HG Metal- value to be unlocked from proposed BRC Asia stake sale

In our previous report on HG Metal, we had assumed Sia Ling Sing to be the substantial shareholder whom has been approached with regard to a sale of his stake in BRC Asia. We also posited that if such a transaction leads to a sale of HG Metal’s own BRC Asia shares, it will be a major boost to HG Metal’s balance sheet.

Our assumption was proven correct in last Friday’s announcement by BRC Asia that Esteel Entreprise Pte Ltd (offeror), backed by two individuals in You Zhenhua and Liu Bin, had acquired an aggregate 81.6 million shares from Sia Ling Sin’s Lingco Marine Pte. Ltd. and Lingco Holdings Pte. Ltd., Mr. Seah Kiin Peng, Sin Teck Guan (Pte) Ltd. and Mr. Lim Siak Meng at S$0.925 apiece. As the shares transacted represented 43.77% of the total number of issued BRC Asia shares, this triggered a mandatory takeover offer. The offer is conditional upon the offeror receiving sufficient offer shares as at the close of the offer that will result in it holding at least 50% of BRC Asia’s total outstanding shares.

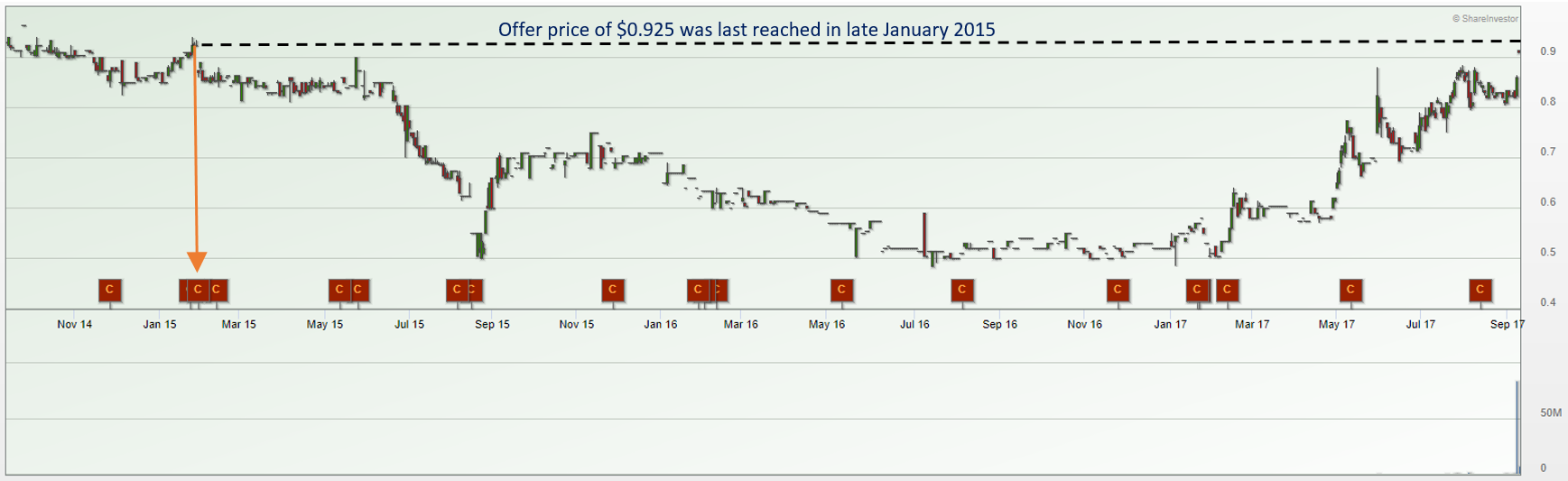

The offer price is at a slight premium to BRC Asia’s latest reported net asset value of S$0.897 per share and translates into a TTM (Trailing 12-month) high PE of more than 43x. We also note that BRC Asia last traded at the offer price more than 2 years ago. Further, in its latest Q3 results announcements, the company also continued to warn of the bleak industry outlook going forward. All signs, hence, point to the likelihood that BRC Asia shareholders will find the offer an attractive proposition. With the offeror needing just 6.23% in acceptances to hit 50%, we think the offer turning unconditional is a matter of when, not if.

Consequently, HG Metal’s share price has reacted positively by closing at $0.58, up almost 40% from the date of our last report.

Yongnam- Misses out on Kim Chuan Depot extension project but consolation came in the form of other smaller contract wins

While HG Metal shareholders rejoice last Friday, the opposite could be said for Yongnam shareholders.

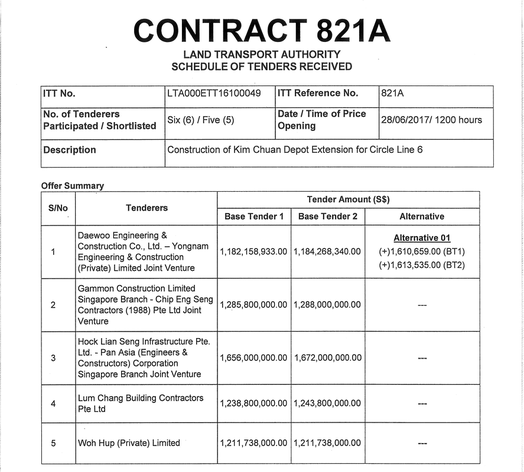

When we last wrote about Yongnam, we pointed out that its JV with Korean giant Daewoo E&C had submitted the lowest bid for LTA’s mega contract to construct the Kim Chuan Depot Extension for Circle Line 6 but warned that there is no assurance that the lowest bidder will be the winner with other factors such as quality and safety surely being considered. Unfortunately for its shareholders, Yongnam lost out again, this time to privately held Woh Hup’s slightly higher winning bid of $1.21 billion. This is also the second time one of Yongnam’s JVs had been pipped in a mega LTA contract tender in the last 2 years, having missed out on the $2 billion East Coast Integrated Depot project in 2016.

The market has since responded negatively with Yongnam shares closing down more than 8% on Monday at $0.265, from the $0.29 it last traded before the results of Kim Chuan Depot extension tender was announced over the last weekend.

However, there was some consolation for shareholders in the form of $70 million of contract wins announced on 30 August 17, which are expected to contribute positively to its FY17 and FY18 results. This follows the $36.2 million total contract wins announced earlier on 15 June 17.

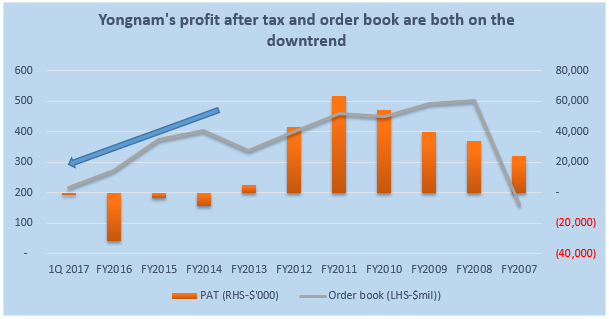

Going forward, shareholders can only hope for more positive new flow from the Yongnam-JGC Corporation-Changi Group consortium’s pending US$1.4 billion Hantharwaddy airport project in Myanmar, which has been slow to take-off but seeing some progress of late as well as more project wins especially from the Singapore public infrastructure sector where many projects have yet to be awarded. Only then can a turnaround in its fortunes be truly realised.

(All currency above in SGD unless otherwise stated)

RSS Feed

RSS Feed