Background

Up until 2014, KSTB had been engaged in the core business of providing tubular handling equipment and running services as well as tubular inspection and maintenance services for companies in the oil and gas industry. It was also in the business of providing land rig services.

However, that began to change in November 2013 when it entered into an agreement with Bursa-listed Destini Berhad to dispose of its entire interest in Samudra Oil Services Sdn Bhd ("Samudra Oil"), through which it had been conducting its tubular handling equipment business, for RM 80 million. The consideration was satisfied fully in new Destini shares to be disposed of via a placement exercise. The disposal of Samudra was subsequently completed in April 2014 following which the Destini consideration shares were placed out at RM0.35 each[1].

Concurrently with the disposal of Samudra Oil, KSTB also entered into two separate agreements with Indonesian drilling services provider, PT Duta Adhikarya Negeri, to dispose of its 2 land rigs for a total consideration of US$10.5 million.

With the disposals, KSTB effectively exited both the tubular handling and land rig businesses, leaving it with a relatively small tubular inspection and maintenance services business which is currently operated by its wholly owned subsidiary Samudra Timur Sdn Bhd. As a result, the Company triggered Practice Note 17 ("PN17") of the Bursa listing rules giving it until 2 April 2015 to acquire a new core business in order to maintain its listing status. The Company subsequently triggered Practice Note 16 of the Bursa listing rules as a cash company on 27 February 2015. On the basis of its PN16 status, it has applied to seek an extension of the deadline to acquire a new core business to 26 February 2016. The outcome of this application is currently pending.

For the half year ended 31 December 2014, the group recorded after-tax profit (PAT) of approximately RM3.67 million, translating into a fully diluted EPS of 1.61 sens per share[2]. PAT was up from RM0.13 million in the previous corresponding period in 2013 with the increase largely attributed to foreign exchange gains of RM2.45 million and interest income of 1.65 million. Revenue was RM5.85 million.

Conditional Voluntary Takeover Offer by Dato' Chee and Concert Parties

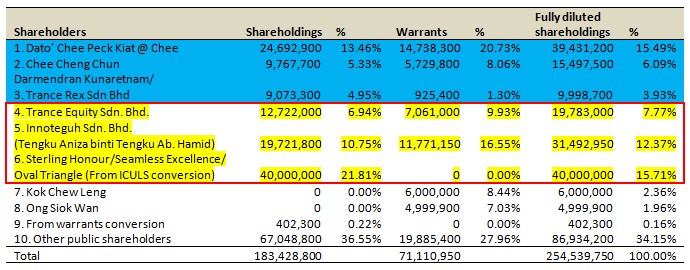

On 23 March 2015, Dato' Chee Peck Kiat, his son Chee Cheng Chun and Darmendran a/l Kunaretnam (collectively "Joint Offerors"), an Executive Director of the Company, made a conditional voluntary offer for all outstanding shares not held by the Joint Offerors amounting to 76.72% of the total outstanding shares of the Company. The all cash offer was RM0.48 per share. Concurrently, the Joint Offerors[3] also made an offer of RM0.18 for all outstanding warrants of the Company not held by them amounting to 69.92% of the total warrants in issue. The Offer is conditional upon the Joint Offerors achieving a minimum shareholding percentage of at least 50% by the close of the Offer. In addition, the Joint Offerors have indicated their intentions to keep KSTB listed.

Our Views

Success of the Offer lies in the hands of a few shareholders

With sizeable stakes in the Company concentrated in the hands of a few key shareholders (We will call them “Key Shareholders” here), the success of the Offer depends very much on their willingness to accept the Offer terms.

These Key Shareholders include long time shareholders, Innoteguh Sdn. Bhd. and Trance Equity Sdn. Bhd. (not to be confused with Trance Rex Sdn Bhd) as well as Sterling Honour, Seamless Excellence and Oval Triangle, all of whom became shareholders by virtue of converting their ICULS[4] holdings. The Key Shareholders altogether hold 39.50% out of the 76.72% shares not owned by the Joint Offerors and have yet to give any indications as to their intentions with regards to the Offer.

We do not think any of the Key Shareholders holding significant shares have any compelling reason to put up a competing offer with the offer price already at a premium to adjusted NTA per shares. Should they wish to thwart the takeover attempt by the Joint Offerors, inaction may be the best course of action as the Joint Offerors still need to acquire another 26.72% of shares just to make the Offer unconditional. Furthermore, the board of KSTB had also announced on 25 March 2015 that it does not intend to seek an alternative offer.

Offer Price is at a premium to adjusted NTA representing a decent valuation of the remaining tubular inspection and maintenance business

The offer price of RM0.48 per share is only at a small premium of 4.3% over the last traded price of KSTB prior to the Offer announcement. It is also at a significant discount of 28.0% to its last reported NTA of RM0.67 per share as at 31 December 2014.

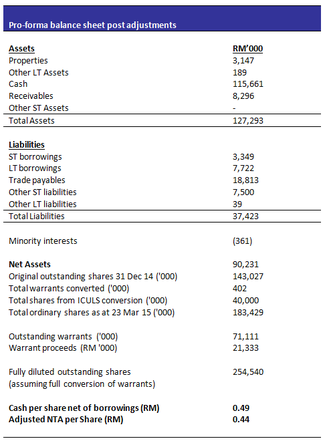

However, taking into account adjustments from shares issued arising from conversions of the ICULS issue and warrants as well as its recent dividend payout of 4.5 sens per share, we estimate that the offer price is actually at a premium of 9.8% to KSTB's adjusted NTA of RM0.44. See Figure 3 below for computation.

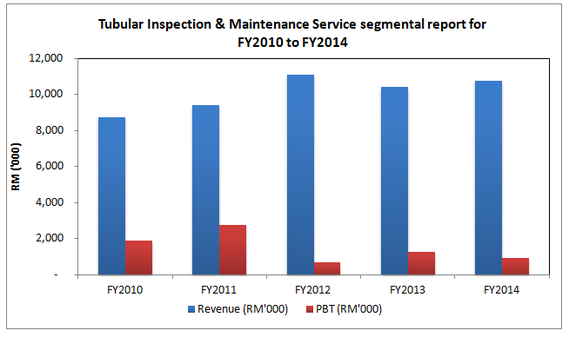

For the past 5 financial years, the remaining tubular inspection and maintenance service segment has contributed between RM 8.77 million to RM11.11 million in revenue and RM 0.72 million to RM 2.78 million in profit before tax, or an average of RM 1.53 million equivalent to a fully diluted pre-tax earnings per share of just 0.6 sens.

As such, the offer premium over NTA of RM0.04 per share implies a valuation of approximately 7 times profit before tax for the tubular inspection and maintenance services business, which is neither too expensive or cheap in the current environment.

Takeover timing needs to be taken into consideration too

Further taking into consideration that the Company is already past the first deadline of 2 April 2015 for submission of a regularisation plan to Bursa Securities to continue its listing status and with the further extension of such deadline to 26 February 2016 uncertain, we believe existing KSTB shareholders should see the Offer as a welcome insurance in the event that the Company is forced to delist. According to the Malaysian takeover rules, the offer document has to be sent to shareholders within 21 days of the takeover announcement on 23 March 2015 and the Offer will need to be open for acceptance for at least another 21 days after the offer document has been despatched. This should buy some time while shareholders await Bursa's response to the Company's request for extension of time to acquire a new core business.

Recommendations

We believe shareholders should wait and see if the application by KSTB to extend the deadline to acquire a new business to 26 February 2016 is approved before making a decision on the Offer. As the Offer will be open for a minimum of 21 days after the Offer document has been despatched to shareholders, they will likely have between 3-4 weeks time while awaiting Bursa's decision. In the event that the extension is rejected by Bursa and the Company faces the prospects of being delisted, we believe that the RM0.48 cash offer provides an adequate compensation for shareholders to exit their investments. Should the extension be approved, KSTB will have until 26 February 2016 to acquire another new business to stay listed. In this case, even if shareholders decide to hold on to their shares, we believe that the downside will be limited given that the bulk of KSTB's assets consist of cash.

For investors not vested in the Company as yet, there is little risk but limited upside in buying in at the current price of RM0.48 per share pending acquisition of a new core business.

[2] Adjustments include interest and interest savings from the warrants conversion proceeds and ICULS conversion.

[3] On an unrelated but interesting note, we noticed that Chee Cheng Chun and Darmendran had also amassed a sizeable 18.64% stake in another Bursa listed company, Rex Industry Bhd, from 23 February 2015 to 5 March 2015 just prior to the Offer announcement. There are no indications as of now that the two transactions are related though.

[4] KSTB issued RM12.0 million worth of 5-year Irredeemable Convertible Unsecured Loan Stocks ("ICULS") to Maybank Berhad as part settlement of debt pursuant to a Debt Settlement Agreement dated 3 September 2013. It is not disclosed if Sterling Honour Sdn Bhd, Seamless Excellence Sdn Bhd and Oval Triangle Sdn Bhd are entities related to Maybank.

RSS Feed

RSS Feed