- Sysma’s FY18 profit came in at $4.0 mil, which was below its half year profit of $4.3 mil, meaning that it likely recorded a loss for 2H18. The main culprit was a non-recurring provision for defective work of $3.8 mil which we assume was for its property development projects.

- Revenue continued to decline as expected to $75.2 mil. Out of this, about 60% or $42.6 mil was from property development and the rest from construction.

- With the bulk of its property projects fully sold and delivered, leaving behind only 4 shop units at 28 RC Suites, expect the group’s revenue for next year to be closer to this year’s construction revenue of $32.6 mil. The current construction order book of $56.7 mil should be sufficient to ensure this as all but part of the recently clinched Verandah Residences contract will be fully recognised next FY.

- Company’s cash hoard continues to build up. It now has $71.5 mil or 28.3 cts per share in net cash and zero bank loans. NTA, which is essentially 100% cash backed, is at $52.6 mil or 20.9 cts per share.

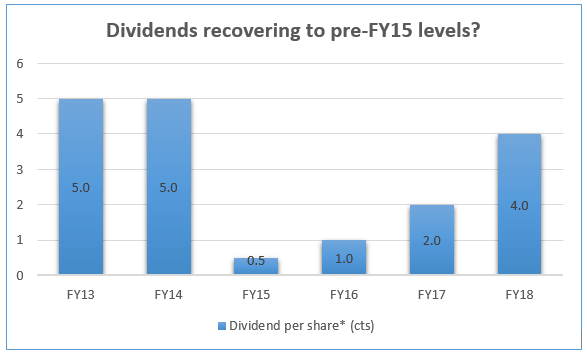

- Company declared a dividend of 0.8 cts per share which was 60% higher than last year’s 0.5 cts. At the last traded share price of $0.151, dividend yield is at a pretty decent 5.3%.

Sysma’s proposed dividend payout was higher than last FY but disappointing given the huge cash pile it sits on. The company can definitely afford a much higher payout of more than 1ct with perhaps an additional special dividend. Since neither materialised, we can only surmise that the management has much better uses of the financial resources at its disposal.

Going forward, the likely catalysts will probably be in the form of additional contract wins and earnings accretive investments the company can net with its war chest. In the meantime, the stock remains almost comically undervalued, trading at a 28% discount to its 100% net cash backed NTA.

RSS Feed

RSS Feed