- On 16 January 2015, ABRIC announced that it had entered into a sale and purchase agreement for the acquisition of an office unit within a 45-storey Grade A office building known as Q Sentral, part of the Kuala Lumpur Sentral development. The consideration is RM3,704,590, to be paid over the construction period of 48 months.

- ABRIC Berhad has been trading ex-dividend (of RM0.30 per share) since 21 January 2015 which reduces our entry price at the date of last report to RM0.405 vs last close of RM0.425.

- As at 25 January 2015, ABRIC has only announced total outstanding shares of 140,486,774 instead of the maximum 148,578,750 had all its outstanding warrants being exercised.

Our Views

The property purchase does not materially affect our estimates. Recall that ABRIC had sold off all its operating assets except for two properties that are currently leased out to its former subsidiaries. This new property once completed is intended to serve as its corporate headquarters. It will be constructed and paid progressively over 48 months, meaning that the cashflow impact is minimal and should be more than offset by incoming cash proceeds of up to RM11.0 million yet to be received as part of the sale of its security seal business.

As it stands, there are still 8.1 million company warrants that have either curiously not been converted or which conversions have not been announced as at 25 January 2015. Pending further announcements on new conversions that made the 23 January 2015 books closure date deadline, holders of these warrants likely missed out on the RM0.30 special dividend bonanza. The implication is that the additional RM2.4 million saved bumps up our cash estimates by another RM0.02 per share.

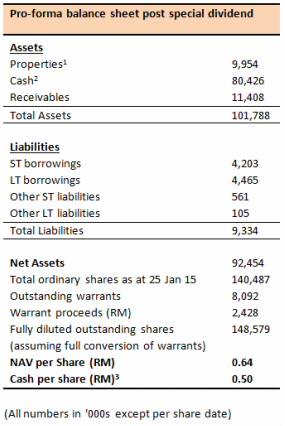

Our revised estimates of the NAV and cash per share is now RM0.50 and RM0.64 respectively:

1. The newly acquired property has not been included as it will only be recognised progressively over the next 48 months

2. Updated to cash position announced on 21 Jan 15 and adjusted for actual special dividends likely paid based on total outstanding shares as at 25 Jan 15

3. Net of total borrowings but not inclusive of cash in the escrow account of RM10 million and addition RM1 million which has been lumped together under Receivables

Recommendation

At RM0.425 per share, ABRIC continues to trade at significant discounts to its breakup value of RM0.64 per share and net cash per share of RM0.50 which does not include another RM0.05 worth of receivables even after conservatively adjusting fully for the new property purchase. We believe the current share price provides an attractive entry point and a good margin of safety for value investors.

RSS Feed

RSS Feed