- FY18 revenue of S$60.8 million represents a topline growth of 22% over FY17, the first upturn since FY2012.

- Profit after tax of S$4.7 million is also a multi-year high, although it was aided by a net gain on investment property of S$2.3 million as well as certain tax credits.

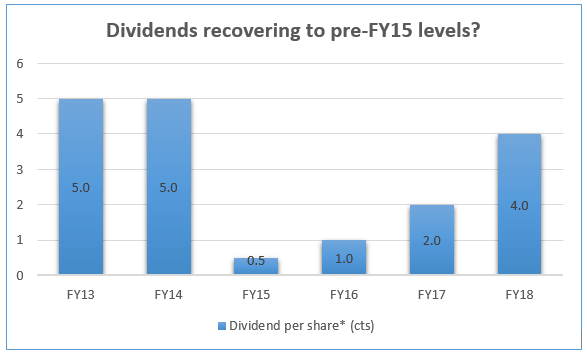

- Management’s decision to declare a final + special dividend of 2 cts per share brings total full year dividends to 4 cts, more than any in the past 3 years. Current yield stands at a respectable 4.6% based on a closing price of S$0.865.

- However, amidst the positive news, the company also cautioned that its recovery could be weakened by the ongoing trade war and a stronger US dollar.

Our Take

Interestingly, at last year’s AGM, some shareholders complained that the dividend payout of 2 cts per share pales in comparison to the 5 cts which Hupsteel used to pay up until FY14. The management, in doubling this year’s payout to 4 cts, perhaps gave the clearest indication that it has paid heed to them. We are of the view that the Company would restore its dividend to 5 cts in the near to mid future should the macro environment hold up.

RSS Feed

RSS Feed