Irving Kahn was 109 years of age at the time of his passing. He was seen as an embodiment of hard work and commitment to value investing (see video below). We think that investors like him should be an inspiration to all value investors and investors in general across the world. RIP.

|

We take a moment today to pay a tribute to long time value investor and centenarian, Irving Kahn. He was one of the original Benjamin Graham group of disciples along with other famed investors like Warren Buffett, Walter Schloss and Bill Ruane. Irving Kahn was 109 years of age at the time of his passing. He was seen as an embodiment of hard work and commitment to value investing (see video below). We think that investors like him should be an inspiration to all value investors and investors in general across the world. RIP. P.S. We feel kind of stupid having to include this here but before anyone asks, no, we do not know him personally. We just think it appropriate to pay tribute to one of the most amazing and longest living value investor of all time.

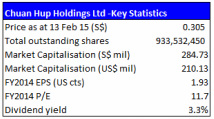

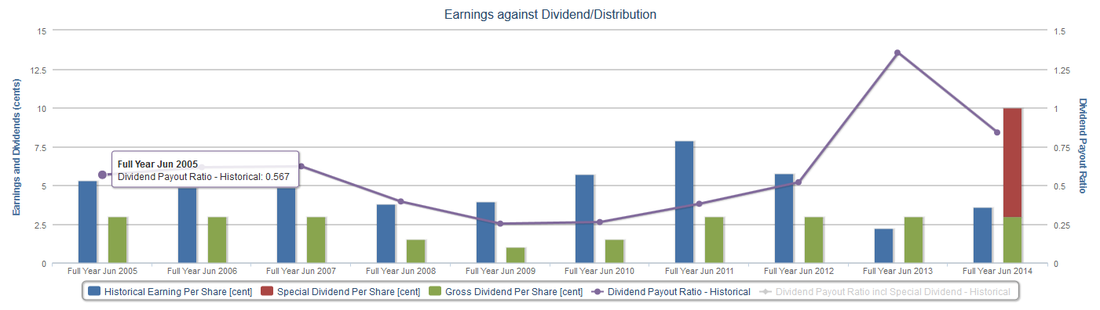

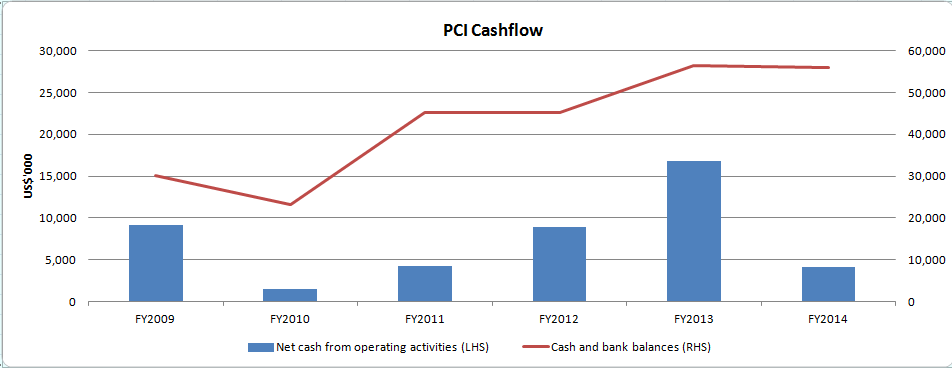

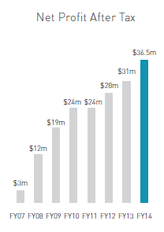

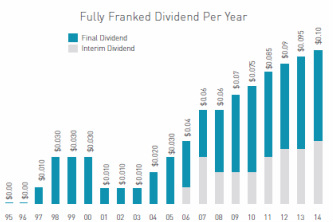

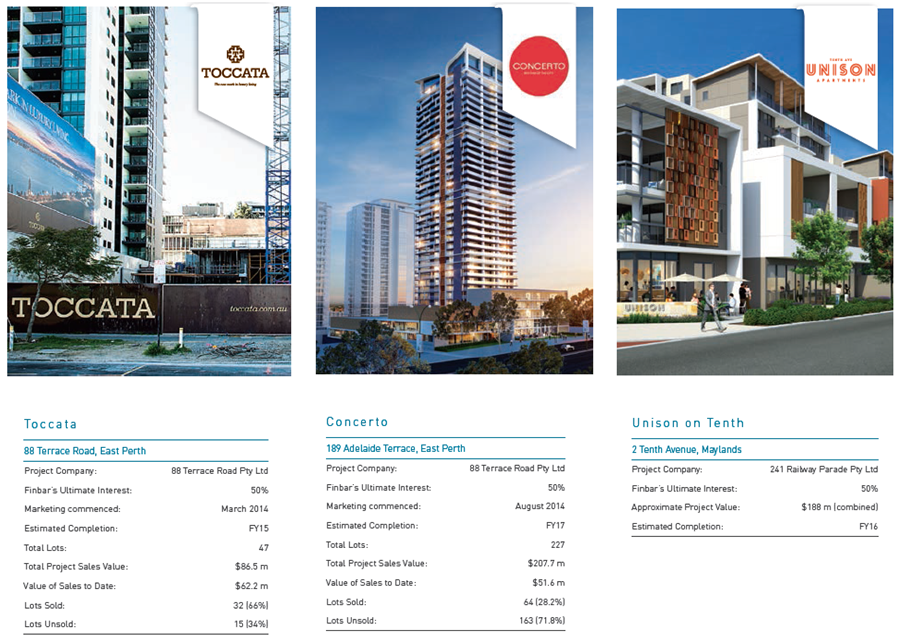

The intriguing but short shareholders' tussle over CH Offshore Ltd ("CHO") has put the spotlight squarely on Chuan Hup, an undervalued gem long known to value investors but yet attracts little to no analyst coverage. Following its decision to dispose of its entire 24.67% stake in CHO, Chuan Hup stands to reap a windfall of $95.7 million. Its share price has since reacted by adding 11% to close at $0.305 per share on 13 February 2015. With an extremely robust cash-rich balance sheet, key investment holdings in strong cashflow generating entities, prospects of a good dividend payout, we rate Chuan Hup as a good long term buy for investors with a possible short term price catalyst. Background Brief takeover tussle On 9 February 2015, Falcon Energy Group Ltd ("FEG") announced that it will increase its offer for CH Offshore shares to $0.55 per share from $0.495 previously. On the same day, Chuan Hup announced its intention to accept the revised offer after initially rejecting the original and snapping up 0.91% worth of shares in the open market in an apparent attempt to put pressure on FEG. This is close to the 1% it can acquire in any 6 month-period before triggering its own takeover as Chuan Hup and Peh Kwee Chim, its controlling shareholder own more than 30.6% of CHO's total shares (although it was disclosed in the CHO offeree circular dated 8 January 2015 that including associates, this figure is around 35.1%) prior to the FEG offer. This effectively ended a shareholders' deadlock that has been in existence ever since FEG acquired its original 29.1% stake in April 2010 from Bursa-listed Scomi Marine Berhad (n.k.a. Scomi Energy Services Berhad), who in turn had acquired the same stake from Chuan Hup back in 2005. Potential Win-Win-Win FEG finally managed to wrest control of CHO at a reasonable price after initially spending $143.5 million in 2010 to acquire its 29.1% stake at a much higher price of $0.70 per CHO share. The revised offer of $0.55 is at a slight discount to the estimated revalued NTA per share of $0.57 per CHO share (source: CHO offeree circular) as at 30 September 2014. CHO also has an ungeared balance sheet with net cash per share of around $0.13 per share potentially giving FEG flexibility to recapitalise the company and reduce its own upfront cost of funding the acquisition. We expect synergies to be derived from combining FEG's fleet of mainly accommodation barges and rigs with CHO's complementary fleet of AHTS vessels going forward. Shareholders of CHO get to exit their investments at a price that has not been reached for more than 4 years even as the share prices of almost all other oil and gas counters have plummeted. (see CHO historical price chart below) Even shareholders who chose not to accept the offer and remain as CHO shareholders can potentially benefit from the operational synergies as described above. Figure 1: CHO last traded at $0.55 in 2010 Finally, Chuan Hup gets to cash in on its CHO stake for a tidy sum of $95.7 million and turn its focus on other investments amidst a weak current operating environment for CHO's oil and gas services business. Shareholders of Chuan Hup could even be in line for a special bonanza if the board of directors decides to emulate its feat of distributing a bumper 44 cts per share special dividend in FY2006 representing almost 100% of its $485.6 million cash proceeds from the disposal of its marine logistics business along with 49.1% stake in PT Rig Tenders Indonesia and the 29.1% stake of CHO shares to Scomi Marine. For comparison purposes, the $95.7 million proceeds should translate to about 10.2 cts per share if distributed fully. Chuan Hup and its treasure trove Since its establishment in 1970 as a tug and service provider for PSA Corporation in Singapore, Chuan Hup has quietly grown under the guidance of co-founder Peh Kwee Chim into a diversified group with core interests in oil and gas services, property development and electronics manufacturing services. Post CHO disposal, the company is likely to focus its attention on the latter two while seeking out new investments. PCI Ltd Chuan Hup's electronics manufacturing business is carried out under SGX Mainboard-listed PCI Ltd (www.pciltd.com), which it successfully made its subsidiary (76.7% owned) following a mandatory conditional offer in May 2011. Despite operating in a tough and competitive industry, PCI has delivered at least 10 consecutive years of profits and has an enviable and uninterrupted track record of paying consistent dividends of at least 3 cts per share for most years in the same period with a total of 10 cts paid for the financial year ending 30 June 2014. Figure 2: PCI has a strong uninterrupted track record of dividend payments with at least 3cts per share in 7 out of the past 10 financial years despite operating in a competitive industry (Source: company, shareinvestor) Figure 3: PCI has maintained positive operating cashflows and high levels of cash for at least the last 7 financial years (Source: company) PCI also has a very strong balance sheet with no borrowings and cash holdings of $52.9 million (US$39.1 million) as at 31 December 2014 after adjusting for considerations to be received and paid pursuant to its proposed disposal of the Jalan Ahmad Ibrahim property (announced 13 Feb 15) and acquisition of the Pioneer Road North property (2 Jan 15). This forms approximately 62% of its market capitalisation of $85.6 million based on the closing price of $0.43 per share, giving it an enterprise value of just $32.7 million and a very undemanding FY2014 EV/Ebitda of just 3.1 times. At $0.43 per share, Chuan Hup's stake is worth $65.7 million. Finbar Group Ltd Chuan Hup’s other major investment in a listed company is in Perth-based Australian property developer and ASX-listed Finbar Group Limited (www.finbar.com.au), in which it holds a long term strategic stake of 17.5%. It should be noted that even though the stake is less than 20% and Chuan Hup could not equity account for Finbar's share of profits, it is actually the largest single shareholder in the property company. Finbar is a leading property developer in Western Australia, particularly Perth, and has a long established track record of 2 decades, having completed 58 projects worth A$2.8 billion. It also has an impressive streak of having generated 8 consecutive years of net profit growth with an even longer run of increased dividend payments since FY2003. Figure 4: Finbar has an impressive track record of generating profits and increased dividends. Despite being a property developer and consistently paying dividends, the company has also managed to keep its net gearing to a low level of just 7.3% as at 30 June 2014. As at the closing price of A$1.345 per share, Finbar has an attractive dividend yield of 7.4%. Chuan Hup's stake is worth $56.3 million (A$53.6 million) Property development in Australia Chuan Hup currently has 2 property joint ventures with Finbar ("Australian JVs"):

Under both JV agreements, Chuan Hup contributed the land and Finbar contributed the working capital necessary for the development. There should thus be no further foreseeable capital requirements for Chuan Hup going forward for these JVs. Profits from both developments will only be recognised upon physical completion and settlement of sold apartments. Based on information from Finbar's website to date, Toccata has sold 68% of its units while Concerto's sales is at 46% (104 of 226 units) since marketing commenced in March and August 2014 respectively. Unison on Tenth has sold 32% of its units (54 of 167) since marketing commenced in early FY2015. With a book value carried at cost of just US$33.5 million ($45.4 million) for both Symphony City and Unison, Finbar’s impressive track record, we expect positive contributions from these two projects over the next 3 years despite the current challenging conditions in the Western Australia real estate market. For illustration, Chuan Hup registered a profit before tax of US$19.4 million over FY2013 and FY2014 for its property development segment primarily due to completion of Adagio. Figure 5: Toccata, Concerto, Unison on Tenth. Sales figures as at September 2014 based on Finbar’s annual report although Finbar's website lists more updated figures. Source: Finbar Other significant assets:

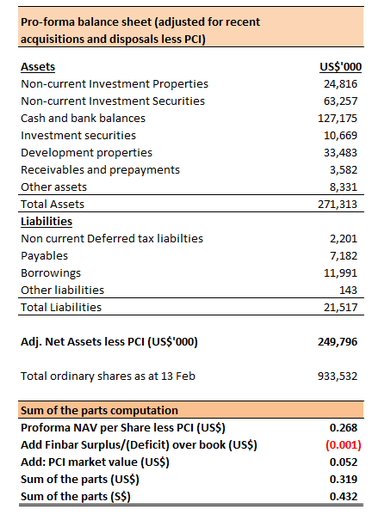

Valuation Using sum-of the parts (SOTP) method, we derive at a conservative value for Chuan Hup of $0.432 per share. Our valuation pegs PCI and Finbar to their respective market valuations and the remaining assets conservatively at book value, which in the case of the Australian JVs is at cost. The valuation is supported by approximately $0.226 net cash per share, taking into account Chuan Hup's share of the PCI's cash hoard. This is, in our view, reasonable as Chuan Hup effectively controls the use of cash at PCI. Figure 6: SOTP computation

Recommendation We believe there is deep value embedded in Chuan Hup which should appeal to long term value investors. In addition, Chuan Hup's shareholders could also benefit in the short term should sales proceeds from the disposal of CHO shares be paid out as special dividends in a repeat of the disposal to Scomi Marine in 2005. The shares are currently trading at a 29.4% discount to its intrinsic conservative SOTP value of $0.432 per share with good downside protection provided by its adjusted net cash per share of $0.226 as well as a decent dividend yield of 3.3%. We are buyers at this price. Key Risks The strengthening US dollar against both the Australian and Singapore dollar has resulted in Chuan Hup being hit by significant foreign currency related losses in recent quarters. We think that this could be a key concern going forward. The weakening Western Australian real estate market could also pose challenges to both its Australian JVs, although this is mitigated by the Australian JVs being carried on its books at cost. (All preceding amounts in SGD unless stated, USD:SGD X-rate of 1.3550 and AUD:SGD X-rate of 1.0520 assumed) Events since our first report (link) Trading in Memstar Technology Ltd was temporarily halted from 2 to 5 February 2015 in what must have been a nerve-wracking few days for its shareholders. Recall that in our previous report, we had highlighted risks relating to completion of the RTO, which is subject to a host of conditions. Two of the key conditions were supposed to have been met by 31 January 2015:

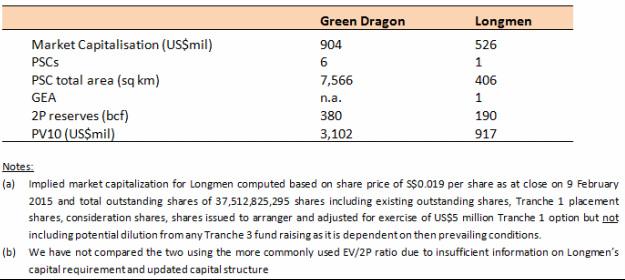

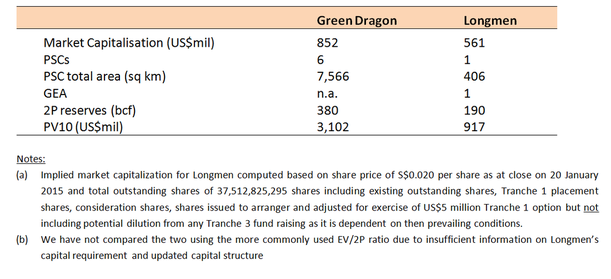

Our Views The extension of deadline highlights the non-completion risks shareholders face even as the clock is ticking on Memstar's own 11 April 2015 deadline to fulfill SGX continuing listing requirements. While SGX could possibly grant an extension for the RTO to complete, we reiterate that should it be aborted, the prospects of shareholders being able to extract any meaningful value out of their shares would be quite dim. Even if the RTO is successfully completed, the implied market valuation of Longmen (representing the combined group) post completion at US$526 million looks rich compared to its much bigger competitor, Green Dragon. Updated comparison table: Recommendations

At $0.019, the share price seems to have fully priced in certainty of deal completion. We still do not think this is justified given the multiple risks factors that might affect completion. Downside risks far outweigh any upside potential, if any at all. Investors should steer clear at this price. Events since our first report on 6 January 2015 (link)

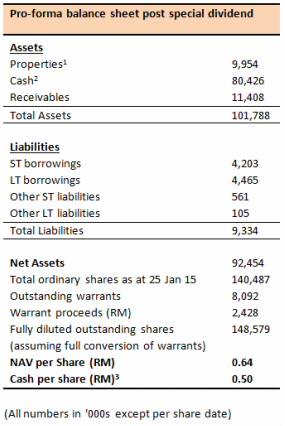

Our Views The property purchase does not materially affect our estimates. Recall that ABRIC had sold off all its operating assets except for two properties that are currently leased out to its former subsidiaries. This new property once completed is intended to serve as its corporate headquarters. It will be constructed and paid progressively over 48 months, meaning that the cashflow impact is minimal and should be more than offset by incoming cash proceeds of up to RM11.0 million yet to be received as part of the sale of its security seal business. As it stands, there are still 8.1 million company warrants that have either curiously not been converted or which conversions have not been announced as at 25 January 2015. Pending further announcements on new conversions that made the 23 January 2015 books closure date deadline, holders of these warrants likely missed out on the RM0.30 special dividend bonanza. The implication is that the additional RM2.4 million saved bumps up our cash estimates by another RM0.02 per share. Our revised estimates of the NAV and cash per share is now RM0.50 and RM0.64 respectively: Notes:

1. The newly acquired property has not been included as it will only be recognised progressively over the next 48 months 2. Updated to cash position announced on 21 Jan 15 and adjusted for actual special dividends likely paid based on total outstanding shares as at 25 Jan 15 3. Net of total borrowings but not inclusive of cash in the escrow account of RM10 million and addition RM1 million which has been lumped together under Receivables Recommendation At RM0.425 per share, ABRIC continues to trade at significant discounts to its breakup value of RM0.64 per share and net cash per share of RM0.50 which does not include another RM0.05 worth of receivables even after conservatively adjusting fully for the new property purchase. We believe the current share price provides an attractive entry point and a good margin of safety for value investors. Memstar Technology Ltd has surged 33.3% in the last one month since announcing a reverse takeover ("RTO") on 20 December 2014 of Longmen Group Ltd ("Target"), a private developer of coal bed methane ("CBM") resources in Shaanxi Province, China. While the announcement may be a welcome boost to shareholders of Memstar given that it has only until 11 April 2015 to meet requirements to stay listed or be possibly forced into a delisting by SGX, we think that the surge is more speculative in nature and not backed by fundamentals. We see no reason for the shares to trade at the current price of S$0.020 pending further details on the acquisition. Background Memstar announced that it had entered into an agreement to acquire Longmen for US$420 million (S$546 million[1]) by issuing 33.81 billion consideration shares at S$0.01615 per share, a 7.7% premium to its closing price of S$0.015 on 28 November 2014, the last trading day before trading was temporarily halted pending the RTO announcement. Longmen owns participating interests in 2 CBM concessions (collectively "Longmen Concessions"):

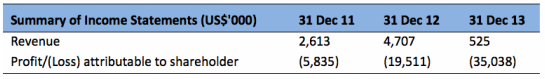

The Longmen concessions contain net 2P (Proved and Probable) CBM reserves of 190 billion cubic feet, with a present value of approximately US$917 million calculated using the standard 10% discount rate (otherwise known as a PV10 value, a common nomenclature for Oil and Gas reserves). The Target is 50.43% owned by LESS Longmen Co Ltd, a fund of funds, with the remaining shareholders a collection of private equity funds and current and prior management. The Target has been loss making for FY2011-13 and is in a net liability position of US$43.7 million largely due to existing liability and derivative tied to redeemable preference shares in issue of US$99.1 million in total. The RTO is subject to, amongst other conditions, completion of 3 tranches of fund raising exercises at various stages:

Our Views At the current price of S$0.020 per share, Memstar has a market capitalisation of S$61.1 million taking into account new shares that were issued pursuant to the Tranche 1 placement. This is backed by an NTA of just S$9.2 million comprising the S$6.6 million refundable deposit paid to Target with the remaining in cash. Completion of the transaction is far from certain and subject to a host of conditions including further fund raising exercises to be completed and Target being able to successfully procure all exploration rights to be renewed for maximum possible term. As we have noted before, RTOs historically do not enjoy high completion rates (see here). This is also the second attempt by Longmen to list on SGX after having previously failed to reach agreement on terms following a non-binding MOU signed with PSL Holdings Ltd back in 14 May 2014. The exclusivity for the MOU lapsed on 13 October 2014 and a similar refundable deposit of US$5 million has since been returned to PSL. Memstar has been classified as a cash company under SGX listing rules since 11 April 2014 and has just until 11 April 2015 to meet SGX requirements to continue to be listed. Should the transaction be aborted for whatever reasons, there is likely to be insufficient time for Memstar to seek another target to maintain its listing status and shareholders will be left with a company that has little assets other than cash of just S$0.003 per share vs the current price of S$0.020! Further, we note that the main reason for the current optimism could lie in the Target's reported 2P reserves of 190 billion cubic feet with a PV10 value of US$917 million. Investors should, however, put this into perspective against the following:

Recommendation While the RTO is a potential lifeline for Memstar shareholders who might otherwise be faced with the unwelcome prospect of a forced delisting by SGX come 11 April 2015, investors should be cognisant of the significant downside risks posed in the event the deal is aborted. Even if the RTO is completed successfully, the current price of S$0.020 per share is unjustified based on currently available information and on valuation grounds. We see no reason for it to be trading at such lofty levels. [1] Based on exchange rate of US$1 to S$1.30 provided in announcement

[2] Henry Hub spot prices have declined from US$4.71/mmbtu in January 2014 to US$3.48/mmbtu in December 2014 [3] Reuters, 9 December 2014: Price of LNG lowest in 4 years. LNG prices in Asia down nearly 50% since January 2014 Background ABRIC Berhad ("ABRIC") is a Malaysian company listed on Bursa Malaysia (formerly known as Kuala Lumpur Stock Exchange). Prior to December 2014, it was primarily engaged in the provision of security sealing solutions with a presence in over 80 countries worldwide. In September 2014, ABRIC announced that it has entered into an agreement with UK based Essentra PLC to dispose of its core operating business for a total consideration of RM146.0 milllion on a "cash-free, debt-free" basis. The disposal was subsequently completed following approval from its shareholders at a shareholders' meeting held on 9 December 2014. Post completion, ABRIC has become a cash company with the majority of its assets in cash and properties. Under Bursa rules, ABRIC has to submit a proposal for approval to acquire a new core business within 12 months from the date it becomes a cash company implement its proposal within the timeframe prescribed by the Securities Commission, failing which they would be forced to delist, a scenario which would likely mean that they would be forced to dispose of the remaining assets and distribute the cash back to its shareholders. Significant Undervaluation We estimate that the shares are worth conservatively RM0.92 per share vs the current price of RM0.705 per share giving the shares potential upside of 30%. Our computation is as follows: (All numbers in '000 except per share data) Notes

1. Based on cash consideration received as 16 Dec 14 less estimated expenses of RM6 million 2. Based on Cash and cash equivalents less total borrowings but not inclusive of cash in the escrow account of RM10 million and addition RM1 million which has been lumped together under Receivables We further note that ABRIC has entered into a lease agreement with its former subsidiaries to lease out its 2 properties for a combined RM1.1 million per year for at least 2 and 3 years respectively. This implies a high capitalisation rate of 11.4% based on the current book value of the properties. As such, we believe that the market value of the properties would be higher than that stated in its books. However, to be conservative, we have not included any potential property valuation surplus in our computation. Recommendation The stock is trading at a significant discount to its breakup value of RM0.92 per share and net cash per share of RM0.78 which does not include another RM0.08 worth of receivables due as part of the disposal. We are a buyer at this price. Further upside will come from potential acquisition of a new core business as management has set aside RM50.0 million for this purpose. Downside is limited to its cash holdings in the event of a liquidation or breakup pursuant to a delisting. Furthermore, ABRIC has announced a special dividend of RM0.30 per share which will enhance the already favourable risk-reward at RM0.705 as net exposure will be down to RM0.405 per share ex-dividend against RM0.62 and RM0.48 per share of NAV and net cash respectively. While management has set aside another RM15.2 million for working capital, we think this is purely for contingency purposes as the remaining 2 properties leased to its former subsidiaries are its only assets left and hardly justify such a large working capital. Key Risks As with cash companies, the key risks would be for the management to spend all its cash on acquiring a value destructive business. However, this risk is partially mitigated by the special dividend that has already been announced and is to be paid on 6 Feb 15 (ex-div date is 21 Jan 15) |

Like our Facebook page for the latest updates:

AuthorStockResearchAsia Team Archives

June 2020

Categories

All

|

RSS Feed

RSS Feed