- TSH Corporation Ltd (Update-2) – Big payday for shareholders

TSH released a couple of significant updates over the past 2 weeks

- On 16 September 16, TSH announced that a big total payout of S$0.1232 per share of cash will be distributed back to shareholders, comprising S$0.016 in special dividends and S$0.1072 in cash distribution via a capital reduction. Total amount to be paid out is S$29.63 million or almost 88% of its current cash balance of S$33.69 million; and

- The company had disposed of the majority of its Hibiscus shares earlier on 8 September 16. This means that the cash position it announced on 31 August did not include proceeds from the Hibiscus shares.

Our Take

While not surprised that the Company bumped up the upcoming cash distribution (see previous update) to include proceeds from the property disposal, the quantum of the payout pleasantly exceeded our expectations. Nonetheless, we welcome this very minority friendly approach taken by the Company. Together with the S$0.03 dividend paid in May, total distribution from the Company this year will hit S$0.1532 per share, close to double the original share price when our initial report was posted 5 months ago. Post distribution, shareholders will still retain their original shareholdings backed by a mostly cash net asset value of 1.9 to 2.6 S cts per share, based on the updated cash position which now includes Hibiscus proceeds and assumed Unilink sale price. More upside could even be in store if an RTO materialises.

We expect the market to react positively to news of the bumper distribution given that the last traded price of S$0.127 is just slightly above the total payout amount.

- TSH Corporation Ltd (Update) – Sitting on mountain of cash following disposals

Since our last update in which we pointed out the strong possibility of TSH monetising all its assets and distributing the resultant proceeds in the mid to near future, the Company has successfully completed the disposals of most of its key assets in the space of 3 months.

Cash company sitting on cash hoard even before proposed Unilink sale

Having sold its main operating units, TSH is now a cash company as defined by Rule 1017 of the SGX Catalist rules. It currently sits on a cash hoard estimated at S$32.69 million, 90% of which will be held in an escrow account, according to its latest announcement as at 31 Aug 16. TSH will now have 12 months (with an additional extension of 6 months subject to SGX approval) to look for a new operating business which meets SGX’s listing requirements or be delisted, a scenario which should result in a distribution of all its cash. It should also be noted that under the Catalist rules, money in the escrow account can only be used for distributions to shareholders or to pay for expenses incurred in a reverse takeover. This should accord shareholders some assurance that the bulk of the cash will be safe and not be used to pay for ongoing corporate expenses such as directors’ fees.

The reported cash position translates to a per share cash value of S$0.136 but does not include proceeds from the yet to be sold 26.5% stake in Unilink Development Limited. While we had previously flagged out that the realisable value of the Unilink stake could be much lower than book if pegged to the recent Metronic transaction, TSH’s management appears to think otherwise as it only adjusted the carrying value slightly downwards to S$2.98 million. A successful sale of this stake close to this price should boost its net cash per share to S$0.148 as the company has already repaid all its debts.

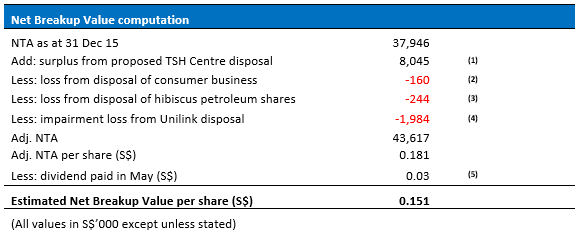

But net liquidation value slightly lower than previously estimated

Using the management’s value estimation of the Unilink stake and including all residual assets and liabilities currently on its books, the net liquidation value of TSH works out to be about S$0.145 per share[1]. Should the more conservative sale price of Unilink be applied i.e. pegged to Metronic transaction, the net liquidation value is estimated to be S$0.137 instead. Both figures are slightly lower than our previous estimate of S$0.151 per share with the main difference being the slightly lower than expected sale price of the freehold property at Burn Road as well as forex losses and other expenses incurred in 1H2016.

Payout of at least S$0.025 per share expected soon

The Company has already announced previously its intention to distribute 100% of the net proceeds from the sale of Explomo and Wow totalling S$6 million to its shareholders via a capital reduction. This translates into a payout of S$0.025 per share. With no operating business and a cash hoard likely in excess of what is required in a typical reverse takeover, we will not be surprised if the Company decides to dish out further cash distributions in the coming months or bump up the next distribution to include part of the proceeds from the property disposal.

Recommendations

TSH has turned in an impressive performance since our initial report on 31 March 2016 with total returns of 99% over the 5 month period. As with the situation with all cash companies, further upside will depend very much on what and when Company decides to do with the cash pile over the next 12 months. Going forward, we think the share price should be supported by the current net cash per share of S$0.136 until further developments in the sale of Unilink or a new business acquisition is announced. While a potential acquisition could provide a further boost, we see a distribution of substantially all its cash holdings as the more viable and sensible option under existing market conditions. This means that shareholders should realise the estimated net breakup value of between S$0.137 to S$0.145 per share over the next 12 months or so, an upside of between 8% to 14% over the last traded price of S$0.127.

Key Risks

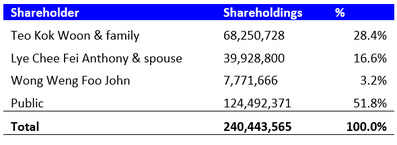

The major risk going forward is of the Company squandering its cash hoard in a value destroying acquisition. However, with 3 of the 4 board members (Teo Kok Woon-28.4%, Anthony Lye-16.6%, John Wong-3.2%) owning collectively more than 48% of the Company’s shares, we believe the interests between management and minority shareholders are sufficiently aligned in this case to mitigate this risk.

[1] We have assumed that the Hibiscus Petroleum Berhad shares that the Company owns have been sold and proceeds form part of the cash hoard of S$32.69 million. Should this not be the case, then the eventual net cash estimate would be higher than reported post Hibiscus disposal.

- TSH Corporation Ltd- Expect more to come

Since our initial write-up on TSH, the share price has surged, returning a total of 86% in less than 2 months. Our initial estimates pegged the value of the shares to the sum of its existing net cash and short-term securities position of S$0.077 rising to S$0.139 (S$0.0107 and S$0.169 respectively before adjusting for the 3 S cts dividend it had earlier paid) should the freehold property be successfully disposed. Recent developments, however, suggest that our views have been too conservative.

We now see a strong likelihood of the company monetizing all its assets and distributing the resultant proceeds in the mid to near future. Shareholders should realize total proceeds of at least S$0.151 per share should that happen. This represents a further 29% upside from the last traded price of S$0.117. We remain long at the current price.

Key developments since our report

- TSH announced on 28 April 2016 following its AGM that it had entered into a sale and purchase agreement with Exact Solution Management Ltd to dispose of its Consumer Electronics business carried out under its wholly owned subsidiary, Wow Technologies (Singapore) Pte Ltd. The consideration is US$2.4 million or S$3.24 million. It intends to distribute 100% of the net proceeds from this sale to shareholders.

- Concurrently, the Company has entered into a non-binding term sheet with its CEO, Anthony Lye, for the disposal of its Homeland Security Services business, consisting of its wholly owned subsidiary, Starmo International Ltd as well as subsidiaries under Starmo. The consideration shall be in cash and is to be agreed by the Company and Anthony subject to a valuation report to be prepared and issued by an independent valuer.

- Company revealed in its annual report for FY 2015 in regard to its 26.5% stake in Unilink Development Limited that “Following the plan of the Company in 2015 to dispose of the investment in Unilink, the Company has followed up with a concrete plan to locate buyer and is of the view that the sale is highly probable to be completed within a year.” Consequently, the value of the Unilink stake has been written down to S$3.127 million as an estimated recoverable amount based on discussions with third parties.

Our Take

Twin disposal of Consumer Electronic Business and Homeland Security Business leaves TSH with no core businesses and removes key cash drain risk

Coupled with the company’s decision not to actively pursue any property development projects after the disposal of its Australian properties, TSH is set to become a cash company upon the completion of the twin disposals of Wow Technologies and Starmo.

We previously flagged out the consumer electronics business, which incurred a loss of S$2.73 million in 2015, as the prime risk to TSH’s cash pile. Thus, we see its proposed disposal as positive news for shareholders even though the consideration of S$3.24 million would result in a non-cash disposal loss of S$0.37 million. The resulting cash distribution from this sale is estimated to be 1.3 S cts per share, representing 11% of the last traded price of S$0.117.

At the same time, we think the disposal of its Homeland Security Business, Starmo, should generate proceeds no less than the net carrying value of its tangible assets given that this division has consistently generated profits, albeit declining, over the last 3 financial years.

However, net realisable value of Unilink stake may be lower than book value

Although the Company has estimated that the recoverable value of the 26.5% stake in Unilink to be S$3.13 million, we note that Malaysia-listed Metronic Global Bhd recently disposed of a 17.7% stake in the same company for just US$551,724. Should the sale of TSH’s stake in Unilink be transacted at a similar valuation, the consideration it eventually receives may be closer to S$1.15 million (US$:S$=1.380), representing an S$1.98 million deficit over its current book value.

Net Breakup Value is likely to become key share price driver going forward

With the latest announcements, we think that TSH will eventually dispose of all its key assets and businesses and return the proceeds to shareholders. As such, the focus for shareholders should shift towards TSH’s net breakup value as its assets will eventually be converted into cash.

Recommendation

Even though the share price of TSH has surged since our initial report, recent developments suggest that more upside may be installed for its shareholders. The pace of the disposals and distributions would likely drive share price going forward. Nevertheless, shareholders should eventually realise no less than our conservative estimate of TSH’s net breakup value of S$0.151 per share, representing an upside of 29% over the last traded price of S$0.117.

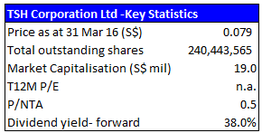

Further upside could come either in the form of a higher selling price of TSH Centre, Starmo or the stake in Unilink as we have assumed undemanding considerations for each of these assets. As an example, should TSH sell its property at say 909 psf which is the current lowest asking price of comparable properties in the vicinity, the net breakup value could rise to S$0.169 or 44% above the current share price.

We continue to be buyers at this price.

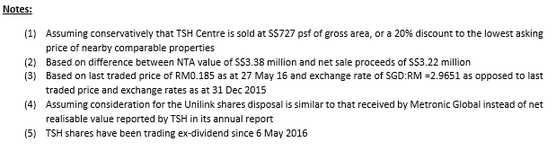

- TSH Corporation Ltd- Classic net-net micro-cap trading at steep discount to net cash, announces big dividends

We believe that low profile SGX listed microcap TSH Corporation Ltd (“TSH”) should be on the immediate radar screen of investors. Not only does it trade at a steep 20% discount to its net cash position of S$0.099 per share, it recently declared a dividend of S$0.03, which in itself makes up 38% of the last traded price of S$0.079. On top of these, the company has also announced its decision to dispose of its freehold property near Tai Seng MRT, a building it acquired shortly after the GFC in 2009. Our conservative estimates show that if the company successfully disposes of the said property even at a significant discount to current asking prices of similar properties in the vicinity, its net cash position would balloon to S$0.169 or 2.1 times the last traded price! With the company choosing not to take an active approach in the capital-intensive property development business for now, we see limited risk of excessive cash drain threatening its cash pile.

At the current market price of S$0.079, TSH is significantly undervalued. We think it should, at the very least, trade at its existing net cash and short-term securities position of S$0.107, or a 35% premium to its last traded price. An even bigger upside could be realised if TSH succeeds in disposing of its freehold property at our assumed price or better.

Background

Brief summary on TSH

TSH operates in 3 main business segments: Homeland Security Services, Consumer Electronic Products and Property Development, the last of which is effectively dormant following the recent sale of its Australian property developments.

TSH’s Homeland Security Services business, which is largely project-based in nature, provides the following services:

- Defence related materials disposal and recycling;

- Land remediation;

- Security consultancy;

- Civil defence shelter; and

- Supply and choreography of pyrotechnic and firework displays.

Its Consumer Electronic Products business consists of the design and development of electronic products such as headphones, earphones, speakers and accessories for mobile phones and tablets as well as original design and manufacture of digital imaging products.

Prominent controlling shareholder

The largest shareholder in TSH is the family of late hotelier Teo Lay Swee, whose stake is held through family holding company Cockpit International Pte Ltd and Teo Kok Woon. The low key Teo family has a long history of shrewd property deals, the most prominent being the disposal of Cockpit Hotel (which has since been developed into Vision Crest Commercial and Residential buildings) together with the adjacent House of Tan Yeok Nee to WingTai for S$380 million[i] back in 1996, several times the total amount the senior Teo paid for them in 1983 and 1991 respectively. Others include selling Ibis Novena for S$118 million at a reported a profit of over S$40 million 2 years after developing it. That said, the family appears to be a rather passive controlling shareholder with Teo Kok Woon himself happy to remain as a non-executive director in TSH for the past 10 years.

Low key results announcements including dividends and property disposal

On 29 February 2016, TSH released its annual results for the year ending 31 December 2015. Its results were unremarkable as it recorded a pre-tax loss of S$7.1 million largely due to one off exceptional items including impairment losses and loss on disposal of property of S$4.5 million and S$1.9 million respectively. Excluding all exceptional items, the loss before tax would have been a much more benign S$0.2 million, reversing from a gain of S$1 million the year before.

Despite the loss, however, TSH unexpectedly announced a bumper dividend of S$0.03 per share or almost 38% of its last traded price of S$0.079. Interestingly, this is the first time the company announced a dividend in the last 5 years. As part of the announcement, the management also revealed its intention to dispose of its freehold property at Burn Road.

Freehold Property to be put up for sale

The freehold property in question is a 7-storey detached freehold industrial building named TSH Centre located within a short distance of Tai Seng MRT station and with an estimated gross floor area of 23,508 sq ft and land area of 10,623 sq ft. It was acquired at a bargain price of S$8.8 million close to the bottom of the property cycle in 2009. URA has zoned the area in which the property is situated as a B1 industrial zone with a maximum plot ratio of 2.5.

Our Take

Market is effectively paying you to buy TSH shares even if property sale does not happen…

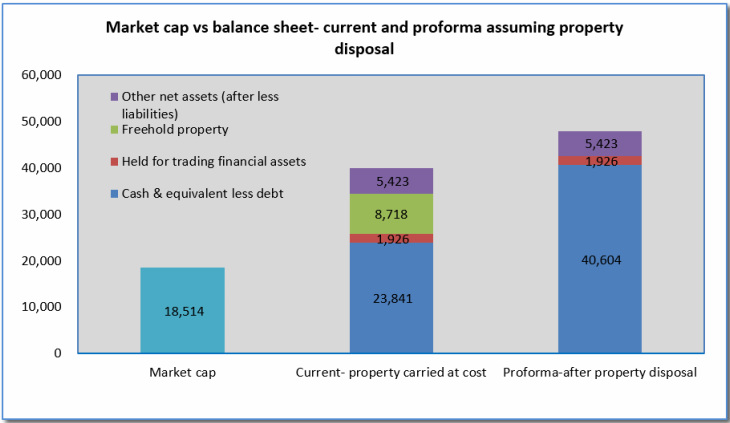

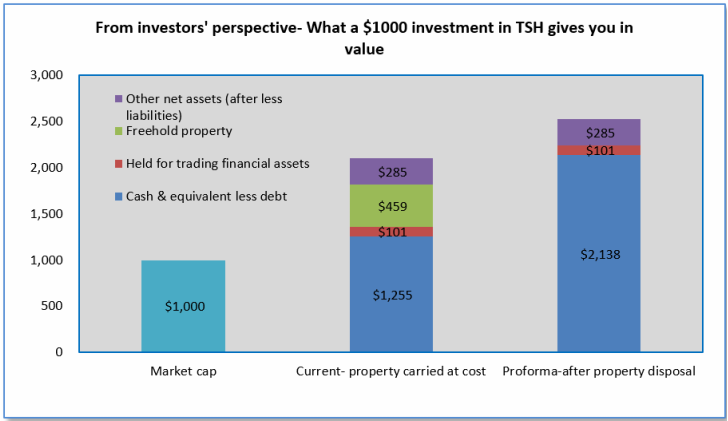

TSH currently trades at a discount of 20% to its net cash value (giving it a negative enterprise value) and a discount of 26% to the total value of its net cash and ST securities. This means that if you as an investor were to buy S$1000 of TSH shares at the current price, you would get back in value: net cash of S$1255 and another S$101 in short term securities. Yet more bonus value comes in the form of the freehold property (S$459 if measured by book value alone) and S$285 in other net assets.

…but potential reward increases significantly if property sale goes ahead

The sale of TSH Centre looks set to provide an even bigger boon to shareholders as it will unlock value in the property. We estimate that the property is currently carried on TSH’s books at a cost less depreciation of S$8.7 million or just S$378 per square foot of gross area. To estimate how this compares with the actual realisable price in the event of a sale, we did a search on publicly available commercial property platforms for B1 Industrial properties in the building’s vicinity. Our search yielded two freehold properties:

(Source: Map from URA, pictures by stockresearchasia.com)

Figure 1: Table and map showing plot ratio and key statistics of TSH Centre and nearby freehold properties listed for sale on commercial platforms

Both properties are being listed for sale at above S$900 psf, with a plot ratio close to the maximum permissible of 2.5. While both properties are broadly comparable to TSH Centre, they are also much newer and display different characteristics in terms of size, proximity to public transport facilities like the MRT station and frontage. Further taking into account that their actual transacted prices could be lower than list prices especially given the challenging market conditions, we choose to err on the side of caution and peg the value of TSH Centre at S$727 psf of gross area, a 20% discount to the lower psf of the two properties. This would yield potential sale proceeds of S$16.8 million or almost double its book value. Consequently, TSH’s net cash position could balloon to S$40.6 million or about 2.1 times the current market capitalisation.

Using our earlier example of the investor buying S$1000 of TSH shares to illustrate, should the company succeed in selling TSH Centre, the investor would be getting in value S$2138 in cash in addition S$101 in short term securities and S$285 in other net assets. This is not even taking into account the proposed dividend of S$380 that the investor should receive by May 2016.

Given that the company will not be actively seeking new property development projects, we posit that the management might even choose to reward shareholders with more bumper dividend payments in future.

Figure 2: TSH is trading at a steep discount to just its current net cash position; discount set to increase even further if property is disposed as planned by management

Possible target for shareholder activists?

The Company’s shareholdings are fairly loosely controlled with the three biggest groups of shareholders, namely the Teo family, CEO Anthony Lye & his spouse and non-executive Chairman John Wong holding 48.2% in total, leaving the public free float at 51.8%. With more than 50% in the hands of the public, small market capitalisation and a cash loaded balance sheet, we think that TSH could potentially be targeted by activist shareholder groups. In the event this happens, value realisation could be expedited. We stress, though, that this should not be a primary reason for investors to buy into TSH.

Figure 3: Top 3 shareholders own less than 49% of TSH’s total outstanding shares

Recommendation

With the stock trading at such a significant discount to just the value of its net cash and short term securities, TSH is a compelling buy. The buy case gets even stronger if the company manages to sell its freehold property even at the conservative price we have assumed. Add to the fact that a dividend of 3 S cts per share is set to be paid in the coming months, we believe the risk reward for an investment in TSH is too favourable for investors to ignore. The current price presents an excellent opportunity to accumulate its shares with limited downside risks. We are definitely buyers at this price.

Key Risks

Further deterioration in the company’s consumer electronics business could put pressure on the company’s cashflow and consequently its cash pile. However, this should be partially mitigated by the more stable homeland security business. The company has also generated on average positive free cash flows over the past 5 years which provides us with some comfort in its cash flow generating powers.

[i] Cockpit Hotel and House of Tan Yeok Nee were separately acquired by Teo Lay Swee in 1983 and 1991 respectively. The consideration for Cockpit Hotel then was S$62 million. While the price for House of Tan Yeok Nee was not disclosed, it is safe to assume that it cost much less. The conservation property was onsold by Wingtai to Union Investment Real Estate AG and then ERC, the latter transaction happening in 2012 or 21 years after Teo Lay Swee bought it at a price slightly more than S$60 million and after Wing Tai had spent S$12 million restoring the property in 1999.

IMPORTANT NOTICE

We put money where our mouth is. As such, we do take positions in the securities mentioned on this website or any securities related thereto and may from time to time add or dispose of or may be materially interested in any such securities. The research materials provided on this site is for information only. Investors should seek the assistance of a qualified and licensed financial advisor in making their investment decisions. The research reports/notes are compiled based on information, which we believe to be reliable. Any opinions expressed reflect our judgment at as at the date of the reports or notes and are subject to change without notice. It does not have regards to the specific investment objectives, financial situation and the particular needs of any specific person who may receive or access this research material. Our recommendations are not to be construed as an offer, or solicitation of an offer to sell or buy securities referred herein. The use of this material does not absolve you of your responsibility for your own investment decisions. We accept no liability for any direct or indirect loss arising from the use of this research material. This research material may not be reproduced, distributed or published for any purpose by anyone without our specific prior consent.