Of the 57 cts per share, 12.5 cts is to be paid in cash with the remaining 44.5 cts to be paid in the form of a 3 year 2.25% unlisted unsecured senior bond issued at par by the Bidco. ASM and its funds have already undertaken to tender a maximum of 110,732,656 TIH shares equivalent to 45.8% of the total issued share capital in acceptance of the offer. The number of shares to be tendered by ASM and its funds will be reduced by the aggregate number of shares tendered by minority shareholders and acquired through open market purchases made by the Bidco.

Based on the responses so far, it seems that the offer has not been received well by the minority shareholders. While it remains to be seen if shareholders have indeed been short-changed, we think one big winner has already emerged regardless of the outcome of the offer: the Lippo group.

Firstly, due to the undertaking by ASM and its funds, LCR is already assured of acquiring an initial 45.8% controlling stake in TIH based on its 100% ownership of Bidco (although Bidco, LCR and ASM may transfer TIH shares between themselves to achieve their desired shareholding levels within 12 months of offer close). If Lippo’s intention is indeed to expand its securities and fund investment business in Asia through TIH, then this is certainly a cost effective way to do so. Afterall, based on the undertaking shares, LCR need only pay a maximum amount of $13.8 mil upfront for the entire stake with the remainder mostly paid 3 years later.

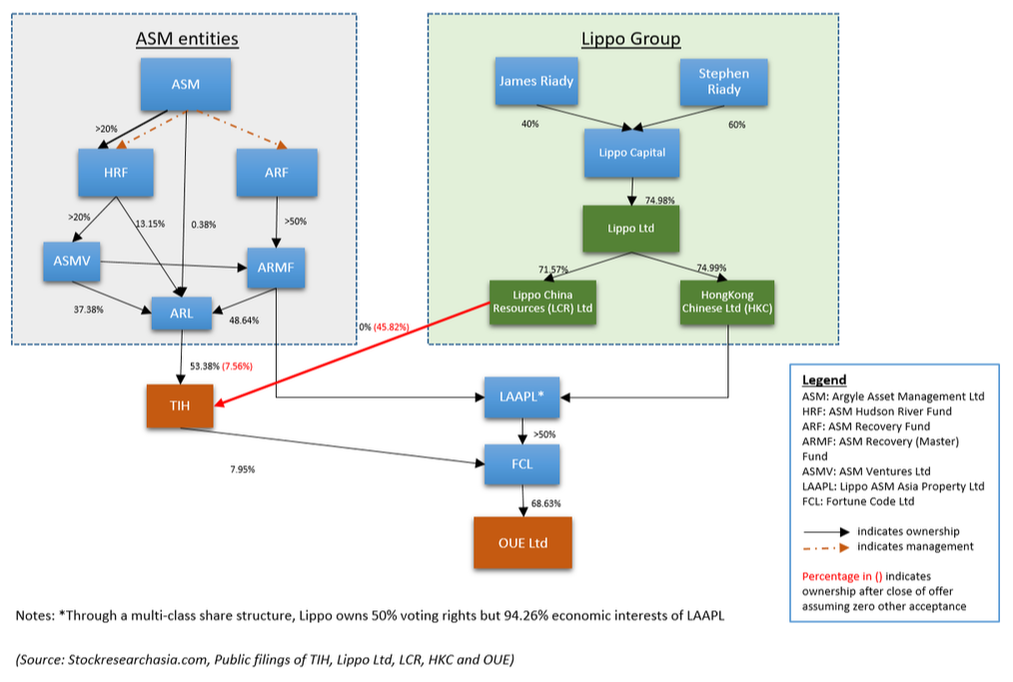

Secondly, and perhaps more importantly, the move actually helps Lippo tighten its hold on OUE Ltd. To understand why, we only need to look at the simplified ownership chart compiled below:

In particular, ASM-controlled TIH currently owns a 7.95% stake in FCL which in turn controls more than 68% of OUE shares. Had ASM sold its stake in TIH to a 3rd party, Lippo would have to deal with a potentially unfriendly minority shareholder in FCL. The Joint Offer by ASM and Lippo’s LCR basically ensures that such a scenario would not happen.

On top of it, Lippo will now gain direct control over the stake in FCL held by TIH. All these for a upfront cash outlay which is unlikely to burn a hole in Lippo’s deep pockets.

In our opinion, this makes them the biggest winner in this takeover exercise, by far.

RSS Feed

RSS Feed