S cts per share in each of the past six years under the current management. Based on the last traded share price of S$0.136, its current running dividend yield is 11%, making it one of the highest in Singapore.

Going forward, the company is keeping its guidance for 0.75 S cts in interim dividends for the 1st half of 2016, on track to maintaining its annualised 1.5 S cts dividend for the full year.

It will be interesting to see how GIL can sustain its generous dividend payments as its share base continually increases as a result of its scrip dividend scheme. However, thanks largely to GIL trading at a discount of 27% to its NTA as at 31 Mar 16 (adjusted for its scrip dividends), it only needs to generate a target return on its assets of 7.6% to achieve that. This is arguably not too unrealistic a target given that its average ROA for the past 6 years adjusted[1] for rights issue proceeds is about 7.8%.

4. It is not subject to the MTP

In March 2015, SGX announced and subsequently implemented the Minimum Trading Price (MTP) continuing listing requirement, which obligates all SGX mainboard listed companies to maintain a minimum trading price of S$0.20 per share. Since then, the MTP has been blamed, rightly and wrongly, for causing the dearth of trading liquidity and loss of market value of some mainboard listed counters.

While GIL has been listed on the SGX mainboard since late 2006 and trading below the S$0.20 per share level for the last few years, SGX has ruled that the MTP will not apply to it as it is classified as an investment fund.

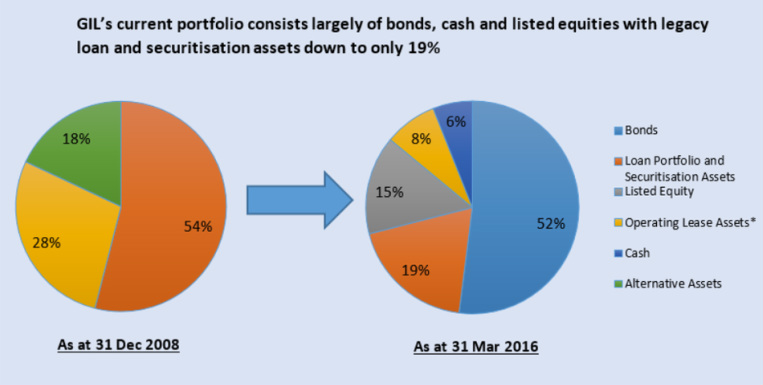

5. Long gone are most of toxic assets it once had

As at the end of 2008, the last full year under which GIL was managed by its previous manager Babcock and Brown, it had a portfolio comprising a majority of loan and securitisation assets, alternative assets and operating lease assets as well as a highly geared balance sheet with net debt to NTA at almost 0.9.

Since then, STAM, its manager until recently, had worked hard to clean up the fund portfolio and strengthen its balance sheet. As a result, its current portfolio and balance sheet is almost unrecognisable from 2008's. Its current portfolio is made up of largely high yield bonds (with 80% rated a weighted average of Ba3 or 3 rungs below Moody’s lowest investment grade of Baa3), cash, and listed equities with a much smaller portion of legacy collaterised loan obligations (CLOs) and residential mortgage-backed securities (RMBS). It also has a much cleaner balance sheet with about S$56.7 million in cash[2] and no debt.

*Note: Operating Lease Assets as at 31 March 2016 was comprised entirely of GIL’s 40.6% interest in Ascendos Investments Ltd. GIL has since then completed the disposal of Ascendos as at 16 June 2016 for €16.0 million, a small surplus above its carry value of €14.3 million.

Our Take

GIL is a much maligned company struggling to rid itself of its less than glorious past under Babcock and Brown. Despite paying a generous dividend that it has maintained for six years running and being linked to Temasek Holdings, it has not generated substantial interest from the investment community as evidenced by the lack of analyst coverage. While it is listed on SGX and often compared to other shares, we think it should be more appropriately treated as a high yield multi asset class fund and would serve as a useful diversification for investors looking for exposure to more than just equities.

(Article first posted on 24 Jul 16)

Our Take

GIL is a much maligned company struggling to rid itself of its less than glorious past under Babcock and Brown. Despite paying a generous dividend that it has maintained for six years running and being linked to Temasek Holdings, it has not generated substantial interest from the investment community as evidenced by the lack of analyst coverage. While it is listed on SGX and often compared to other shares, we think it should be more appropriately treated as a high yield multi asset class fund and would serve as a useful diversification for investors looking for exposure to more than just equities.

(Article first posted on 24 Jul 16)

[1] Total assets used in ROA computation is weight adjusted to account for rights issue proceeds in FY2011, FY2012 and FY2013.

[2] After adjusting for proceeds from disposal of its investment in Ascendos Investments Ltd.

[2] After adjusting for proceeds from disposal of its investment in Ascendos Investments Ltd.