Trading in Memstar Technology Ltd was temporarily halted from 2 to 5 February 2015 in what must have been a nerve-wracking few days for its shareholders.

Recall that in our previous report, we had highlighted risks relating to completion of the RTO, which is subject to a host of conditions. Two of the key conditions were supposed to have been met by 31 January 2015:

- the Target successfully completing Tranche 2 Fundraising of US$15 million; and

- the Target entering into an off-Take agreement with Petro China and/or CNPC for the purchase of the Target’s coal bed methane.

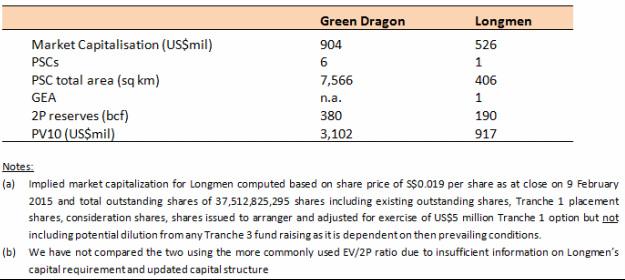

The extension of deadline highlights the non-completion risks shareholders face even as the clock is ticking on Memstar's own 11 April 2015 deadline to fulfill SGX continuing listing requirements. While SGX could possibly grant an extension for the RTO to complete, we reiterate that should it be aborted, the prospects of shareholders being able to extract any meaningful value out of their shares would be quite dim. Even if the RTO is successfully completed, the implied market valuation of Longmen (representing the combined group) post completion at US$526 million looks rich compared to its much bigger competitor, Green Dragon.

Updated comparison table:

At $0.019, the share price seems to have fully priced in certainty of deal completion. We still do not think this is justified given the multiple risks factors that might affect completion. Downside risks far outweigh any upside potential, if any at all. Investors should steer clear at this price.

RSS Feed

RSS Feed