Activist fund Quarz Capital Management’s open letter to HG Metal Manufacturing Ltd’s (“HG Metal”) board two weeks ago created quite a buzz, sending the steel stockist’s shares up 21% in just two days. This was preceded by BRC Asia Ltd’s ("BRC Asia") announcement the day before revealing that certain substantial shareholders have received an unsolicited approach in connection with a potential transaction. Details such as the identity(s) of the substantial shareholders or the nature of the transaction were not disclosed and BRC Asia cautioned that discussions are preliminary and may or may not lead to an acquisition of its issued share capital.

HG Metal subsequently clarified on 1 June 2017 that it has not been approached in relation to the potential sale of its stake in BRC Asia. Since BRC Asia only has two substantial shareholders that own more than 10% each: ex-HG Metal controlling shareholder, Sia Ling Sing, who controls 26.8% of BRC Asia shares and HG Metal itself with 22.6%, it is fair to assume that Sia is likely to be one of the substantial shareholders approached in order to necessitate the original BRC Asia announcement.

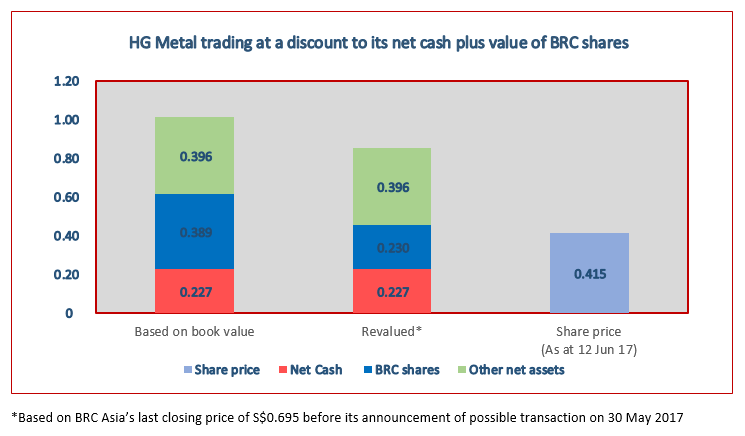

Regardless of the identity of the mystery substantial shareholder or potential buyer, should the said transaction trigger the sale of HG Metal’s stake in one way or the other, it would provide a major boost to its already strong balance sheet, enhancing its net cash position to at least S$0.46 per share, or a 11% premium over its last closing price of S$0.415.

HG Metal is however not the only stockist trading at a deep discount to intrinsic value: Hupsteel Ltd (“Hupsteel”) and Asia Enterprises Holding Ltd (“Asia Enterprises”) also offer enticing value at current prices but tight shareholding structure may discourage a similar approach by an activist fund.

Our Take

Any divestment of BRC Asia stake would be a major boost to balance sheet although write-off expected

As indicated in Quarz Capital Management’s letter to HG Metal, an intriguing part of HG Metal’s value lies in its 22.6% stake in BRC Asia, one of the leading prefabricated reinforcement steel players in Singapore.

To recap, HG Metal first acquired its original stake of 43.7%[1] in 2008 and 2009 through a combination of share purchase from the then AIM-listed Acertec Engineering Ltd and the subsequent mandatory general offer. The stake was eventually whittled down to the current 22.6% after a couple of placement exercises by HG Metal and issuances of new shares by BRC Asia itself.

Currently, BRC Asia is accounted for as an associate company on the books of HG Metal, with an approximate carrying value of S$49 million largely reflecting HG Metal’s share of BRC Asia’s total net assets plus goodwill. However, the market value of the same stake was only S$29.3 million based on BRC Asia’s last closing price of S$0.695 per share prior to the 30th May announcement. Should HG Metal dispose of its BRC Asia stake at no premium to the 30th May closing price, it will likely have to write off almost S$20 million. Despite this, its net cash would balloon to S$58 million or S$0.46 per share, giving it plenty of flexibility to reward shareholders should it wish to.

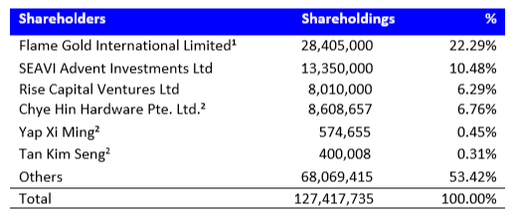

Unlike the other two stockists mentioned here, HG Metal does not have a majority controlling shareholder. Currently, the two biggest shareholders are Foo Sey Liang and private equity fund SEAVI Advent Investments (“Seavi”), holding 22.3% and 10.5% respectively. The other two substantial shareholders with over 6% each are Rise Capital Ventures (Rise Capital”) and Chye Hin Hardware.

The investment has not turn out well for Foo, Seavi or Rise Capital so far as HG Metal’s share price has only gone south since their respective acquisitions in 2014, trading as low as S$0.30 earlier this year before the recent run up.

Seavi, though, could be under more pressure than the other two given its status as a private equity fund. Private equity investments are typically held for between 3 to 5 years before a planned exit and with Seavi entering into its 4th year of investment this coming October, we think it’s possible that it would soon need to decide on a potential exit or at least seek a partial return on its capital invested. Quarz Capital’s attempt to get the board to maximise shareholder value could therefore very well find support with Seavi and its representative on board, HG Metal Chairman Tan.

Growing Myanmar story a potential bright spark?

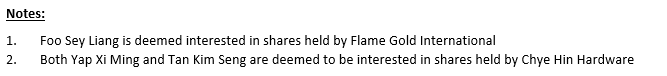

Since the entry of both Foo and Seavi, HG Metal has focused its efforts into expanding in Myanmar. There have been some early signs of success, as revenue contribution from the fast growing economy has gone up five times in 2 short years, from S$10.2 million annually to S$61.2 million for FY2016, dwarfing its traditional stronghold of Singapore.

Fellow stockists Hupsteel and Asia Enterprises also offer intriguing value but lacks obvious catalysts

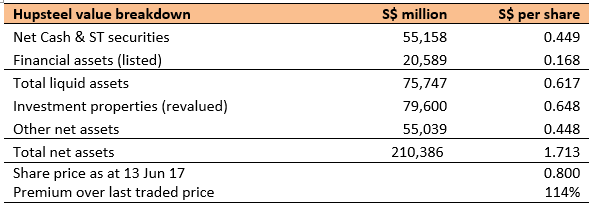

Similar to HG Metal, Hupsteel is sitting on a balance sheet stuffed full of cash and listed securities. As at 31 March 2017, it held S$55.1 million of net cash in addition to S$20.6 million of listed securities (~80% debt, 20% equity), meaning 77% of its current market capitalisation is represented by liquid assets.

In addition, Hupsteel has also over the years accumulated a healthy portfolio of industrial and commercial property investments. So far it has amassed more than 120,000 sf of industrial properties located in the eastern part of Singapore along with shophouse and office units along Jalan Besar. The investment properties are largely carried at cost less accumulated depreciation and has a net book value of S$34.9 million. However, the company has also disclosed in its annual report that the properties are in fact worth more than double its carrying value, with the latest fair value as at 30 June 2016 pegged at S$79.6 million.

Taken together, this means that Hupsteel’s liquid assets and investment properties are already worth S$155.3 million or more than 58% above its current market capitalisation, potentially making it an attractive investment or target for activist funds.

Meanwhile, the situation at Asia Enterprises is more straightforward. While it does not own a large chunk of shares in another listed company or have value embedded in some investment properties, it continues to sit on a mountain of net cash of about S$60.5 million, just a shade below its latest market capitalisation S$61.4 million. We note though that the company has been hoarding this cash pile for at least the last 3 years and does not seem to have taken any concrete steps towards either deploying or distributing it. Unless the controlling Lee family (38.7%), who together with fellow long time directors of its key operating subsidiary, Harmaidy (11.7%) and Teo Keng Thwan[4] (5.1%), control just over 50% of the shares, has a change of heart, this might not bode well for shareholders seeking a windfall from the accumulated cash.

Conclusion

While discussions are preliminary, any potential transaction at BRC Asia that leads to an eventual sale of HG Metal’s stake is likely to be positive for HG Metal shareholders. It remains to be seen if HG Metal decides to take adopt some of Quarz Capital Management’s suggestions. Regardless, we believe HG Metal’s two largest shareholders’ interests, private equity outfit Seavi in particular, are pretty much aligned with the public shareholders’ given that both acquired their stakes at significantly higher prices than today.

Hupsteel and Asia Enterprises, in the meanwhile, remain significantly undervalued themselves. However, the tightly controlled shareholding structures in these two companies are likely to dissuade any activist fund from trying a similar approach as that of HG Metal. Any efforts to unlock shareholders’ value would have to be driven by the respective controlling shareholders themselves.

[1] Post capital reduction of HG Metal Pte Ltd, a 51% owned subsidiary which was used to acquire the original BRC stake from Acertec

[2] After adjusting for 10-to-1 share consolidation

[3] Source: Timetric’s Construction Intelligence Centre

[4] Harmaidy and Teo Keng Thwan have each been a director of Asia Enterprises (Private) Ltd since 1984 and 1986 respectively. Teo stepped down in 2014 while Harmaidy is still on board the subsidiary. Both are also currently on the board of the listed parent.

RSS Feed

RSS Feed