Background

Memstar announced that it had entered into an agreement to acquire Longmen for US$420 million (S$546 million[1]) by issuing 33.81 billion consideration shares at S$0.01615 per share, a 7.7% premium to its closing price of S$0.015 on 28 November 2014, the last trading day before trading was temporarily halted pending the RTO announcement.

Longmen owns participating interests in 2 CBM concessions (collectively "Longmen Concessions"):

- A 60% participating interest through a production sharing contract (PSC) entered into with China National Petroleum Corporation (CNPC) to explore, develop, produce and sell CBM gas covering 2 blocks of area in Hancheng, Shaanxi effective for 30 years from March 2007.

- An 80% participating interest in a gas extraction agreement (GEA) with Hancheng Coal Mine Bureau for CBM extraction in 3 mines in Hancheng effective for 20 years from July 2008. Coal mining is currently ongoing in these mines with concurrent CBM production.

The Longmen concessions contain net 2P (Proved and Probable) CBM reserves of 190 billion cubic feet, with a present value of approximately US$917 million calculated using the standard 10% discount rate (otherwise known as a PV10 value, a common nomenclature for Oil and Gas reserves).

The Target is 50.43% owned by LESS Longmen Co Ltd, a fund of funds, with the remaining shareholders a collection of private equity funds and current and prior management.

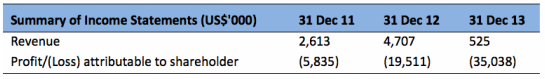

The Target has been loss making for FY2011-13 and is in a net liability position of US$43.7 million largely due to existing liability and derivative tied to redeemable preference shares in issue of US$99.1 million in total.

- Tranche 1: Initial US$5 million refundable deposit, to be raised by Memstar and paid to Target, which carries a option to convert into Target shares at valuation of US$210 million. (Tranche 1 has been completed on 6 January 2015)

- Tranche 2: US$15 million to be raised by Target on or before 31 January 2015

- Tranche 3: US$60 million to be raised by Memstar on or before completion of RTO

Our Views

At the current price of S$0.020 per share, Memstar has a market capitalisation of S$61.1 million taking into account new shares that were issued pursuant to the Tranche 1 placement. This is backed by an NTA of just S$9.2 million comprising the S$6.6 million refundable deposit paid to Target with the remaining in cash.

Completion of the transaction is far from certain and subject to a host of conditions including further fund raising exercises to be completed and Target being able to successfully procure all exploration rights to be renewed for maximum possible term.

As we have noted before, RTOs historically do not enjoy high completion rates (see here). This is also the second attempt by Longmen to list on SGX after having previously failed to reach agreement on terms following a non-binding MOU signed with PSL Holdings Ltd back in 14 May 2014. The exclusivity for the MOU lapsed on 13 October 2014 and a similar refundable deposit of US$5 million has since been returned to PSL.

Memstar has been classified as a cash company under SGX listing rules since 11 April 2014 and has just until 11 April 2015 to meet SGX requirements to continue to be listed. Should the transaction be aborted for whatever reasons, there is likely to be insufficient time for Memstar to seek another target to maintain its listing status and shareholders will be left with a company that has little assets other than cash of just S$0.003 per share vs the current price of S$0.020!

Further, we note that the main reason for the current optimism could lie in the Target's reported 2P reserves of 190 billion cubic feet with a PV10 value of US$917 million. Investors should, however, put this into perspective against the following:

- The PV10 value was computed based on a report dated 31 December 2013. Although CBM prices usually trade at a slight premium to conventional natural gas prices, there is nonetheless a strong correlation between the two. As natural gas prices has softened considerably in the last one year[2],[3], there is a risk that the reported PV10 value using CBM price assumptions then may be on the high side. That said, possible mitigation to this risk could come from increased Chinese government subsidy.

- The Longmen Concessions are largely still at the pre-production stage. Although the GEA covers an area which is currently in production, it is not a significant revenue contributor as yet as witnessed by Longmen Group's paltry revenues of US$0.5 million for FY13 and just US$2.6 million on average for the last 3 FYs.

- Under the PSC, there are two main blocks: a north block covering 234.3 sq km, which is still in exploration stage and largely inactive, and a south block covering 171.8 sq km, for which exploration has been completed and full-scale commercial production is planned for early 2016. There is likely to be significant capital expenditures required in order to bring both blocks under the PSC to full commercial production and contribute to the bottom line.

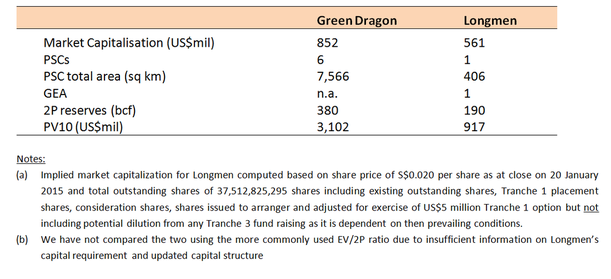

- Longmen's much larger competitor, LSE-listed Green Dragon Gas (Bloomberg code GDG:LN) has, as at November 2014, 2P reserves of 380 billion cubic feet with a PV10 of US$3.1 billion and 6 PSCs covering 7,566 sq km. Green Dragon currently has a market capitalisation of US$852 million (GBP 562 million) and Enterprise Value of US$872 million.

- Comparing the two, Longmen’s valuation appears excessively rich:

While the RTO is a potential lifeline for Memstar shareholders who might otherwise be faced with the unwelcome prospect of a forced delisting by SGX come 11 April 2015, investors should be cognisant of the significant downside risks posed in the event the deal is aborted. Even if the RTO is completed successfully, the current price of S$0.020 per share is unjustified based on currently available information and on valuation grounds. We see no reason for it to be trading at such lofty levels.

[2] Henry Hub spot prices have declined from US$4.71/mmbtu in January 2014 to US$3.48/mmbtu in December 2014

[3] Reuters, 9 December 2014: Price of LNG lowest in 4 years. LNG prices in Asia down nearly 50% since January 2014

RSS Feed

RSS Feed