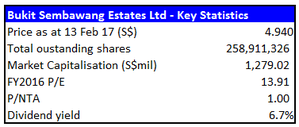

While a recent surge of interest has seen its share price rally 9% in 3 weeks, we think investors still do not fully appreciate how undervalued it truly is. With its legacy land bank carried at a historical cost determined more than 60 years ago, a best in class dividend yield of more than 6.7% and a net cash balance sheet that is the strongest it has been in at least 20 years, BSE is our top pick to ride out the current trough in the property cycle.

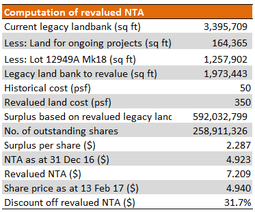

Just revaluing the legacy landbank at close to current market prices and without taking into account any future development profits should see the Company add another $2.29 per share to its NTA, giving it a base NTA of at least $7.21 per share, or 46% above its last closing price of $4.94. This is not even taking into account any potential gains from BSE’s recent moves to resolve its long running dispute over its land along Ang Mo Kio Ave 5 (Lot 12949A Mk 18) by surrendering its 999 year lease for a fresh 99-year one in order to convert it fully into residential land without restrictions or the bulk sale of its non-landed projects built on land acquired at attractively low prices.

Background

Long history as one of the largest land owners in Singapore backed by prominent shareholders

BSE, in its current form, started out as a developer to build and sell properties on large tracts of legacy rubber plantations owned by OCBC Bank’s founding Lee family. In the 1950s, BSE owned as much as 172 million sq ft (16 km2) of land. To put this in perspective, this is approximately 2.7% of Singapore’s total land area at that time [i].

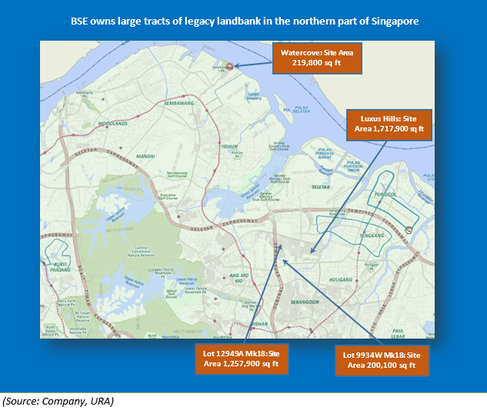

Over the years, however, its landholdings have shrunk greatly, largely because of compulsory acquisitions by the Singapore government as well as BSE’s own development projects. By 1998, a year after BSE had another 1.7 million sq ft of land acquired by the government, they were left with just 5 million sq ft of legacy land. While still a massive landbank by all accounts, it was a far cry from their original landholdings. From then on, most of the depletion has been a result of their own development projects. The largely freehold/999-year leasehold legacy landbank today stands at 3.2 million sq ft, which excludes a couple of development phases currently in the works.

Legacy landbank carried at miniscule cost price

Although it is no secret that BSE’s legacy landbank is carried on its balance sheet at historical cost, there is little clarity among the investing public as to what this cost might be. Part of the problem lies in BSE’s lack of disclosure in its own results announcements and annual reports as it had stopped providing an annual breakdown of its development properties from 2004.

- BSE’s legacy land cost stated in its earlier annual reports were in fact based on its historical book value as at 1953. In 1995, its close to 7 million sq ft of land was carried at a mere cost of around $862,000, less than what it would normally cost for a 1,000 sq ft condominium today; and

- Inclusive of development charges it had paid, we deduce that the carrying cost of the legacy landbank could be as low as $50 psf.

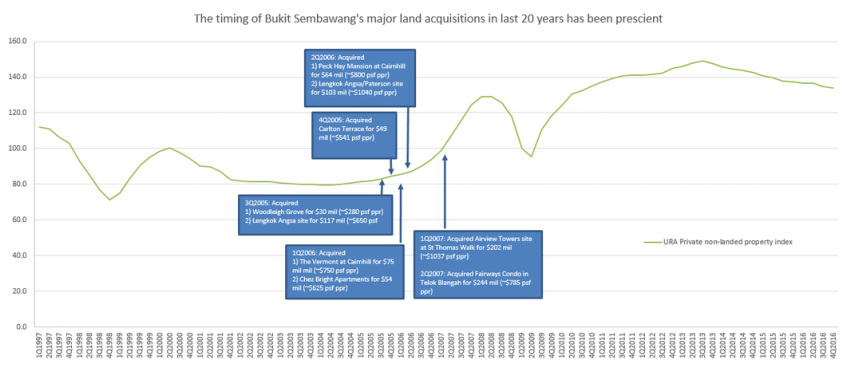

Excellent track record in land acquisitions

In addition to its legacy landbank, BSE has also proven to be very adept at timing the market in its land acquisitions. For instance, all its major land acquisitions in last 20 years have come in a 2-year period between the 3rd quarter of 2005 and 2nd quarter of 2007, when it shelled out more than $900 million to acquire 9 different non-landed development sites, majority of which are in the prime districts 9 and 10. This acquisition spree came at the tail end of a long property lull which lasted from 2000 to 2006. As a result, it was able to replenish and expand its landbank during a period when property prices were either at or below even the lows of the 2008-2009 global financial crisis.

Our Take

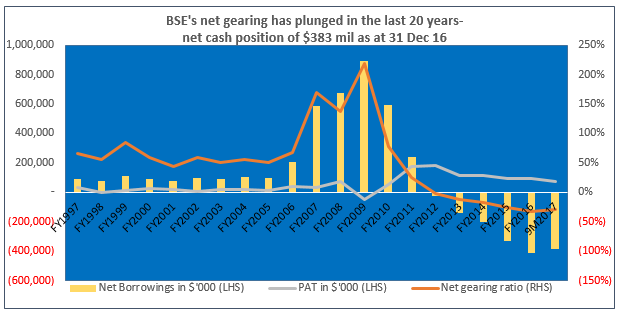

Strongest balance sheet in at least 20 years supporting a best in class dividend yield of 6.7%

As a result of its well-timed land acquisitions, BSE has been able to generate strong profit numbers and cashflow over the past 5 financial years. This has culminated in a balance sheet that is the strongest it has been in at least 20 years, with a net cash position of $383 million as at 31 Dec 2016 even after deducting the $85 million in dividends paid in the quarter prior. This net cash forms as much as 30% of both its current market capitalisation and NTA, which is unusual for a property developer.

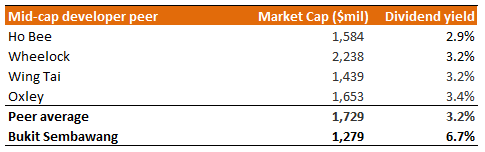

On the back of its balance sheet strength, BSE has also taken steps to reward its shareholders, paying an annual dividend of 33 cts per share in each of the last 2 years. Based on its last traded price of $4.94 per share, this translates into a dividend yield of 6.7%, the highest by far among SGX listed mid cap developers.

Limited supply for landed properties should augur well for BSE

While BSE has a good track record of developing non-landed properties, its bread and butter is in the landed developments. Its large landbank and long track record in the northern part of Singapore has earned it the nickname “King of Seletar Hills”. According to the Company, it has over the past half a century built more than 2,500 houses in Seletar Hills, 1,000 in Sembawang and 500 elsewhere.

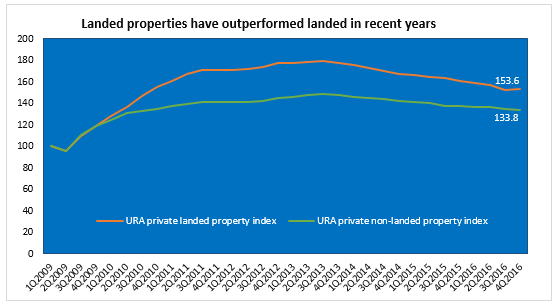

Unlike non-landed properties, landed properties can only be bought by Singaporeans and selected foreigners approved by the Singapore government. Despite this, prices of landed properties have outperformed non-landed by a wide margin in recent years according to URA’s Property Price Index (PPI). A large part of this can be explained by the much tighter supply of landed properties in land scarce Singapore.

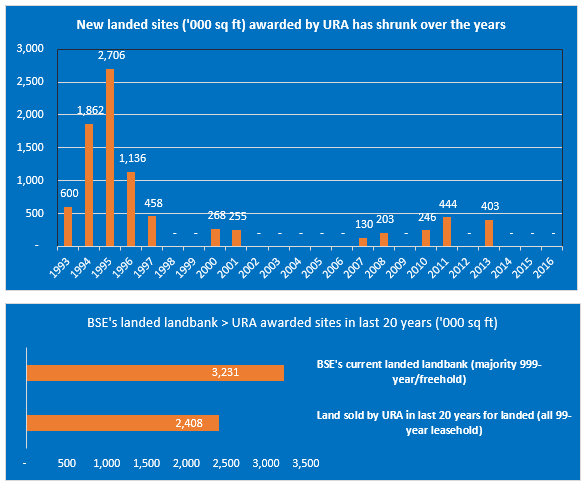

New landed sites, the main supply of landed properties besides development/redevelopment of existing sites, awarded by URA have shrunk over the years. Only around 403,000 sq ft of land was awarded for landed developments in the last 5 years and a total of 2.4 million sq ft over the last 20 years, comprising entirely of 99-year leasehold land. In contrast, BSE alone has more than 3.2 million sq ft [ii] as at 31 Mar 2016, with close to two-thirds either 999-year leasehold or freehold land.

BSE has sufficient options to allay QC concerns for its non-landed projects

In an effort to curb the then runaway property prices, the Singapore government had in recent years introduced a slew of property cooling measures, including requiring all foreign property developers (defined as all developers with shareholders or directors who are not all Singaporeans) to be issued a qualifying certificate (“QC”) whenever they buy land for residential development. Once a QC is issued, a foreign developer will be bound by the QC rules. One of these rules states that the foreign developer has 5 years to complete a project after land purchase with another 2 subsequent years after completion to sell all the units in the project. If it fails to meet this deadline, it may have to forfeit a banker's guarantee worth 10 per cent of the land purchase price. The foreign developer can extend the QC for another 3 years by paying a fee that goes from 8 per cent of the purchase price for the first year to 16 per cent for the second year and 24 per cent for the third.

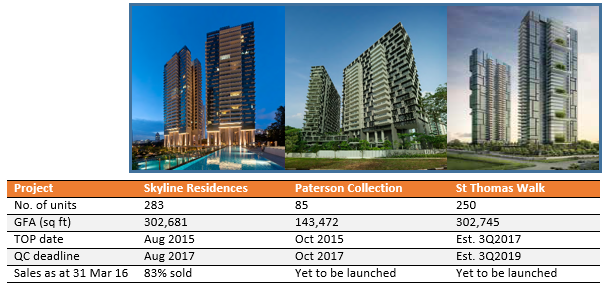

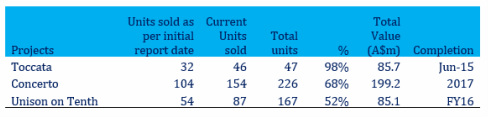

As a listed company, BSE falls under the definition of a foreign developer with respect to the QC rule. Hence, it faces pressure to complete the sale of all its units in completed projects as well as soon to be completed projects. The projects likely to be affected include Skyline Residences in Telok Blangah, Paterson Collection in Orchard and St Thomas Walk in River Valley. We examine below how each of these projects could potentially be affected.

BSE projects that are likely to be affected by QC rules

St Thomas Walk: With the TOP set for the 3rd quarter this year and the QC deadline only in Q3 2019, we believe there is still sufficient time for the Company to market and sell these units even though it has yet to launch the project. There is also the possibility that the government could loosen the QC rules by the time St Thomas Walk’s QC deadline approaches. We estimate that the project has a breakeven price of $1,400 psf vs $1,750 psf [iv] average selling price achieved for nearby comparable projects such as St Thomas Suites.

Paterson Collection: Perhaps the most at risk to QC penalties given that the project’s QC deadline is in October this year and that the project is yet to be launched. However, with low land cost and an estimated breakeven price of $1,600 psf vs an average price of around $2240 psf [v] for Paterson Suites (also by BSE) just across the road, we believe the Company has plenty of flexibility in achieving a positive outcome prior to the QC deadline.

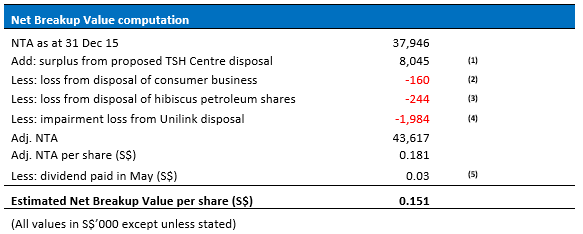

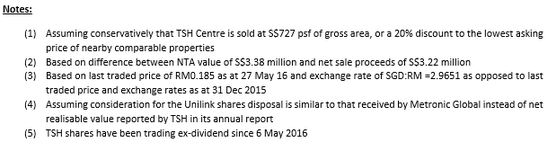

One possibility would be for a bulk sale of the project to a non-related party at a discount to market prices. We believe a conservative discount of 25% would be more than sufficient to attract buyers. Even at this discounted price of approximately $1680 psf, we estimate that BSE would be able to generate a profit of over $10 million and most importantly bring in over $200 million in cash. As the project had already achieved TOP in 2015, meaning all its costs have been capitalised with zero borrowings, all proceeds net of tax from such a sale would accrue to BSE’s already impressive cash pile.

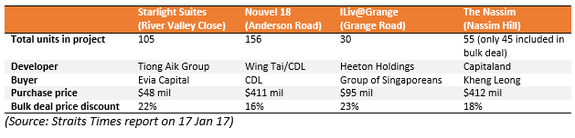

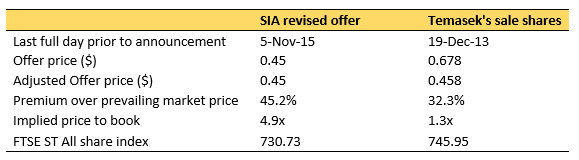

Recent bulk deals were transacted at discounts of between 16% and 23%:

A third option would be for the Lee family to privatise the entire company. Despite the Lee family having no shortage of resources to do so, we see this as being a less likely option. For a start, at a market capitalisation of $1.3 billion, privatising the entire company at a premium would cost several times more than the amount needed to just buy all the units in Paterson Collection. In addition, the Lee family is not known for privatising listed companies it controls even when valuations are low, e.g. in 2003 or 2009. Both takeover attempts by the family for Straits Trading and then WBL in 2008 and 2013 respectively were exceptions and came in the form of counter-offers to rival bids by the Tan family. A privatisation offer is probably more likely to come in the form of an attractive external bid, particularly by a land hungry developer.

Recommendation

BSE is a deep value play trading at around 1.0x NTA. However, carrying its legacy land at historical cost pegged to 1953 prices has resulted in a severely understated book. Just valuing the freehold/999-year leasehold legacy landbank at a conservative $350 psf would bring its NTA up to $7.21 per share.

- Potential upside from new launches on its low cost legacy land along Ang Mo Kio Ave 5 (Lot 12949A Mk18) for which it has announced that it will pay SLA a differential premium and surrender the 999-year lease in order to be re-issued a fresh 99-year lease without building restrictions; and

- Any surplus generated from potential bulk sale of units in Paterson Collection or the soon to be completed St Thomas Walk, keeping in mind that the plots of land on which these projects are sited were acquired at low prices in the period from 2005 to 2007.

It is notoriously difficult to predict exactly when the property market will improve given the current headwinds including the slowing economy, the property cooling measures in place and the spectre of an US-led interest rate hike. Until a more pronounced uptrend happens, BSE’s results in the coming quarters could stay subdued, just as the recently announced 3Q17 results has shown with profit down 78% YOY. That said, its strong balance sheet with a net cash position of $383 million should provide sufficient buffer to see it through the lull period and protect it against any interest rate shocks. In the meantime, investors would still be able to enjoy a best-in-class dividend yield of 6.7%, far higher than any of its mid-cap property developer peers. We thus think BSE’s current share price of $4.94 offers compelling value to value investors and yield seekers alike. We are buyers at this price.

Key Risks

A prolonged downturn in the property market coupled with inaction regarding its non-landed projects at or near TOP could see the Company being hit with hefty QC penalties. However, as we have pointed out, the Company with a financially strong controlling shareholder has enough options to mitigate this risk.

Payment of the yet to be disclosed differential premium for the land at Ang Mo Kio Ave 5 may see a large chunk of cash depleted leaving shareholders with the possibility of a lower dividend payout in immediate years. Having said that, shareholders should eventually be compensated as the Company starts monetizing the site via new project launches.

(All currency in SGD unless otherwise stated)

[i] Source: Straits Times, 9 Aug 1997 and data.gov.sg

[ii] Excludes current developments Luxus Hills phase 6 and 7

[iii] Based on the Population White Paper released by the Singapore government in 2013

[iv] Based on URA caveats lodged in 2016 for Skyline 360, St Thomas Suites but excludes Espada which has mainly shoebox units selling at higher psf

[v] Based on URA caveats lodged in 2016

RSS Feed

RSS Feed