While we will not weigh in on the fairness of the offer (there are enough market opinions/advice out there for minority shareholders to mull over with respect to that), we believe that shareholders should take note of some key issues when considering whether to ultimately accept SIA’s revised offer.

Background

SIA initially launched an offer of $0.41 per share for all Tigerair shares not owned by it on 6 November 2015. The offer is conditional upon SIA’s total shareholding inclusive of valid acceptances hitting at least 90% before the end of the offer period. While the offer was originally slated to end on 28 December 2015, it was extended to 8 January 2016 after SIA fell way short of its target (74.5% then vs 90%).

On 4 January 2016, SIA revised the offer price to $0.45 and further extended the deadline to 22 January 2016 indicating at the same time that it does not intend to revise the price further.

Key points to note

Current offer vs consideration for Temasek’s shares in 2013

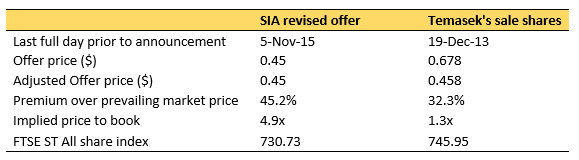

So is the SIA revised offer really worse off when compared to the consideration it paid for the Temasek sale shares as some believed? On the surface, it may seem so. After all, on an absolute per share basis, 45 cents per share is 34% less than the 67.8 cents SIA previously paid. This, however, has not taken into account the 85 for 100 rights issue in late 2014 during which Tigerair offered new shares to then existing shareholders at 20 cents per share. Once accounted for, the consideration paid during the Temasek purchase would have been adjusted down to 45.8 cents, just 2% higher than SIA’s current offer.

Furthermore, the current SIA offer that is taking place at a time when the market conditions are weaker (as measured by FSTE ST All Share index), is also superior when we compare other measures such as premium paid over prevailing market prices and the implied price to book ratio.

Hence, we think there is little evidence to suggest that the current revised offer is less compelling than that offered to Temasek for its shares in 2013.

Offer may not be extended by much longer due to regulatory restrictions

That SIA has extended its offer period twice so far in a bid to convince Tigerair minorities shows its resolve to take the ailing budget airline private. Still, shareholders who have yet to take up the offer should not expect another significant extension. This is because the Singapore Code on Takeovers and Mergers specifically provides that:

“No offer (whether revised or not) will be capable of becoming or being declared unconditional as to acceptances after 5.30 pm on the 60th day after the date the offer document is initially posted nor of being kept open after the expiry of such period unless it has previously become or been declared unconditional as to acceptances. An offer may be extended beyond that period of 60 days with the permission of the Council. The Council will consider granting such permission in circumstances, including but not limited to, where a competing offer has been announced.”

As the Offer Document was posted on 26 November 2015, this implies, by our calculation, that SIA would not be able to extend its offer period beyond 25 January 2015 (vs the current deadline of 22 January 2015) unless permission is sought from the Securities Industry Council (SIC), often in exceptional circumstances such as a competing offer. With SIA owning more than 57% as at 8 January 2016, not including acceptances as offer has not turn unconditional, it is hard to see the SIC allowing such an extension.

Likely scenarios and their implications for shareholders

So given that SIA’s offer is unlikely to be revised or extended much further, shareholders should naturally be aware of the different scenarios that will play out come 22 January 2016 and how it will affect their options.

Scenario A: SIA fails to hit the 90% shareholding threshold

As the offer is conditional upon SIA hitting the 90% shareholding threshold, the offer will lapse if SIA falls short of this level. Consequently, all Tigerair minority shareholders, regardless of whether they have previously accepted the offer, will retain all their original shareholdings and not receive any consideration from SIA for them.

Scenario B: SIA reaches the compulsory acquisition level (95.58%)

Under Section 215(1) of the Companies Act of Singapore, SIA would be entitled to compulsorily acquire all shares held by the minority shareholders should it accumulate during the offer period, through valid acceptances or on-market acquisitions during the offer period at least 90% of all shares excluding those owned by it at the start of the offer. Since SIA and its concert parties already owned 55.79% of Tigerair’s shares as at commencement of the offer, this follows that it will need to acquire another 39.79% (0.9 x 44.21%) during the offer period, hence a total of 95.58%, to have the right acquire all minority shareholdings. Under this scenario, all shareholders would have to sell their shares to SIA irrespective of whether they chose to accept the offer.

Scenario C: SIA reaches 90% but falls short of compulsory acquisition level (95.58%)

If the eventual shareholding of SIA falls between 90% and 95.58% during the offer period, the situation becomes a little more complex.

Firstly, the offer will still be declared unconditional and all shareholders who have tendered their shares prior to closing, will be entitled to receive the revised offer price for their shares.

For dissenting shareholders who chose not to accept the offer, you should note that under the SGX listing rules, any listed company with a public float of less than 10% will face a trading suspension imposed by SGX and an eventual delisting unless the company takes the necessary steps to restore the public float to the minimum level. As SIA has already explicitly indicated that it does not intend to restore the public float and retain the listing under this scenario, these dissenting shareholders will likely be holding shares in a private company post the offer period.

However, dissenting shareholders will still be able to require SIA to acquire their shares for a period of time after the offer period by invoking their rights under Section 215(3) of the Companies Act. This right kicks in as long as SIA acquires at least 90% of all Tigerair shares including those it held as at commencement of the offer. Shareholders should note the difference between their right to require their Tigerair shares to be acquired by SIA and the right by SIA to compulsorily acquire theirs.

Should the dissenting shareholders choose neither to accept the revised offer nor to invoke their rights under Section 215(3) of the Companies Act, they will remain as minority shareholders of an unlisted Tigerair. While such a situation may not be ideal given that they will no longer have the benefit of being able to trade their Tigerair shares on SGX, there have been instances (the CK Tang privatisation in 2009 comes to mind) where holding out may pay off eventually in the form of an improved offer in future if Tigerair shares are indeed being undervalued by SIA’s current offer as they might believe.

Final Note

We may have taken all reasonable efforts to verify the information we presented in order to provide shareholders and investors in general with a good overview of the key issues pertaining to the SIA offer. Nevertheless, we encourage all investors and shareholders alike to familiarise themselves with key regulations governing a takeover offer including the SGX Listing Manual, Singapore Companies Act Section 215 and the Singapore Code on Takeovers and Mergers. This is so that they would be better equipped to evaluate their options and make better investment decisions should circumstances similar to this arise in future.

(All currency in SGD unless stated)

RSS Feed

RSS Feed