Last week’s full year results announcement was a welcome relief for Hupsteel shareholders as it probably confirmed that the worst is over for the Company. The improved performance was driven by increased demand for its steel products induced by a higher and more stable oil price. Some key highlights:

- FY18 revenue of S$60.8 million represents a topline growth of 22% over FY17, the first upturn since FY2012.

- Profit after tax of S$4.7 million is also a multi-year high, although it was aided by a net gain on investment property of S$2.3 million as well as certain tax credits.

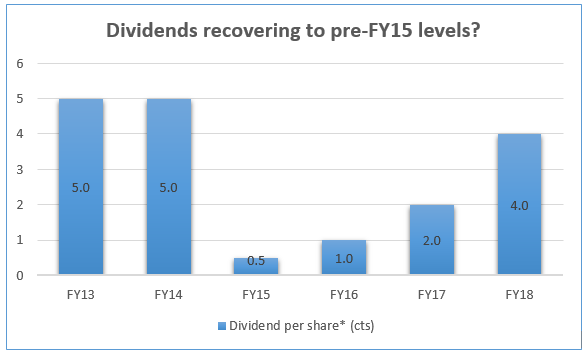

- Management’s decision to declare a final + special dividend of 2 cts per share brings total full year dividends to 4 cts, more than any in the past 3 years. Current yield stands at a respectable 4.6% based on a closing price of S$0.865.

- However, amidst the positive news, the company also cautioned that its recovery could be weakened by the ongoing trade war and a stronger US dollar.

Our Take

Interestingly, at last year’s AGM, some shareholders complained that the dividend payout of 2 cts per share pales in comparison to the 5 cts which Hupsteel used to pay up until FY14. The management, in doubling this year’s payout to 4 cts, perhaps gave the clearest indication that it has paid heed to them. We are of the view that the Company would restore its dividend to 5 cts in the near to mid future should the macro environment hold up.

As we have stated in our original post, our investment thesis for Hupsteel has always been the deep discount it trades to the value of its cash, available for sale investments and investment properties. That has not changed. We remain optimistic that the current CEO will continue to take a proactive approach towards unlocking the substantial value of its investment properties and narrow the said discount. While waiting for that to happen, it certainly doesn’t hurt if the company decides to at least maintain its dividend payout going forward, as it should.