However, we believe that the strength of its current balance sheet is still severely understated as a surge in sales at one of its completed property projects in the last 6 months should give a further boost to its already large cash pile. After taking into account the 0.5 cts dividend paid in November, we estimate its net cash position and NTA to be at least 17 cts and 20.5 cts per share respectively by the time the company releases its HY2018 results come mid-March (for the period ending 31 Jan 18).

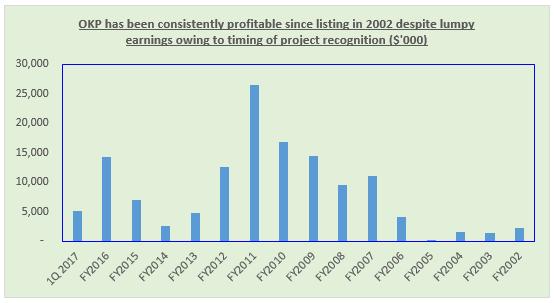

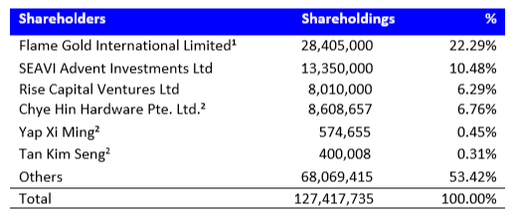

Given that its niche construction business has been consistently delivering healthy pretax profits for the past 5 financial years since listing, we see no reason for its share price to trade at a discount to even its net cash position. Further, with the Executive Chairman cum CEO owning 66% of the total outstanding shares, there is added incentive for management to return a significant chunk of this cash pile to shareholders.

In short, we believe that Sysma is a stock that offers both compelling current value as well as a possible share price catalyst in the form of increased annual or special dividend payouts.

Background

Listed on the SGX Catalist board in 2012, Sysma is a niche contractor focused on the construction of high-end landed housing projects such as detached houses and Good Glass Bungalows (GCBs). It is helmed by Executive Chairman cum CEO, Sin Soon Teng, a construction veteran with more than 50 years of industry experience under his belt.

Since its founding in 1986, it has established an impressive track record and built over 150 bungalows in Singapore amongst other high-end projects.

In 2012, shortly after it made its Catalist debut, Sysma made its initial foray into property developments. In less than a year, the company acquired 3 different sites, in Little India, Serangoon and Mountbatten, which were eventually developed into the respective projects: 28 RC Suites, 18 Charlton and 8M Residences.

Sysma’s property projects

Nonetheless, the company was able to sell the bulk of its remaining units in 28 RC Suites and 8M Residences gradually over the next 3 financial years and pare down most of its bank borrowings. As at 31 July 17, the company is sitting on a much stronger balance sheet including a net cash position of more than $27 million, equivalent to 72% its market capitalisation.

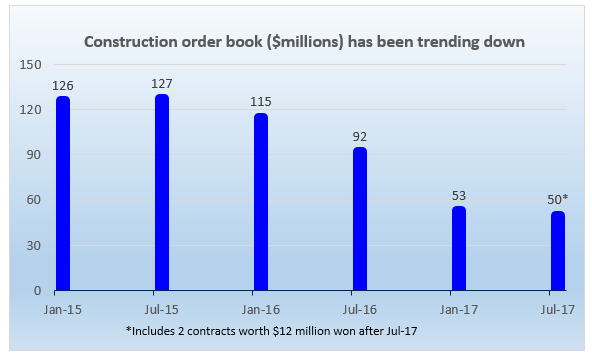

Its construction arm currently has an order book of $50 million after taking into account contracts won in the last 6 months. These orders will be progressively recognised over a period of about 2 years from 1 August 17.

Our Take

Property forays not well-timed but troubles a time of the past

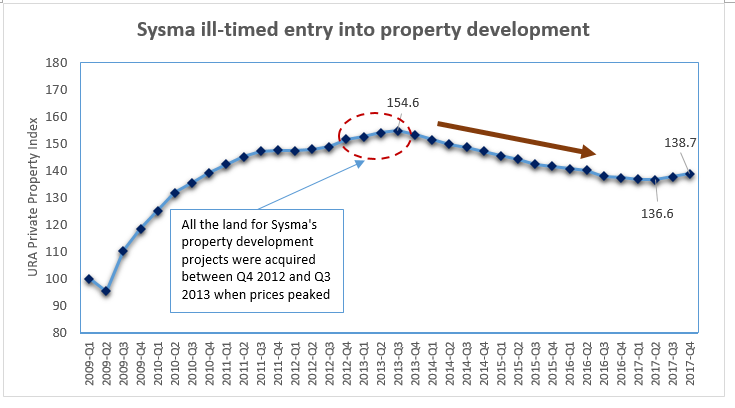

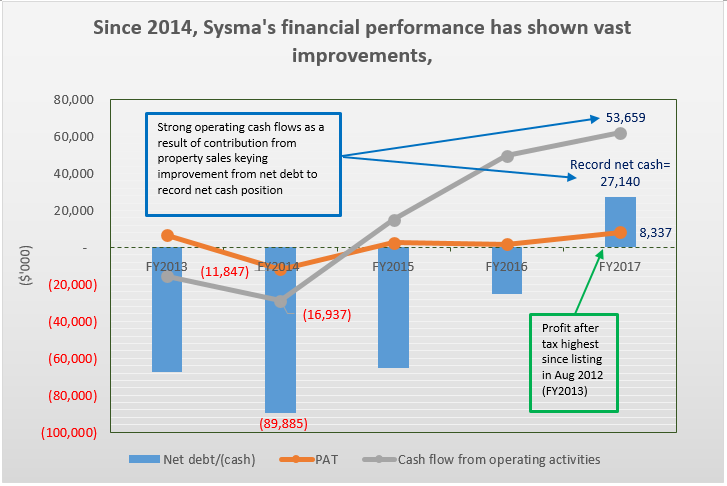

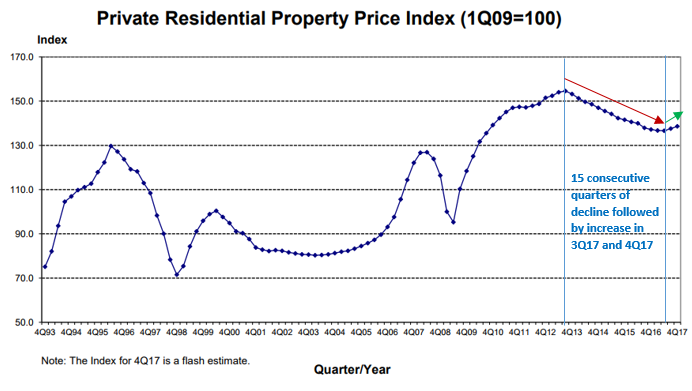

As a relative newcomer to the property development industry, Sysma’s entry couldn’t be more badly timed as it acquired all the land needed for its projects just when property prices were peaking between Q4 2012 and Q3 2013. As a result, it was forced to take a $17.2 million provision for foreseeable losses at its property division in FY2014. That swung its full year profit after tax for that year into the red with a $11.8 million loss from a $6.6 million profit the year before. At the same time, because of the loans it took for the property projects, Sysma’s net gearing also ballooned to more than 2x at its peak in FY2014.

Since then, Sysma has recovered to post 3 consecutive years of profits. Gradual monetisation of its property inventory, especially units at 28 RC Suites and 8M Residences also helped it record strong operating cashflows, thereby enabling it to rapidly pare down its debts. As of 31 July 17, it has a net cash position of $27.1 million, a big improvement from its net debt position of almost $90 million just 3 years earlier.

Surge in Charlton 18 sales should boost already strong balance sheet further; increased dividends possible

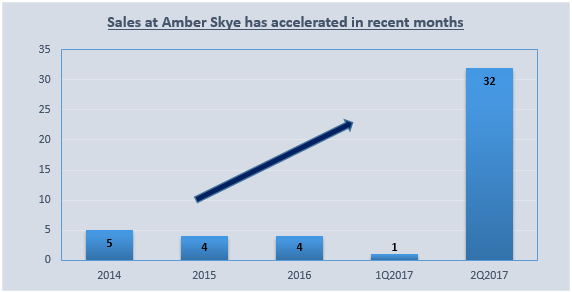

As at FY2017, Sysma carried on its balance sheet $44.1 million worth of development properties, reflecting the 4 remaining shop units at 28 RC Suites and 15 unsold terrace houses at Charlton 18. However, we note from caveats lodged at URA that the company has since sold another 13 units at Charlton 18 for a total of $36.8 million.

Although we do not expect the additional property sales to contribute more than $2 to 2.5 million to the bottom line, the cash proceeds should serve to reinforce an already strong balance sheet. Subject to further working capital movements, we estimate that the company will have a net cash position of at least $43 million and zero debts by 31 January 18, giving it a net cash position of more than 17 cts per share or 14% above its last traded price of $0.149.

With the Executive Chairman owning 66% of the total issued shares, we also think that payment of a much larger annual dividend or even a substantial one time special dividend may be in store.

Dwindling construction order book a concern but stable GCB/landed market offers some comfort

On the flip side, one area of concern for Sysma shareholders is its gradually dwindling construction order book. Its last reported outstanding orders as at 31 July 17 amounted to $38 million. If we take into account the 2 contracts it won recently for projects at Medway Drive (an IPT subject to shareholders approval as it was awarded by Executive Chairman’s son, Sin Ee Wuen) and Tanglin Hill, this figure would increase to $50 million. Still, this is less than half what it was 3 years ago.

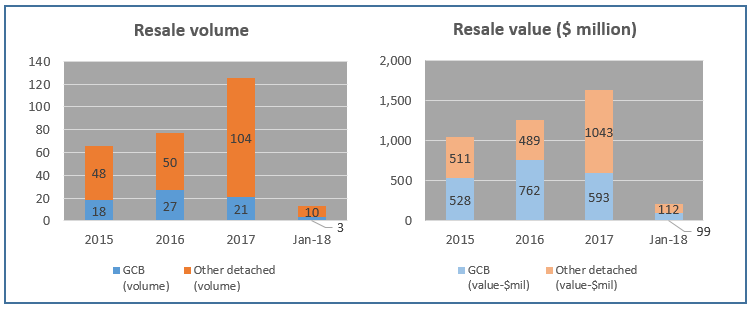

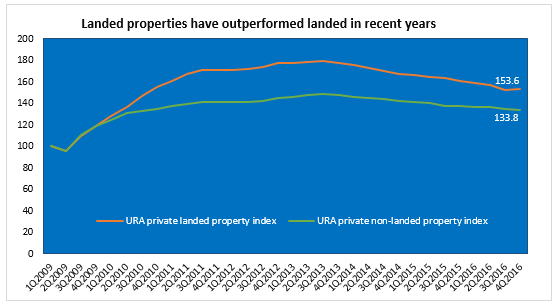

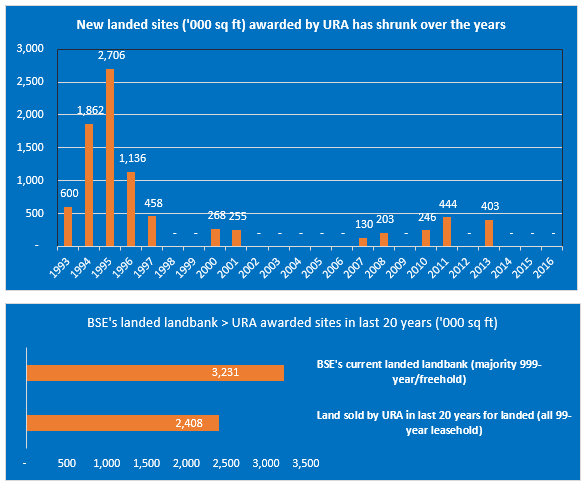

However, we think that there may be a silver lining on the horizon: the GCB and landed detached resale market, which Sysma is highly dependent on, has been growing over the past 3 years.

Based on URA caveats lodged, total resale volume and value of GCB and other detached houses in designated GCB districts (10, 11, 20, 21 and 23) have been on the rise. And since most reconstruction of GCBs and detached houses typically arise only when they change hands, this spells more opportunities in the market for Sysma. Coupled with the company’s strong track record in this niche segment, this gives rise to hope that the company may soon be able to replenish its order book and provide more earnings visibility going forward.

Recommendation

It is likely that Sysma’s missteps in the past 5 years- including a poorly timed entry into property development and a brief “deworsification” attempt into the petroleum products business, which does not offer any natural synergies- may have caused it to fly under investors’ radar.

Nonetheless, a rapidly improving and sterling balance sheet should warrant a closer look from value-oriented investors. At the last traded price of $0.149 and a net cash position estimated to exceed $0.17 per share, the market is effective paying investors $0.021 per share to buy Sysma shares and giving away free-of-charge a consistently profitable niche construction business to boot.

While a dwindling construction order book could raise some concerns, ongoing strength in the GCB and landed detached resale market may open up more opportunities for the company to reverse the downtrend.

All in all, we believe Sysma currently offers compelling value. Possible near term catalysts include increased or special dividend payouts and contract wins. We are buyers at this price.

Key risks

- Another “diworsification” attempt by the management- With the top two management staff of the company owning collectively 72% of the company’s shares, we believe the interests between management and minority shareholders are sufficiently aligned in this case to mitigate this risk. Furthermore, we believe that the management would be more cautious in assessing future opportunities after its experience with Sysma Energy’s petroleum products venture.

- Company committing its cash hoard to another poorly timed attempt at property development- Again, we believe that the company has learnt its lesson from its initial forays into this sector and will be extra cautious in its approach.

- Failure to replenish its construction order book- The next 12-18 months could be key. Should the company fail to win significant contracts going forward, its bottom line may swing into the red. Our initial thesis may change in that instance.

RSS Feed

RSS Feed